The Form 5471 Schedule J is a critical component of the IRS's international reporting requirements for controlled foreign corporations (CFCs). As a taxpayer, it's essential to accurately complete this schedule to avoid penalties and ensure compliance with U.S. tax laws. In this article, we'll delve into the intricacies of Form 5471 Schedule J and provide 7 essential tips to help you navigate the completion process.

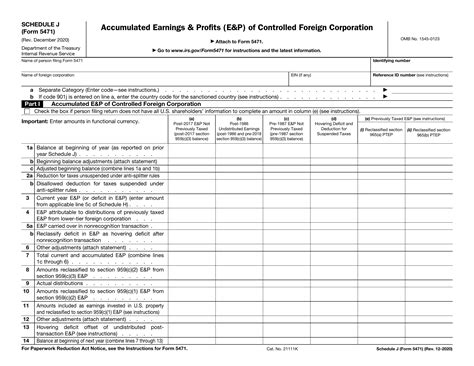

The Form 5471 Schedule J is used to report the accumulation and distribution of earnings and profits (E&P) by a CFC. The schedule is divided into several sections, each requiring specific information about the CFC's E&P, dividends, and other transactions. Accurate completion of this schedule is crucial to ensure that the CFC's E&P is properly reported and that any applicable taxes are paid.

Tip 1: Understand the Purpose of Form 5471 Schedule J

Before diving into the completion process, it's essential to understand the purpose of Form 5471 Schedule J. The schedule is designed to report the E&P of a CFC, which is a critical component of the IRS's Subpart F income calculation. Subpart F income is a type of foreign earnings that is subject to U.S. taxation, even if it's not distributed to the U.S. shareholder.

To accurately complete the schedule, you'll need to understand the concepts of E&P, Subpart F income, and the CFC's tax year. This will require a thorough review of the CFC's financial statements, tax returns, and other relevant documents.

Tip 1.1: Review the CFC's Financial Statements

To complete Form 5471 Schedule J, you'll need to review the CFC's financial statements, including the balance sheet, income statement, and cash flow statement. This will help you identify the CFC's E&P, dividends, and other transactions that need to be reported on the schedule.

Pay particular attention to the CFC's retained earnings, which represent the accumulated profits of the CFC. These earnings are subject to U.S. taxation and must be reported on the schedule.

Tip 2: Determine the CFC's E&P

The CFC's E&P is a critical component of Form 5471 Schedule J. E&P represents the CFC's accumulated profits, which are subject to U.S. taxation. To determine the CFC's E&P, you'll need to review the CFC's financial statements and calculate the E&P for the tax year.

The E&P calculation involves several steps, including:

- Identifying the CFC's gross income

- Subtracting deductions and losses

- Adding back certain items, such as depreciation and amortization

The resulting E&P figure will be reported on Line 1 of Form 5471 Schedule J.

Tip 2.1: Calculate the CFC's E&P

To calculate the CFC's E&P, you'll need to review the CFC's financial statements and follow the steps outlined above. This will require a thorough understanding of the CFC's financial performance and tax position.

Pay particular attention to the CFC's tax deductions and losses, which can impact the E&P calculation. You may need to consult with a tax professional or accountant to ensure that the E&P calculation is accurate and complete.

Tip 3: Report Dividends and Other Transactions

In addition to reporting the CFC's E&P, you'll also need to report dividends and other transactions on Form 5471 Schedule J. This includes:

- Dividends paid to U.S. shareholders

- Dividends paid to foreign shareholders

- Other transactions, such as loans and advances

These transactions must be reported on the schedule in accordance with the IRS's instructions.

Tip 3.1: Identify Dividends and Other Transactions

To report dividends and other transactions, you'll need to review the CFC's financial statements and identify all relevant transactions. This may involve reviewing the CFC's dividend declarations, loan agreements, and other documents.

Pay particular attention to the CFC's dividend policy, which can impact the reporting of dividends on the schedule.

Tip 4: Complete the Schedule J Worksheet

The Schedule J worksheet is a critical component of the Form 5471 Schedule J completion process. The worksheet is used to calculate the CFC's E&P and report dividends and other transactions.

To complete the worksheet, you'll need to follow the IRS's instructions and enter the required information. This may involve calculating the CFC's E&P, reporting dividends and other transactions, and completing other sections of the worksheet.

Tip 4.1: Review the Worksheet Instructions

Before completing the worksheet, review the IRS's instructions carefully. This will help you understand the required information and ensure that the worksheet is completed accurately.

Pay particular attention to the worksheet's formatting and layout, which can impact the accuracy of the calculation.

Tip 5: Attach Supporting Schedules and Statements

In addition to completing the Form 5471 Schedule J, you may need to attach supporting schedules and statements. This includes:

- Schedule C (Dividend Income)

- Schedule D (Capital Gains and Losses)

- Schedule E (Income from Rentals and Royalties)

These schedules and statements must be completed in accordance with the IRS's instructions.

Tip 5.1: Review the Supporting Schedules and Statements

Before attaching the supporting schedules and statements, review them carefully to ensure that they are accurate and complete. This may involve reviewing the CFC's financial statements and tax returns.

Pay particular attention to the formatting and layout of the schedules and statements, which can impact the accuracy of the reporting.

Tip 6: Sign and Date the Schedule

Once you've completed the Form 5471 Schedule J, you'll need to sign and date the schedule. This is a critical step, as it confirms that the information reported on the schedule is accurate and complete.

Tip 6.1: Review the Signing Requirements

Before signing the schedule, review the IRS's signing requirements carefully. This will help you understand the required information and ensure that the schedule is signed accurately.

Pay particular attention to the signature block, which must be completed in accordance with the IRS's instructions.

Tip 7: File the Schedule with the IRS

Finally, you'll need to file the completed Form 5471 Schedule J with the IRS. This must be done in accordance with the IRS's instructions and deadlines.

Tip 7.1: Review the Filing Requirements

Before filing the schedule, review the IRS's filing requirements carefully. This will help you understand the required information and ensure that the schedule is filed accurately.

Pay particular attention to the filing deadlines, which can impact the accuracy of the reporting.

By following these 7 essential tips, you can ensure that your Form 5471 Schedule J is completed accurately and in compliance with U.S. tax laws. Remember to review the IRS's instructions carefully and seek professional advice if you're unsure about any aspect of the completion process.

Now that you've completed the Form 5471 Schedule J, take a moment to review your work and ensure that everything is accurate and complete. If you have any questions or concerns, don't hesitate to reach out to a tax professional or accountant for guidance.

Share your experiences and tips for completing the Form 5471 Schedule J in the comments below. Your feedback and insights can help others navigate this complex reporting requirement.

What is the purpose of Form 5471 Schedule J?

+Form 5471 Schedule J is used to report the accumulation and distribution of earnings and profits (E&P) by a controlled foreign corporation (CFC).

How do I calculate the CFC's E&P?

+To calculate the CFC's E&P, you'll need to review the CFC's financial statements and follow the steps outlined in the IRS's instructions.

What supporting schedules and statements do I need to attach to Form 5471 Schedule J?

+You may need to attach supporting schedules and statements, such as Schedule C (Dividend Income), Schedule D (Capital Gains and Losses), and Schedule E (Income from Rentals and Royalties).