Completing the MN ST-19 form is a crucial step for Minnesota-based businesses, as it helps them obtain a sales tax permit. This permit is necessary for collecting and remitting sales tax on transactions. In this article, we will guide you through the process of completing the MN ST-19 form in 5 easy steps.

Understanding the MN ST-19 Form

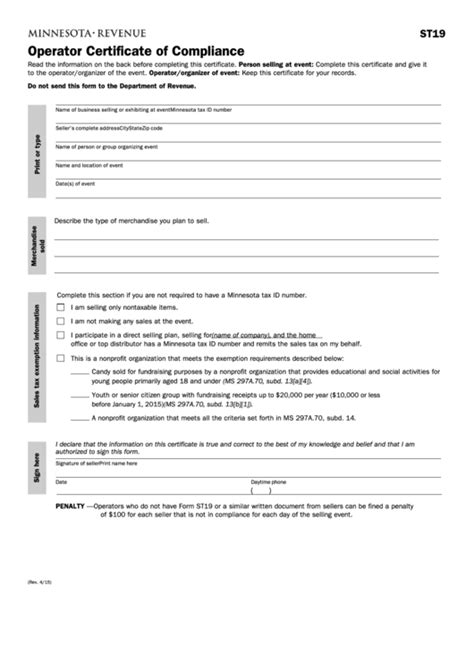

The MN ST-19 form, also known as the Application for a Sales Tax Permit, is a document required by the Minnesota Department of Revenue. It gathers essential information about your business, including its name, address, and tax obligations. By completing this form, you can obtain a sales tax permit, which is necessary for conducting business in Minnesota.

Step 1: Gather Required Information

Before starting the application process, ensure you have the necessary information about your business. This includes:- Business name and address

- Federal Employer Identification Number (FEIN)

- Type of business (sole proprietorship, partnership, corporation, etc.)

- Type of products or services sold

- Estimated monthly sales tax liability

Having this information readily available will make the application process smoother and faster.

Step 2: Complete the Business Information Section

In this section, you will provide basic information about your business, such as its name, address, and FEIN. Make sure to enter this information accurately, as it will be used to identify your business and process your application.

- Business name: Enter your business's exact name, as it appears on your business license or articles of incorporation.

- Business address: Enter your business's physical address, including the street address, city, state, and ZIP code.

- FEIN: Enter your business's 9-digit FEIN, which can be found on your federal tax return or by contacting the IRS.

Step 3: Complete the Sales Tax Information Section

In this section, you will provide information about your business's sales tax obligations. This includes:

- Type of business: Select the type of business you operate, such as retail, wholesale, or service.

- Type of products or services sold: Describe the types of products or services your business sells.

- Estimated monthly sales tax liability: Estimate the amount of sales tax your business will collect each month.

Accurately completing this section will help the Minnesota Department of Revenue determine your business's sales tax obligations.

Step 4: Complete the Additional Information Section

In this section, you will provide additional information about your business, such as:

- Bank account information: Enter your business's bank account information, including the bank name, account number, and routing number.

- Contact information: Enter the name, title, and contact information of the person responsible for managing your business's sales tax obligations.

Completing this section accurately will ensure that your business's sales tax obligations are properly managed.

Step 5: Submit the Application

Once you have completed the MN ST-19 form, review it carefully to ensure all information is accurate and complete. Then, submit the application to the Minnesota Department of Revenue.

You can submit the application online, by mail, or in person. Make sure to keep a copy of the application for your records.

By following these 5 easy steps, you can complete the MN ST-19 form and obtain a sales tax permit for your Minnesota-based business.

We hope this article has been helpful in guiding you through the process of completing the MN ST-19 form. If you have any questions or need further assistance, please don't hesitate to ask.

Share your thoughts and experiences with completing the MN ST-19 form in the comments below. Have you encountered any challenges or difficulties during the application process? What tips or advice would you offer to others who are completing the form for the first time?

What is the purpose of the MN ST-19 form?

+The MN ST-19 form is used to apply for a sales tax permit, which is required for businesses operating in Minnesota.

What information do I need to provide on the MN ST-19 form?

+You will need to provide basic information about your business, including its name, address, and FEIN, as well as information about your sales tax obligations.

How do I submit the MN ST-19 form?

+You can submit the application online, by mail, or in person to the Minnesota Department of Revenue.