The Internal Revenue Service (IRS) Form 433-D is a crucial document for individuals and businesses struggling to pay their tax debts. Filling out this form correctly can help you qualify for an installment agreement, which allows you to pay off your tax debt in manageable monthly installments. In this article, we'll provide a step-by-step guide on how to fill out IRS Form 433-D, highlighting five essential ways to complete it accurately.

Understanding IRS Form 433-D

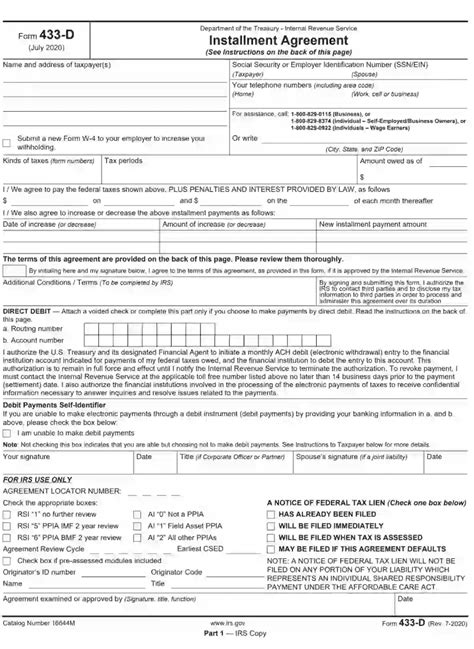

Before diving into the details, it's essential to understand the purpose of Form 433-D. This form is used to establish an installment agreement, which is a payment plan that allows taxpayers to pay their tax debt in installments rather than all at once. The IRS requires this form to assess your financial situation and determine a reasonable monthly payment amount.

5 Ways to Fill Out IRS Form 433-D

1. Gather Required Information

Before starting to fill out Form 433-D, gather all the necessary information and documents. You'll need:

- Your tax return transcripts (Form 1040, 1040A, or 1040EZ)

- Proof of income (pay stubs, W-2 forms, or 1099 forms)

- Bank statements and proof of assets (e.g., stocks, bonds, or real estate)

- A list of your monthly expenses (rent, utilities, food, transportation, and other essential expenses)

- A copy of your installment agreement proposal (if you've already submitted one)

Having all this information readily available will make it easier to complete the form accurately.

2. Complete Part 1: Personal and Business Information

Part 1 of Form 433-D requires personal and business information, including:

- Your name, address, and Social Security number or Employer Identification Number (EIN)

- Business information (if applicable), including the business name, address, and EIN

- Your spouse's information (if filing jointly)

Make sure to provide accurate and up-to-date information, as this will be used to verify your identity and contact you about your installment agreement.

3. Complete Part 2: Income and Expenses

Part 2 of Form 433-D requires you to provide a detailed breakdown of your income and expenses. You'll need to:

- List all sources of income, including employment, self-employment, and investments

- Calculate your total monthly income

- List all monthly expenses, including essential expenses like rent, utilities, and food, as well as non-essential expenses like entertainment and hobbies

Be honest and accurate when reporting your income and expenses, as this information will be used to determine your eligibility for an installment agreement.

4. Complete Part 3: Assets and Liabilities

Part 3 of Form 433-D requires you to provide information about your assets and liabilities, including:

- A list of all assets, including cash, savings, investments, and real estate

- A list of all liabilities, including debts, loans, and credit cards

Make sure to include all assets and liabilities, even if they're not directly related to your tax debt.

5. Review and Sign the Form

Once you've completed all parts of Form 433-D, review the form carefully to ensure accuracy and completeness. Make sure to sign and date the form, as this will confirm your agreement to the terms of the installment agreement.

Additional Tips and Reminders

- Make sure to follow the IRS instructions for completing Form 433-D carefully, as incorrect or incomplete information can delay or reject your installment agreement.

- Keep a copy of the completed form for your records.

- If you're having trouble completing the form, consider consulting a tax professional or seeking guidance from the IRS.

By following these five steps and providing accurate and complete information, you'll be well on your way to establishing an installment agreement with the IRS.

What is IRS Form 433-D?

+IRS Form 433-D is a document used to establish an installment agreement, which allows taxpayers to pay their tax debt in manageable monthly installments.

What information do I need to provide on Form 433-D?

+You'll need to provide personal and business information, income and expenses, assets and liabilities, and other relevant details.

How do I submit Form 433-D?

+You can submit Form 433-D online or by mail to the IRS address listed on the form.