The construction industry is known for its complexity, involving multiple stakeholders, large investments, and high-risk projects. To mitigate these risks, surety bonds have become an essential component of construction projects. A surety bond is a three-party agreement between the contractor (principal), the project owner (obligee), and the surety company. The bond ensures that the contractor fulfills their obligations, including completing the project on time, within budget, and to the required standards.

In the context of construction projects, the DPOR (Department of Professional and Occupational Regulation) surety bond form is a critical document that outlines the terms and conditions of the bond. The DPOR surety bond form requirements are put in place to protect the interests of all parties involved in the project.

Understanding the DPOR Surety Bond Form

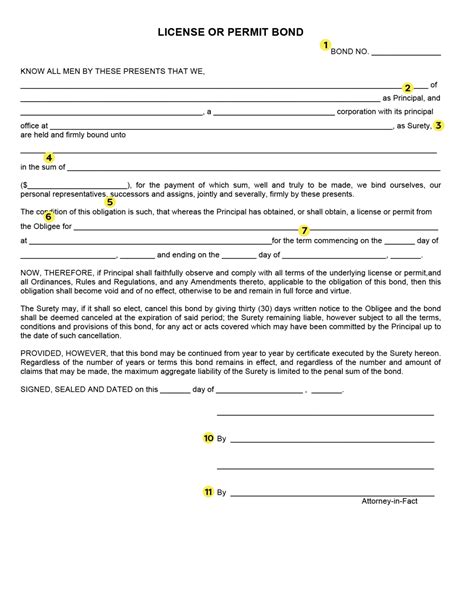

The DPOR surety bond form is a standardized document that outlines the terms and conditions of the bond. The form includes essential information, such as:

- The names and addresses of the contractor (principal), the project owner (obligee), and the surety company

- The project details, including the location, scope of work, and contract amount

- The bond amount and premium

- The bond term and expiration date

- The conditions under which the bond can be claimed

DPOR Surety Bond Form Requirements

To ensure compliance with the DPOR surety bond form requirements, contractors and surety companies must adhere to the following guidelines:

- The bond form must be completed in its entirety, with all required information provided

- The bond form must be signed and dated by the contractor (principal) and the surety company

- The bond form must be submitted to the DPOR within the specified timeframe (usually 30 days from the date of contract award)

- The bond form must be accompanied by the required premium payment

Failure to comply with these requirements can result in delays, fines, or even bond cancellation.

Benefits of the DPOR Surety Bond Form

The DPOR surety bond form offers several benefits to contractors, project owners, and surety companies, including:

- Protection for project owners against contractor default or non-performance

- Assurance for contractors that they can obtain payment for their work

- Compliance with regulatory requirements

- Standardization of bond terms and conditions

Common Mistakes to Avoid

When completing the DPOR surety bond form, contractors and surety companies must avoid common mistakes, such as:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Late submission of the form

- Insufficient premium payment

These mistakes can result in delays, fines, or even bond cancellation.

DPOR Surety Bond Form Requirements for Contractors

Contractors must comply with the DPOR surety bond form requirements to ensure that their bond is approved and they can begin work on the project. Contractors must:

- Complete the bond form in its entirety

- Provide all required information, including project details and bond amount

- Sign and date the form

- Submit the form to the DPOR within the specified timeframe

- Pay the required premium

DPOR Surety Bond Form Requirements for Surety Companies

Surety companies must also comply with the DPOR surety bond form requirements to ensure that the bond is issued correctly. Surety companies must:

- Complete the bond form in its entirety

- Provide all required information, including bond amount and premium

- Sign and date the form

- Submit the form to the DPOR within the specified timeframe

- Issue the bond to the contractor

DPOR Surety Bond Form Requirements for Project Owners

Project owners must also comply with the DPOR surety bond form requirements to ensure that the bond is issued correctly. Project owners must:

- Provide all required information, including project details and contract amount

- Review and approve the bond form

- Ensure that the bond is issued to the contractor

Conclusion

In conclusion, the DPOR surety bond form is a critical document that outlines the terms and conditions of the bond. Contractors, surety companies, and project owners must comply with the DPOR surety bond form requirements to ensure that the bond is approved and the project can proceed. By understanding the requirements and benefits of the DPOR surety bond form, stakeholders can ensure a successful project outcome.

Take Action

Don't let non-compliance with the DPOR surety bond form requirements hold you back. Take action today to ensure that your bond is approved and your project can proceed. Contact a surety bond expert to guide you through the process and ensure that you comply with all requirements.

FAQ Section:

What is the DPOR surety bond form?

+The DPOR surety bond form is a standardized document that outlines the terms and conditions of the bond.

What are the benefits of the DPOR surety bond form?

+The DPOR surety bond form offers several benefits, including protection for project owners, assurance for contractors, and compliance with regulatory requirements.

Who must comply with the DPOR surety bond form requirements?

+Contractors, surety companies, and project owners must comply with the DPOR surety bond form requirements.