The Kentucky Form K-4, also known as the Employees Withholding Certificate, is a crucial document that helps employees and employers navigate the complexities of state income tax withholding. As an employee, understanding the ins and outs of this form is essential to ensure you're not overpaying or underpaying your taxes. In this comprehensive guide, we'll walk you through the purpose, benefits, and step-by-step instructions for completing the Kentucky Form K-4.

Why is the Kentucky Form K-4 Important?

The Kentucky Form K-4 serves as a vital communication tool between employees and employers. Its primary purpose is to determine the correct amount of state income tax to withhold from an employee's wages. By accurately completing this form, employees can ensure they're not overpaying their taxes, which can lead to a larger refund when filing their tax return. Conversely, underpaying taxes can result in penalties and interest.

Benefits of Accurate Withholding

Accurate withholding is essential for both employees and employers. Here are some benefits of proper withholding:

- Avoid overpayment of taxes, resulting in a larger refund

- Prevent underpayment of taxes, avoiding penalties and interest

- Simplify tax filing and reduce the risk of errors

- Ensure compliance with Kentucky state tax laws

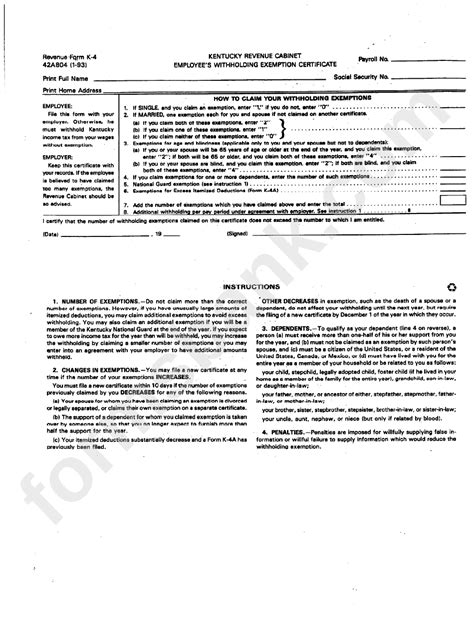

How to Complete the Kentucky Form K-4

Completing the Kentucky Form K-4 is a straightforward process. Here's a step-by-step guide to help you get started:

Section 1: Employee Information

- Provide your name, address, and Social Security number.

- Indicate your filing status (single, married, or head of household).

- Claim the number of dependents you're eligible for.

Section 2: Withholding Allowances

- Claim the number of withholding allowances you're eligible for. This will determine the amount of taxes withheld from your wages.

- If you're eligible for additional allowances, claim them in this section.

Section 3: Special Withholding Instructions

- If you have special withholding instructions, such as a specific dollar amount to withhold, indicate it in this section.

- If you're subject to backup withholding, check the corresponding box.

Section 4: Certification

- Sign and date the form to certify that the information provided is accurate.

- Provide your employer with the completed form.

Tips and Reminders

- Complete the Kentucky Form K-4 accurately to avoid errors and penalties.

- Review and update your withholding allowances regularly to ensure accurate withholding.

- If you're unsure about any section of the form, consult with your employer or a tax professional.

Common Mistakes to Avoid

- Failing to claim the correct number of withholding allowances

- Not updating withholding allowances regularly

- Providing incorrect or incomplete information

Consequences of Inaccurate Withholding

Inaccurate withholding can lead to a range of consequences, including:

- Overpayment of taxes, resulting in a larger refund

- Underpayment of taxes, resulting in penalties and interest

- Errors and delays in tax filing

Conclusion

The Kentucky Form K-4 is a crucial document that helps employees and employers navigate the complexities of state income tax withholding. By accurately completing this form, employees can ensure they're not overpaying or underpaying their taxes. Remember to review and update your withholding allowances regularly to ensure accurate withholding. If you're unsure about any section of the form, consult with your employer or a tax professional.

We hope this guide has been informative and helpful. If you have any questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences with the Kentucky Form K-4 in the comments below.

What is the purpose of the Kentucky Form K-4?

+The Kentucky Form K-4 is used to determine the correct amount of state income tax to withhold from an employee's wages.

How often should I review and update my withholding allowances?

+You should review and update your withholding allowances regularly, especially if your income or family situation changes.

What are the consequences of inaccurate withholding?

+Inaccurate withholding can lead to overpayment or underpayment of taxes, resulting in penalties and interest.