Filling out forms can be a daunting task, especially when it comes to government documents. The Treasury Direct Form 1522, also known as the "Application for Savings Bonds," is no exception. However, with the right guidance, you can navigate this process with ease. In this article, we will provide you with 5 tips for filling out the Treasury Direct Form 1522, making it a breeze to invest in savings bonds.

Understanding the Form

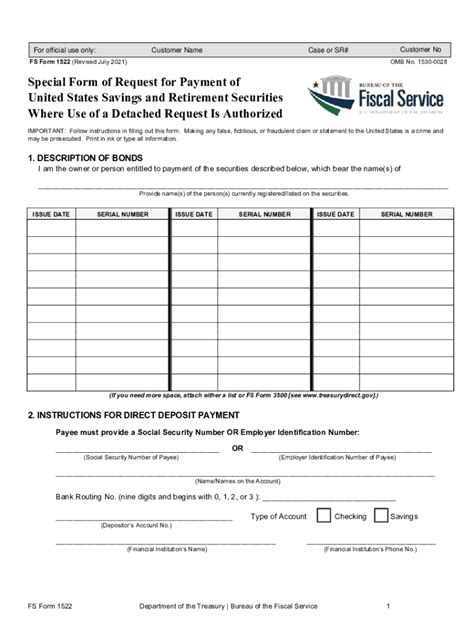

Before we dive into the tips, it's essential to understand the purpose of the form. The Treasury Direct Form 1522 is used to purchase savings bonds, specifically Series EE and Series I bonds, through the Treasury Department's online platform, TreasuryDirect. These bonds are a type of investment that earns interest over time, making them a popular choice for individuals looking to save for the future.

Tip 1: Gather Required Information

Before starting the application process, make sure you have all the necessary information at your fingertips. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your full name and address

- Your date of birth

- Your bank account information (if you want to fund your account via bank transfer)

Tip 2: Choose the Correct Bond Type

The Treasury Direct Form 1522 allows you to purchase two types of savings bonds: Series EE and Series I. It's crucial to understand the differences between the two before making a decision.

- Series EE bonds earn a fixed interest rate, which is set by the Treasury Department.

- Series I bonds earn a combination of a fixed interest rate and an inflation-indexed rate, which is adjusted semiannually.

Consider your financial goals and risk tolerance when choosing between the two bond types.

Tip 3: Fund Your Account

Once you've completed the application, you'll need to fund your account. You can do this via bank transfer, check, or cash. Make sure you have the necessary funds available before initiating the transfer.

- Bank transfer: You can transfer funds from your bank account directly to your TreasuryDirect account.

- Check: You can mail a check to the Treasury Department, made payable to "U.S. Department of the Treasury."

- Cash: You can deposit cash into your account using a pay.gov voucher.

Funding Options

| Funding Option | Description |

|---|---|

| Bank Transfer | Transfer funds from your bank account directly to your TreasuryDirect account. |

| Check | Mail a check to the Treasury Department, made payable to "U.S. Department of the Treasury." |

| Cash | Deposit cash into your account using a pay.gov voucher. |

Tip 4: Review and Submit Your Application

Carefully review your application before submitting it. Make sure all the information is accurate and complete. If you're unsure about any part of the application, you can contact the Treasury Department's customer support team for assistance.

- Double-check your name, address, and Social Security number or ITIN.

- Verify your bank account information (if applicable).

- Review your bond selection and funding option.

Common Mistakes to Avoid

- Inaccurate or incomplete information.

- Insufficient funds for the initial investment.

- Failure to review the application carefully before submission.

Tip 5: Monitor Your Account

After submitting your application, monitor your account regularly to ensure that your investment is performing as expected. You can log in to your TreasuryDirect account online to:

- View your account balance and transaction history.

- Update your account information (if necessary).

- Request a redemption or change your investment.

By following these 5 tips, you'll be well on your way to successfully filling out the Treasury Direct Form 1522 and investing in savings bonds. Remember to carefully review your application, choose the correct bond type, and monitor your account regularly to ensure a smooth and successful investment experience.

Join the Conversation

We hope you found this article helpful in navigating the Treasury Direct Form 1522. Do you have any questions or experiences to share? Leave a comment below and let's discuss!

FAQ Section

What is the minimum investment required for a savings bond?

+The minimum investment required for a savings bond is $25.

How do I access my TreasuryDirect account?

+You can access your TreasuryDirect account online by logging in with your account number and password.

Can I purchase savings bonds for someone else?

+Yes, you can purchase savings bonds for someone else, such as a child or grandchild, using the Treasury Direct Form 1522.