Understanding the Importance of DD Form 2293

The DD Form 2293, also known as the "Application for Former Spouse Payments from Retired Pay," is a crucial document for former spouses of military personnel. It serves as a formal request for the payment of a portion of the retired pay of a military member, as mandated by the Uniformed Services Former Spouses' Protection Act (USFSPA). This act provides former spouses with a share of the military member's retired pay, taking into account the length of the marriage and the member's years of service.

The DD Form 2293 is a vital document for former spouses seeking to obtain their rightful share of retired pay. Its significance extends beyond mere paperwork, as it ensures that former spouses receive the financial support they deserve after a divorce. In this article, we will delve into five essential facts about the DD Form 2293, including its purpose, eligibility requirements, and the application process.

Fact #1: Purpose of the DD Form 2293

The primary purpose of the DD Form 2293 is to facilitate the payment of a portion of a military member's retired pay to their former spouse. This payment is calculated based on the length of the marriage and the member's years of service. The form serves as a formal request for this payment, which is then processed by the Defense Finance and Accounting Service (DFAS).

To be eligible for this payment, the former spouse must meet specific requirements, including:

- Being married to the military member for at least 10 years

- Being divorced from the military member

- Not being remarried

- Not having waived their right to receive a portion of the retired pay in a divorce agreement

Eligibility Requirements

The eligibility requirements for the DD Form 2293 are strict, and former spouses must meet all the conditions to be considered eligible. These requirements include:

- Being married to the military member for at least 10 years

- Being divorced from the military member

- Not being remarried

- Not having waived their right to receive a portion of the retired pay in a divorce agreement

Former spouses who meet these requirements can proceed with completing the DD Form 2293 and submitting it to the DFAS for processing.

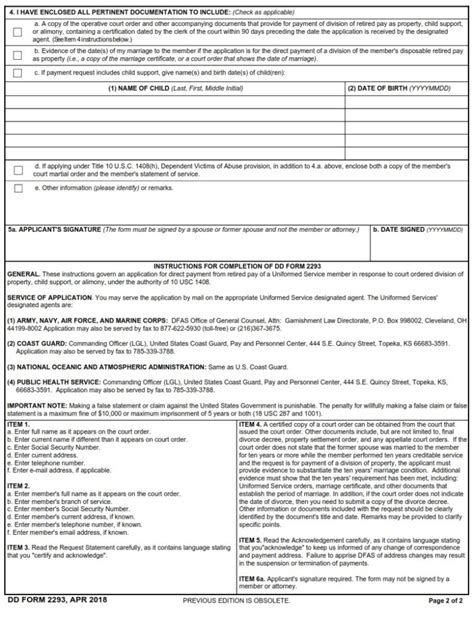

Fact #2: Completing the DD Form 2293

Completing the DD Form 2293 requires careful attention to detail, as any errors or omissions can delay or even reject the application. The form consists of several sections, including:

- Section 1: Identifying information, including the former spouse's name, Social Security number, and date of birth

- Section 2: Information about the military member, including their name, Social Security number, and date of birth

- Section 3: Information about the marriage, including the dates of marriage and divorce

- Section 4: Information about the former spouse's entitlement to a portion of the retired pay

Former spouses must ensure that they complete all sections accurately and thoroughly, as any errors can result in delays or rejections.

Tips for Completing the Form

When completing the DD Form 2293, former spouses should keep the following tips in mind:

- Use black ink to complete the form

- Ensure that all information is accurate and complete

- Use the correct Social Security number for both the former spouse and the military member

- Attach all required supporting documents, including divorce decrees and marriage certificates

By following these tips, former spouses can ensure that their application is processed efficiently and effectively.

Fact #3: Submitting the DD Form 2293

Once the DD Form 2293 is completed, former spouses must submit it to the DFAS for processing. The form can be submitted via mail or fax, and former spouses should ensure that they keep a copy of the form for their records.

When submitting the form, former spouses should include all required supporting documents, including:

- Divorce decrees

- Marriage certificates

- Proof of identity

The DFAS will review the application and verify the information provided. If the application is approved, the former spouse will begin receiving payments within 60 days.

What to Expect After Submitting the Form

After submitting the DD Form 2293, former spouses can expect the following:

- The DFAS will review the application and verify the information provided

- If the application is approved, the former spouse will begin receiving payments within 60 days

- The payments will be made monthly, and the amount will be based on the military member's retired pay and the length of the marriage

Former spouses should note that the payment amount may be subject to change based on the military member's retired pay and other factors.

Fact #4: Payment Amounts and Entitlement

The payment amount for former spouses is calculated based on the military member's retired pay and the length of the marriage. The payment amount is typically a percentage of the military member's retired pay, ranging from 20% to 50%.

Former spouses are entitled to receive payments for as long as the military member receives retired pay. However, the payment amount may be subject to change based on the military member's retired pay and other factors.

Factors Affecting Payment Amounts

Several factors can affect the payment amount for former spouses, including:

- The military member's retired pay

- The length of the marriage

- The former spouse's remarriage or cohabitation status

- The military member's death or disability

Former spouses should note that these factors can result in changes to the payment amount or even termination of payments.

Fact #5: Tax Implications and Payment Options

The payments received by former spouses are considered taxable income. Former spouses must report these payments on their tax returns and may be subject to federal income tax withholding.

Former spouses have several payment options, including:

- Direct deposit

- Check

- Electronic funds transfer

Former spouses can choose the payment option that best suits their needs and financial situation.

Tax Implications and Payment Options

Former spouses should note the following tax implications and payment options:

- Payments are considered taxable income and must be reported on tax returns

- Federal income tax withholding may apply

- Payment options include direct deposit, check, and electronic funds transfer

By understanding these tax implications and payment options, former spouses can make informed decisions about their financial situation.

What is the purpose of the DD Form 2293?

+The DD Form 2293 is used to facilitate the payment of a portion of a military member's retired pay to their former spouse.

Who is eligible to receive payments under the DD Form 2293?

+Former spouses who were married to the military member for at least 10 years, are divorced, and have not remarried or waived their right to receive a portion of the retired pay in a divorce agreement.

How are payment amounts calculated under the DD Form 2293?

+Payment amounts are calculated based on the military member's retired pay and the length of the marriage, ranging from 20% to 50% of the retired pay.

We hope this article has provided you with a comprehensive understanding of the DD Form 2293 and its significance for former spouses of military personnel. If you have any further questions or concerns, please don't hesitate to reach out to us.