As a homeowner in South Carolina, you're likely no stranger to the expenses that come with owning a property. From mortgage payments to maintenance costs, the bills can add up quickly. However, there is one way to potentially reduce your financial burden: the SC property tax exemption form. In this article, we'll delve into the world of property tax exemptions in South Carolina, exploring what they are, how they work, and most importantly, how you can take advantage of them.

What is the SC Property Tax Exemption Form?

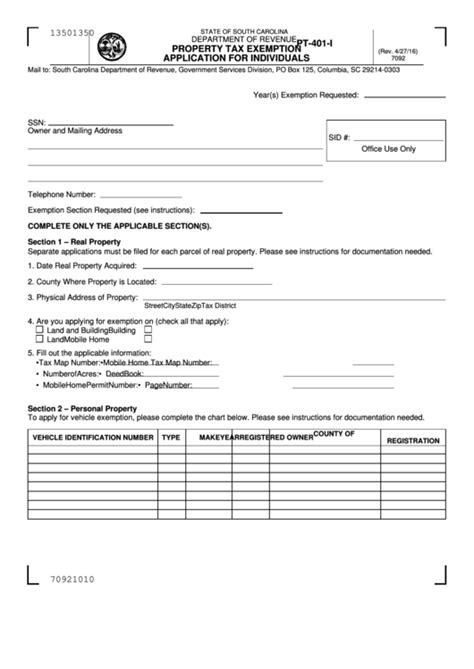

The SC property tax exemption form is a document that allows eligible homeowners in South Carolina to exempt a portion of their property's value from taxation. This exemption can result in significant savings on property taxes, which can be a substantial expense for homeowners. The form is typically filed with the county assessor's office and requires documentation to support the exemption claim.

Types of Property Tax Exemptions in South Carolina

South Carolina offers several types of property tax exemptions, including:

- Homestead exemption: This exemption is available to homeowners who occupy their property as their primary residence. It exempts the first $50,000 of the property's value from taxation.

- Disabled veteran exemption: This exemption is available to disabled veterans who have a service-connected disability rating of 100%. It exempts the entire value of the property from taxation.

- Senior citizen exemption: This exemption is available to homeowners who are 65 years or older and have a total annual income of $29,180 or less. It exempts the first $50,000 of the property's value from taxation.

How to Apply for the SC Property Tax Exemption Form

Applying for the SC property tax exemption form is a relatively straightforward process. Here are the steps to follow:

- Determine your eligibility: Review the eligibility criteria for the exemption you're applying for to ensure you meet the requirements.

- Gather required documentation: You'll need to provide documentation to support your exemption claim, such as proof of residency, income, or disability.

- Obtain the application form: You can obtain the application form from your county assessor's office or download it from their website.

- Complete the application form: Fill out the application form accurately and completely, attaching all required documentation.

- Submit the application form: Submit the application form to your county assessor's office by the deadline (usually January 15th).

Benefits of the SC Property Tax Exemption Form

The SC property tax exemption form can provide several benefits to eligible homeowners, including:

- Reduced property taxes: The exemption can result in significant savings on property taxes, which can be a substantial expense for homeowners.

- Increased disposable income: By reducing property taxes, homeowners can free up more money in their budget for other expenses or savings.

- Improved cash flow: The exemption can help homeowners improve their cash flow by reducing their monthly expenses.

Common Mistakes to Avoid When Applying for the SC Property Tax Exemption Form

When applying for the SC property tax exemption form, there are several common mistakes to avoid, including:

- Missing the deadline: Make sure to submit your application form by the deadline (usually January 15th) to avoid missing out on the exemption.

- Inaccurate or incomplete information: Ensure that your application form is accurate and complete, as errors or omissions can delay or deny your exemption claim.

- Failing to provide required documentation: Make sure to provide all required documentation to support your exemption claim, as failure to do so can result in denial.

Additional Resources

If you're looking for more information on the SC property tax exemption form, here are some additional resources to consider:

- South Carolina Department of Revenue: The South Carolina Department of Revenue website provides information on property tax exemptions, including eligibility criteria and application procedures.

- County assessor's office: Your county assessor's office can provide information on property tax exemptions, including application forms and deadlines.

- Tax professional: A tax professional can provide guidance on the SC property tax exemption form and help you navigate the application process.

By following the steps outlined in this article and avoiding common mistakes, you can take advantage of the SC property tax exemption form and reduce your property taxes. Remember to review the eligibility criteria carefully and provide all required documentation to support your exemption claim. If you're unsure about any aspect of the process, consider consulting a tax professional for guidance.

We hope this article has provided you with a comprehensive guide to the SC property tax exemption form. If you have any questions or comments, please feel free to share them below.

What is the deadline for submitting the SC property tax exemption form?

+The deadline for submitting the SC property tax exemption form is usually January 15th.

Who is eligible for the homestead exemption in South Carolina?

+The homestead exemption is available to homeowners who occupy their property as their primary residence.

How do I apply for the SC property tax exemption form?

+You can apply for the SC property tax exemption form by obtaining the application form from your county assessor's office or downloading it from their website.