Receiving payments directly into your account is a convenient and efficient way to manage your finances. One way to set up direct deposit is by filling out the OnPoint Direct Deposit Form. In this article, we will guide you through the process of filling out the form, highlighting the importance of accuracy and providing tips to ensure a smooth setup.

Why is Direct Deposit Important?

Direct deposit is a payment method that allows funds to be electronically transferred into your account. This method has several benefits, including convenience, speed, and security. By setting up direct deposit, you can avoid the hassle of waiting for checks to arrive, reduce the risk of lost or stolen checks, and ensure that your payments are received promptly.

What is an OnPoint Direct Deposit Form?

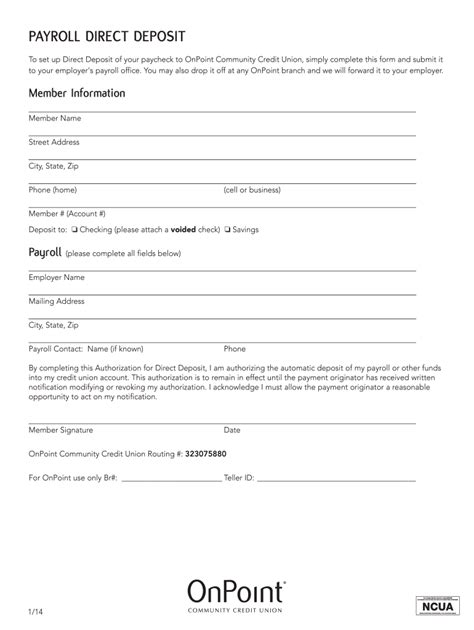

An OnPoint Direct Deposit Form is a document that requires you to provide your account information and authorization to set up direct deposit. The form typically includes sections for your name, address, account number, and routing number. You may need to fill out this form for various purposes, such as receiving payroll, government benefits, or tax refunds.

7 Steps to Fill Out the OnPoint Direct Deposit Form

Here are the steps to follow when filling out the OnPoint Direct Deposit Form:

- Gather Required Information: Before starting to fill out the form, ensure you have all the necessary information, including your account number, routing number, and address.

- Fill in Your Personal Details: Start by filling in your personal details, such as your name, address, and contact information. Make sure to provide accurate information to avoid any issues with your direct deposit setup.

- Provide Account Information: In this section, you will need to provide your account number and routing number. You can find this information on your check or by contacting your bank.

- Specify the Type of Deposit: You will need to specify the type of deposit you want to set up, such as payroll, government benefits, or tax refunds.

- Authorize the Deposit: By signing the form, you are authorizing OnPoint to deposit funds into your account.

- Review and Verify: Review the form carefully to ensure all the information is accurate and complete.

- Submit the Form: Once you have completed the form, submit it to the relevant party, such as your employer or the government agency responsible for your benefits.

Tips for Filling Out the OnPoint Direct Deposit Form

Here are some tips to keep in mind when filling out the OnPoint Direct Deposit Form:

- Use a pen: When filling out the form, use a pen to ensure your handwriting is clear and legible.

- Double-check your information: Before submitting the form, double-check your information to ensure it is accurate and complete.

- Use the correct routing number: Make sure to use the correct routing number for your bank to avoid any issues with your direct deposit setup.

- Keep a copy of the form: Keep a copy of the completed form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the OnPoint Direct Deposit Form:

- Inaccurate information: Providing inaccurate information can lead to delays or issues with your direct deposit setup.

- Missing information: Failing to provide required information can result in the form being rejected.

- Incorrect routing number: Using an incorrect routing number can cause issues with your direct deposit setup.

Benefits of Filling Out the OnPoint Direct Deposit Form

Filling out the OnPoint Direct Deposit Form has several benefits, including:

- Convenience: Direct deposit is a convenient way to receive payments, as funds are electronically transferred into your account.

- Speed: Direct deposit is faster than traditional check payments, as funds are typically available in your account within 24 hours.

- Security: Direct deposit reduces the risk of lost or stolen checks, as funds are electronically transferred into your account.

Conclusion

Filling out the OnPoint Direct Deposit Form is a straightforward process that requires attention to detail and accuracy. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth setup and enjoy the benefits of direct deposit. If you have any questions or concerns, don't hesitate to reach out to OnPoint or your bank for assistance.What is the OnPoint Direct Deposit Form used for?

+The OnPoint Direct Deposit Form is used to set up direct deposit for various purposes, such as receiving payroll, government benefits, or tax refunds.

What information do I need to provide on the OnPoint Direct Deposit Form?

+You will need to provide your personal details, account information, and authorization to set up direct deposit.

How long does it take to set up direct deposit using the OnPoint Direct Deposit Form?

+The setup process typically takes a few days to a week, depending on the type of deposit and the party responsible for processing the form.