In today's digital age, payroll processing has become an essential aspect of any business. One of the most critical components of payroll processing is the paycheck stub, also known as a pay stub or pay slip. A paycheck stub is a document that provides employees with a detailed breakdown of their pay, including gross earnings, deductions, and net pay. With the increasing need for secure, compliant, and easy solutions, Form Pros check stubs have become a popular choice among businesses.

What are Form Pros Check Stubs?

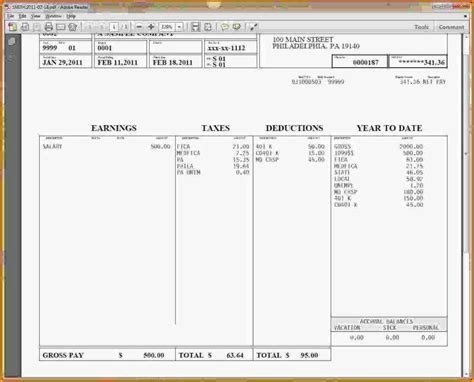

Form Pros check stubs are a type of pay stub that is designed to provide employees with a clear and concise breakdown of their pay. These check stubs are customizable, allowing businesses to include their company logo, name, and address, as well as the employee's name, pay period, and pay date. Form Pros check stubs are available in various formats, including printed and electronic versions.

Benefits of Using Form Pros Check Stubs

Using Form Pros check stubs offers several benefits to businesses and employees alike. Some of the key benefits include:

- Secure: Form Pros check stubs are designed with security in mind, providing a secure way to transmit sensitive employee information.

- Compliant: Form Pros check stubs are compliant with all relevant laws and regulations, including the Fair Labor Standards Act (FLSA) and the Internal Revenue Code (IRC).

- Easy to use: Form Pros check stubs are easy to use and understand, providing employees with a clear breakdown of their pay.

- Customizable: Form Pros check stubs are customizable, allowing businesses to include their company logo, name, and address, as well as the employee's name, pay period, and pay date.

How to Create a Form Pros Check Stub

Creating a Form Pros check stub is a straightforward process that can be completed in a few easy steps. Here's a step-by-step guide on how to create a Form Pros check stub:

- Choose a template: Select a Form Pros check stub template that meets your business needs.

- Enter employee information: Enter the employee's name, pay period, and pay date.

- Enter pay information: Enter the employee's gross earnings, deductions, and net pay.

- Customize the template: Customize the template to include your company logo, name, and address.

- Review and approve: Review the check stub for accuracy and approve it for distribution.

Form Pros Check Stub Requirements

When creating a Form Pros check stub, there are several requirements that must be met. Some of the key requirements include:

- Employee information: The employee's name, pay period, and pay date must be included on the check stub.

- Pay information: The employee's gross earnings, deductions, and net pay must be included on the check stub.

- Company information: The company logo, name, and address must be included on the check stub.

- Compliance: The check stub must comply with all relevant laws and regulations, including the FLSA and IRC.

Advantages of Using Form Pros Check Stubs

Using Form Pros check stubs offers several advantages to businesses and employees alike. Some of the key advantages include:

- Improved accuracy: Form Pros check stubs provide a clear and concise breakdown of pay, reducing errors and discrepancies.

- Increased security: Form Pros check stubs are designed with security in mind, providing a secure way to transmit sensitive employee information.

- Enhanced compliance: Form Pros check stubs are compliant with all relevant laws and regulations, reducing the risk of non-compliance.

- Improved employee satisfaction: Form Pros check stubs provide employees with a clear understanding of their pay, improving employee satisfaction and reducing disputes.

Common Mistakes to Avoid When Using Form Pros Check Stubs

When using Form Pros check stubs, there are several common mistakes to avoid. Some of the key mistakes include:

- Inaccurate information: Ensure that all information on the check stub is accurate, including employee information and pay information.

- Non-compliance: Ensure that the check stub complies with all relevant laws and regulations, including the FLSA and IRC.

- Insufficient security: Ensure that the check stub is transmitted securely, using secure protocols and encryption.

Best Practices for Using Form Pros Check Stubs

Using Form Pros check stubs requires best practices to ensure accuracy, security, and compliance. Some of the key best practices include:

- Regularly review and update: Regularly review and update the check stub template to ensure accuracy and compliance.

- Use secure protocols: Use secure protocols and encryption to transmit the check stub.

- Provide clear instructions: Provide clear instructions to employees on how to read and understand the check stub.

- Maintain accurate records: Maintain accurate records of all check stubs, including employee information and pay information.

Conclusion

Form Pros check stubs offer a secure, compliant, and easy solution for businesses and employees alike. By following best practices and avoiding common mistakes, businesses can ensure accuracy, security, and compliance. With Form Pros check stubs, businesses can improve employee satisfaction, reduce disputes, and enhance their overall payroll processing.

What is a Form Pros check stub?

+A Form Pros check stub is a type of pay stub that provides employees with a clear and concise breakdown of their pay.

What are the benefits of using Form Pros check stubs?

+The benefits of using Form Pros check stubs include improved accuracy, increased security, enhanced compliance, and improved employee satisfaction.

How do I create a Form Pros check stub?

+To create a Form Pros check stub, choose a template, enter employee information, enter pay information, customize the template, and review and approve the check stub.