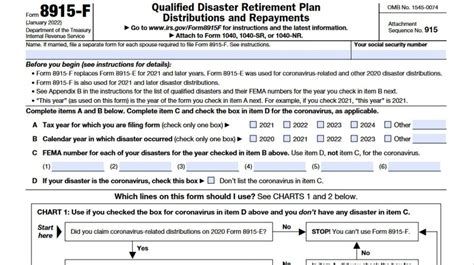

The tax season can be a daunting time for many individuals, especially when it comes to understanding the various tax forms required by the Internal Revenue Service (IRS). One such form that may cause confusion is Tax Form 8915-F, also known as the Qualified Retirement Plan Payments form. In this article, we will break down the complexities of Form 8915-F and provide a step-by-step guide on how to navigate it with ease.

Tax Form 8915-F is used to report qualified retirement plan payments, which includes payments from 401(k), 403(b), and other types of retirement plans. The form is used to determine the taxable amount of these payments and to calculate any penalties that may be owed. Understanding how to properly complete Form 8915-F is crucial to avoid any errors or omissions that may lead to delays in processing or even penalties.

Understanding the Purpose of Form 8915-F

Before we dive into the nitty-gritty of completing Form 8915-F, it's essential to understand its purpose. The form is used to report payments from qualified retirement plans, which are subject to income tax withholding. The IRS requires that these payments be reported on Form 8915-F to ensure that the correct amount of taxes is withheld and paid.

Who Needs to File Form 8915-F?

Not everyone who receives retirement plan payments needs to file Form 8915-F. The form is typically required for individuals who receive payments from a qualified retirement plan, such as:

- 401(k) plans

- 403(b) plans

- Thrift Savings Plan (TSP)

- Annuity contracts

However, there are some exceptions. For example, if you receive a lump-sum payment from a qualified retirement plan, you may not need to file Form 8915-F. Additionally, if you are receiving payments from a Roth IRA or a Roth 401(k), you may not need to file the form.

Step-by-Step Guide to Completing Form 8915-F

Now that we have covered the basics of Form 8915-F, let's move on to the step-by-step guide on how to complete it.

Step 1: Gather Required Information

Before you start filling out Form 8915-F, make sure you have all the necessary information. You will need:

- Your name and Social Security number

- The name and Employer Identification Number (EIN) of the plan administrator

- The type of plan (e.g., 401(k), 403(b), etc.)

- The payment amount and date

- The amount of taxes withheld

Step 2: Complete Part 1 - Payment Information

Part 1 of Form 8915-F requires you to provide information about the payment you received. You will need to enter the following information:

- The payment amount

- The payment date

- The type of plan

- The plan administrator's name and EIN

Step 3: Complete Part 2 - Tax Withholding

Part 2 of Form 8915-F requires you to provide information about the taxes withheld from the payment. You will need to enter the following information:

- The amount of taxes withheld

- The tax withholding rate

Step 4: Complete Part 3 - Taxable Amount

Part 3 of Form 8915-F requires you to calculate the taxable amount of the payment. You will need to enter the following information:

- The payment amount

- The amount of taxes withheld

- The taxable amount

Common Mistakes to Avoid

When completing Form 8915-F, there are several common mistakes to avoid. Some of these mistakes include:

- Failing to report all payments from qualified retirement plans

- Incorrectly calculating the taxable amount

- Failing to withhold sufficient taxes

- Not signing and dating the form

Penalties for Errors or Omissions

If you make an error or omission on Form 8915-F, you may be subject to penalties. The IRS may impose penalties for:

- Failure to file the form

- Failure to report all payments

- Incorrect calculation of the taxable amount

- Failure to withhold sufficient taxes

Conclusion

Completing Tax Form 8915-F can be a complex and daunting task. However, by following the step-by-step guide outlined in this article, you can ensure that you accurately report your qualified retirement plan payments and avoid any errors or omissions. Remember to gather all required information, complete each part of the form carefully, and avoid common mistakes.

We hope this article has provided you with a better understanding of Tax Form 8915-F and how to navigate it with ease. If you have any questions or concerns, please feel free to comment below. Share this article with your friends and family who may be struggling with Form 8915-F.

What is Tax Form 8915-F used for?

+Tax Form 8915-F is used to report qualified retirement plan payments, which includes payments from 401(k), 403(b), and other types of retirement plans.

Who needs to file Form 8915-F?

+Individuals who receive payments from a qualified retirement plan, such as 401(k), 403(b), Thrift Savings Plan (TSP), and annuity contracts, need to file Form 8915-F.

What are the common mistakes to avoid when completing Form 8915-F?

+Common mistakes to avoid include failing to report all payments from qualified retirement plans, incorrectly calculating the taxable amount, failing to withhold sufficient taxes, and not signing and dating the form.