The F&E Form 170 is a crucial tax return form for individuals and businesses in certain regions. As tax season approaches, it's essential to understand the ins and outs of this form to ensure accurate and timely submission. In this comprehensive guide, we'll break down the F&E Form 170, its importance, and provide a step-by-step walkthrough to simplify the process.

What is the F&E Form 170?

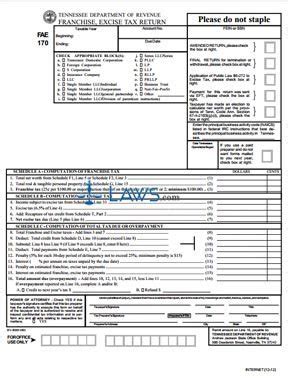

The F&E Form 170 is a tax return form used by individuals and businesses to report their income, expenses, and tax liabilities. It's a critical document that helps tax authorities assess the amount of tax owed or refund due. The form typically includes sections for reporting income, claiming deductions, and calculating tax liabilities.

Why is the F&E Form 170 important?

The F&E Form 170 is essential for several reasons:

- Tax compliance: Submitting the F&E Form 170 on time ensures compliance with tax laws and regulations.

- Accurate tax assessment: The form helps tax authorities accurately assess tax liabilities and refund amounts.

- Avoid penalties and fines: Failure to submit the form or providing incorrect information can result in penalties and fines.

Who needs to file the F&E Form 170?

The following individuals and businesses are required to file the F&E Form 170:

- Individuals: Residents and non-residents who earn income from employment, self-employment, or investments.

- Businesses: Sole proprietorships, partnerships, corporations, and other business entities that generate income.

- Non-profit organizations: Charitable organizations, associations, and other non-profit entities that receive income.

What information is required for the F&E Form 170?

To complete the F&E Form 170, you'll need to gather the following information:

- Personal details: Name, address, tax identification number, and contact information.

- Income details: Employment income, self-employment income, investment income, and other sources of income.

- Expense details: Business expenses, charitable donations, and other deductible expenses.

- Tax payment details: Tax withheld, tax credits, and other tax-related information.

Step-by-Step Guide to Filing the F&E Form 170

Here's a simplified walkthrough to help you file the F&E Form 170:

- Gather required documents: Collect all necessary documents, including income statements, expense receipts, and tax-related documents.

- Fill out the form: Complete the F&E Form 170, ensuring accuracy and completeness.

- Calculate tax liabilities: Use the form to calculate your tax liabilities and refund amounts.

- Submit the form: File the completed form with the relevant tax authority, either online or by mail.

Common mistakes to avoid when filing the F&E Form 170

To avoid penalties and delays, be aware of the following common mistakes:

- Inaccurate information: Ensure all information is accurate and complete.

- Missing documents: Attach all required documents, including income statements and expense receipts.

- Late submission: File the form on time to avoid late fees and penalties.

Tips for a smooth F&E Form 170 filing experience

To ensure a hassle-free filing experience, follow these tips:

- Seek professional help: Consult a tax professional or accountant if you're unsure about any aspect of the form.

- Use tax software: Utilize tax software to simplify the filing process and reduce errors.

- Keep records organized: Maintain accurate and organized records to ensure easy access to required information.

Conclusion and Next Steps

Filing the F&E Form 170 can seem daunting, but with this simplified guide, you're well on your way to a smooth and successful tax filing experience. Remember to gather all required documents, fill out the form accurately, and submit it on time. If you're unsure about any aspect of the process, don't hesitate to seek professional help.

What's next?

- Stay informed: Stay up-to-date with tax law changes and updates to ensure compliance.

- Plan ahead: Plan your tax strategy in advance to minimize tax liabilities and maximize refunds.

- Seek help when needed: Don't hesitate to seek professional help if you're unsure about any aspect of the F&E Form 170.

What is the deadline for filing the F&E Form 170?

+The deadline for filing the F&E Form 170 varies depending on your location and tax authority. Check with your local tax authority for specific deadlines.

Can I file the F&E Form 170 online?

+Yes, many tax authorities offer online filing options for the F&E Form 170. Check with your local tax authority to see if this option is available.

What happens if I miss the deadline for filing the F&E Form 170?

+If you miss the deadline, you may be subject to late fees and penalties. It's essential to file the form as soon as possible to avoid these consequences.