Filing your taxes can be a daunting task, but with the right guidance, it can be a breeze. In this article, we will provide a comprehensive guide on how to file your Missouri state income tax return using Form MO-1040. We will cover the eligibility criteria, required documents, and step-by-step instructions to help you navigate the process with ease.

Why File Form MO-1040?

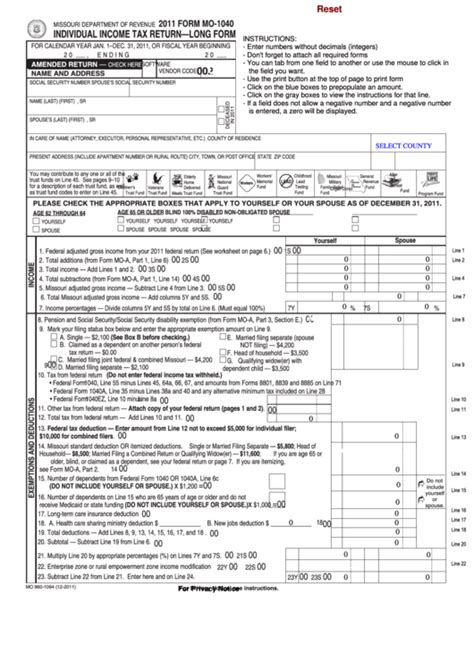

Form MO-1040 is the standard form used by the Missouri Department of Revenue to report individual income tax. If you are a resident of Missouri, you are required to file this form to report your income, claim deductions and credits, and pay any taxes owed. Filing Form MO-1040 is mandatory if your income exceeds the minimum filing requirement, which varies based on your filing status and age.

Eligibility Criteria

To file Form MO-1040, you must meet the following eligibility criteria:

- You are a resident of Missouri.

- You have a Missouri driver's license or state ID.

- You have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- You have income that exceeds the minimum filing requirement.

Required Documents

Before you start filing Form MO-1040, make sure you have the following documents:

- Your Missouri driver's license or state ID.

- Your Social Security number or ITIN.

- Your W-2 forms from your employer(s).

- Your 1099 forms for self-employment income.

- Your interest and dividend statements (1099-INT and 1099-DIV).

- Your charitable donation receipts.

- Your medical expense receipts.

Step-by-Step Instructions

Filing Form MO-1040 involves several steps. Follow these instructions carefully to ensure accuracy and avoid errors.

Filing Status

Your filing status determines your tax rates and deductions. Missouri recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status based on your marital status and family situation.

Income Reporting

Report all your income on Form MO-1040. This includes:

- Wages, salaries, and tips (W-2 income)

- Self-employment income (1099 income)

- Interest and dividend income (1099-INT and 1099-DIV)

- Capital gains and losses

- Unemployment benefits

- Social Security benefits

Use the correct lines and columns to report each type of income.

Deductions and Credits

Claim all eligible deductions and credits to reduce your tax liability. Missouri offers various deductions and credits, including:

- Standard deduction

- Itemized deduction

- Personal exemption

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

Use the correct forms and schedules to claim these deductions and credits.

Tax Payment and Refund

If you owe taxes, you can pay online, by phone, or by mail. If you are due a refund, you can choose to receive it by direct deposit, check, or prepaid debit card.

Tips and Reminders

- File Form MO-1040 electronically to avoid errors and faster processing.

- Use the correct mailing address and filing deadline to avoid penalties.

- Keep a copy of your return and supporting documents for at least three years.

- Consult a tax professional or contact the Missouri Department of Revenue if you have questions or need assistance.

Conclusion

Filing Form MO-1040 is a straightforward process if you follow the instructions carefully. Make sure you have all the required documents and use the correct forms and schedules to report your income, claim deductions and credits, and pay any taxes owed. If you have questions or need assistance, don't hesitate to contact the Missouri Department of Revenue or consult a tax professional.

FAQ Section

What is the minimum filing requirement for Missouri state income tax?

+The minimum filing requirement varies based on your filing status and age. For the 2022 tax year, the minimum filing requirement is $12,200 for single filers and $24,400 for joint filers.

Can I file Form MO-1040 electronically?

+Yes, you can file Form MO-1040 electronically through the Missouri Department of Revenue's website or through a tax preparation software.

What is the deadline for filing Form MO-1040?

+The deadline for filing Form MO-1040 is April 15th of each year.