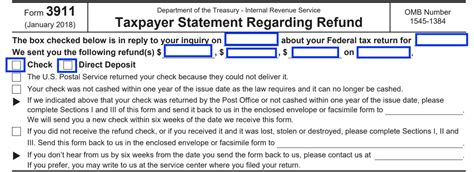

Mailing Form 3911, also known as the Taxpayer Statement Regarding Refund, is an essential step for individuals who need to report an error or discrepancy with their tax refund. The Internal Revenue Service (IRS) provides multiple ways to mail this form, ensuring that taxpayers can choose the method that best suits their needs. In this article, we will explore three ways to mail Form 3911, highlighting the benefits and requirements of each method.

Mailing Form 3911: Understanding the Importance

Before we dive into the mailing methods, it's crucial to understand the significance of Form 3911. This form is used to report errors or discrepancies with tax refunds, such as incorrect refund amounts, missing refunds, or refunds that were not applied to the correct account. By mailing Form 3911, taxpayers can initiate an investigation into the issue and potentially receive a corrected refund.

Method 1: Mailing Form 3911 via USPS

The most traditional method of mailing Form 3911 is through the United States Postal Service (USPS). To mail the form via USPS, taxpayers will need to:

- Complete Form 3911 accurately and sign it

- Attach any required supporting documentation, such as a copy of the tax return or proof of identity

- Address the envelope to the correct IRS address, which can be found on the IRS website or on the form itself

- Affix the correct postage and mail the form via USPS

Mailing Form 3911 via USPS is a reliable method, but it may take longer for the IRS to receive and process the form. Taxpayers can expect a response from the IRS within 6-8 weeks after mailing the form.

Benefits of Mailing Form 3911 via USPS

- Wide availability of USPS mailboxes and post offices

- Ability to track the mail through USPS tracking services

- No requirement for a digital signature or online account

Requirements for Mailing Form 3911 via USPS

- Completed and signed Form 3911

- Required supporting documentation

- Correct postage and addressing

- Mailbox or post office access

Method 2: Mailing Form 3911 via Certified Mail

For an additional fee, taxpayers can mail Form 3911 via certified mail. This method provides proof of mailing and proof of delivery, which can be beneficial in case of disputes or issues with the IRS. To mail Form 3911 via certified mail, taxpayers will need to:

- Complete Form 3911 accurately and sign it

- Attach any required supporting documentation

- Address the envelope to the correct IRS address

- Take the form to a USPS post office and request certified mail services

- Pay the additional fee for certified mail

Mailing Form 3911 via certified mail provides an added layer of security and tracking, but it may be more expensive than regular USPS mail.

Benefits of Mailing Form 3911 via Certified Mail

- Proof of mailing and delivery

- Ability to track the mail through USPS tracking services

- Added security and peace of mind

Requirements for Mailing Form 3911 via Certified Mail

- Completed and signed Form 3911

- Required supporting documentation

- Correct postage and addressing

- USPS post office access

- Additional fee for certified mail services

Method 3: Mailing Form 3911 via Private Delivery Services

Taxpayers can also mail Form 3911 via private delivery services, such as FedEx or UPS. These services may provide faster delivery times and additional tracking features. To mail Form 3911 via private delivery services, taxpayers will need to:

- Complete Form 3911 accurately and sign it

- Attach any required supporting documentation

- Address the envelope to the correct IRS address

- Take the form to a private delivery service location

- Pay the required fee for delivery services

Mailing Form 3911 via private delivery services may be more expensive than USPS mail, but it can provide faster delivery times and additional tracking features.

Benefits of Mailing Form 3911 via Private Delivery Services

- Faster delivery times

- Additional tracking features

- Ability to track the mail through private delivery service tracking services

Requirements for Mailing Form 3911 via Private Delivery Services

- Completed and signed Form 3911

- Required supporting documentation

- Correct addressing

- Private delivery service location access

- Required fee for delivery services

In conclusion, taxpayers have three options for mailing Form 3911: USPS, certified mail, and private delivery services. Each method has its benefits and requirements, and taxpayers should choose the method that best suits their needs. By following the correct procedures and providing the required documentation, taxpayers can ensure that their Form 3911 is processed efficiently and effectively.

We encourage you to share your experiences with mailing Form 3911 in the comments section below. Have you used any of these methods before? Do you have any tips or advice for others who may be mailing Form 3911? Your input can help others navigate the process more smoothly.

What is the purpose of Form 3911?

+Form 3911 is used to report errors or discrepancies with tax refunds, such as incorrect refund amounts, missing refunds, or refunds that were not applied to the correct account.

How long does it take for the IRS to process Form 3911?

+The IRS typically processes Form 3911 within 6-8 weeks after receiving the form. However, processing times may vary depending on the complexity of the issue and the workload of the IRS.

Can I submit Form 3911 online?

+No, Form 3911 cannot be submitted online. Taxpayers must mail the form to the IRS using one of the methods described above.