The Internal Revenue Service (IRS) imposes additional taxes on certain tax benefits, such as early withdrawals from retirement accounts, to encourage taxpayers to use these benefits for their intended purpose. One of the forms used to report and calculate these additional taxes is Form 5329. In this article, we will delve into the world of Form 5329, explaining its purpose, who needs to file it, and how to calculate the additional taxes.

What is Form 5329?

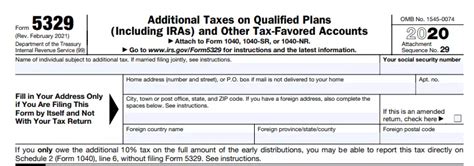

Form 5329 is an IRS form used to report and calculate additional taxes on tax benefits, such as early withdrawals from retirement accounts, health savings accounts (HSAs), and other tax-favored accounts. The form is also used to calculate the tax on excess contributions to these accounts. The additional taxes imposed on these benefits are designed to discourage taxpayers from using them for purposes other than their intended use.

Who needs to file Form 5329?

You need to file Form 5329 if you have taken an early withdrawal from a retirement account, such as a 401(k) or an IRA, before reaching the age of 59 1/2. You also need to file this form if you have made excess contributions to a retirement account or an HSA. Additionally, if you have received a distribution from a qualified retirement plan or an IRA and did not roll it over into another qualified plan or IRA within 60 days, you may need to file Form 5329.

What are the additional taxes on tax benefits?

The additional taxes on tax benefits are imposed on certain distributions from tax-favored accounts, such as:

- Early withdrawals from retirement accounts before reaching the age of 59 1/2

- Excess contributions to retirement accounts or HSAs

- Failure to roll over a distribution from a qualified retirement plan or an IRA within 60 days

The additional taxes are calculated as a percentage of the distribution or excess contribution, ranging from 6% to 50% depending on the type of account and the reason for the distribution.

How to calculate the additional taxes

To calculate the additional taxes on tax benefits, you need to complete Form 5329. The form requires you to report the type and amount of the distribution or excess contribution, as well as the reason for the distribution. You then need to calculate the additional tax using the applicable percentage.

For example, if you took an early withdrawal from a 401(k) account before reaching the age of 59 1/2, you would calculate the additional tax as follows:

- Calculate the amount of the distribution

- Determine the applicable percentage (10% in this case)

- Multiply the distribution amount by the applicable percentage

- Report the additional tax on Form 5329

Early Withdrawal from Retirement Accounts

Early withdrawals from retirement accounts are subject to a 10% additional tax if taken before reaching the age of 59 1/2. However, there are some exceptions to this rule, such as:

- Separation from service

- Disability

- Death

- First-time homebuyer

- Qualified education expenses

If you qualify for one of these exceptions, you may not be subject to the additional tax.

Excess Contributions to Retirement Accounts

Excess contributions to retirement accounts are also subject to additional taxes. If you contribute more than the allowable limit to a retirement account or an HSA, you may be subject to a 6% excise tax on the excess contribution.

To avoid this tax, you can withdraw the excess contribution and any earnings on it before the tax filing deadline. However, if you fail to withdraw the excess contribution, you will need to pay the 6% excise tax on it.

HSAs and Archer MSAs

Health savings accounts (HSAs) and Archer medical savings accounts (MSAs) are also subject to additional taxes on excess contributions. If you contribute more than the allowable limit to an HSA or an Archer MSA, you may be subject to a 6% excise tax on the excess contribution.

Other Tax-Favored Accounts

Other tax-favored accounts, such as Coverdell education savings accounts and qualified tuition programs (529 plans), are also subject to additional taxes on excess contributions.

How to avoid additional taxes

To avoid additional taxes on tax benefits, you can take the following steps:

- Avoid taking early withdrawals from retirement accounts before reaching the age of 59 1/2

- Make contributions to retirement accounts and HSAs within the allowable limits

- Roll over distributions from qualified retirement plans or IRAs within 60 days

- Avoid excess contributions to tax-favored accounts

By following these steps, you can avoid additional taxes on tax benefits and keep more of your hard-earned money.

Conclusion

In conclusion, Form 5329 is an important IRS form used to report and calculate additional taxes on tax benefits. By understanding the purpose and requirements of this form, you can avoid additional taxes and keep more of your hard-earned money. Remember to make contributions to retirement accounts and HSAs within the allowable limits, roll over distributions from qualified retirement plans or IRAs within 60 days, and avoid excess contributions to tax-favored accounts.

FAQs

What is Form 5329?

+Form 5329 is an IRS form used to report and calculate additional taxes on tax benefits, such as early withdrawals from retirement accounts and excess contributions to tax-favored accounts.

Who needs to file Form 5329?

+You need to file Form 5329 if you have taken an early withdrawal from a retirement account, made excess contributions to a retirement account or an HSA, or received a distribution from a qualified retirement plan or an IRA and did not roll it over within 60 days.

What are the additional taxes on tax benefits?

+The additional taxes on tax benefits are imposed on certain distributions from tax-favored accounts, such as early withdrawals from retirement accounts, excess contributions to retirement accounts or HSAs, and failure to roll over a distribution from a qualified retirement plan or an IRA within 60 days.