When it comes to navigating the complexities of Arizona state taxes, understanding the various forms and their purposes can be overwhelming. One crucial form for Arizona residents and businesses is the Form 120, also known as the Arizona Transaction Privilege Tax Return. In this article, we will break down the Form 120 into 5 easy steps, helping you grasp its significance and how to properly file it.

Arizona's tax system is unique, as it combines elements of sales and use taxes, and the transaction privilege tax (TPT) is the primary tax levied on businesses. The TPT is a tax on the privilege of doing business in Arizona, and it is reported on the Form 120. Whether you're a seasoned business owner or an individual with a side hustle, understanding the Form 120 is crucial for maintaining compliance with Arizona's tax laws.

Step 1: Determining Your Filing Status

Before diving into the Form 120, it's essential to determine your filing status. As an Arizona taxpayer, you may be required to file this form on a monthly, quarterly, or annual basis. The frequency of your filings depends on your business's total annual TPT liability.

- If your total annual TPT liability is $100 or less, you can file annually.

- If your total annual TPT liability is between $101 and $1,500, you must file quarterly.

- If your total annual TPT liability exceeds $1,500, you are required to file monthly.

It's crucial to note that even if you don't have any TPT liability, you may still be required to file a Form 120 if you're registered for a transaction privilege tax license.

TPT Licensing and Registration

To file a Form 120, you must first obtain a TPT license from the Arizona Department of Revenue. This license is required for most businesses operating in Arizona, including retailers, wholesalers, and service providers. You can register for a TPT license online through the Arizona Department of Revenue's website or by mailing in a paper application.

Step 2: Gathering Required Information

To complete the Form 120, you'll need to gather various pieces of information, including:

- Your business's name and address

- Your TPT license number

- Your Federal Employer Identification Number (FEIN)

- The reporting period (monthly, quarterly, or annual)

- Your total gross income

- Any deductions or exemptions

- The amount of TPT owed or overpaid

It's essential to ensure accuracy when gathering this information, as any errors or discrepancies can lead to delays or penalties.

Understanding TPT Rates and Deductions

Arizona's TPT rates vary depending on the type of business and the location of the transaction. The state has a complex system of tax rates, with different rates applying to various industries and geographic areas. It's crucial to understand the specific TPT rates and deductions applicable to your business to avoid under or overpaying taxes.

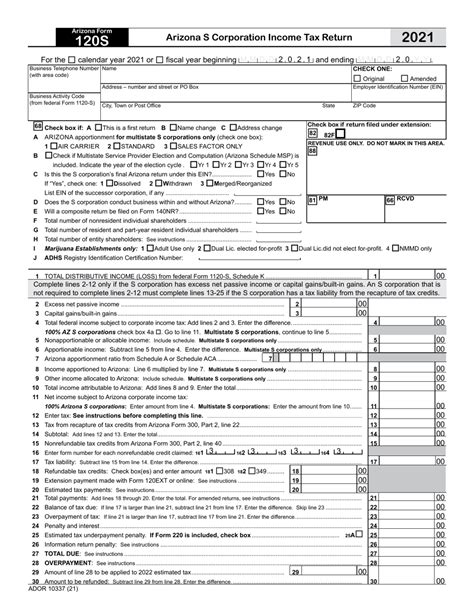

Step 3: Completing the Form 120

Once you've gathered the required information, you can begin completing the Form 120. The form consists of multiple sections, including:

- Section 1: Business Information

- Section 2: Gross Income

- Section 3: Deductions and Exemptions

- Section 4: TPT Liability

- Section 5: Payment and Overpayment

It's essential to carefully review each section and ensure accuracy, as any errors can lead to delays or penalties.

Electronic Filing Options

Arizona offers electronic filing options for the Form 120, including the Arizona Transaction Privilege Tax Return e-file system. This system allows you to file your return online, reducing the risk of errors and ensuring faster processing times.

Step 4: Submitting Your Return

After completing the Form 120, you'll need to submit it to the Arizona Department of Revenue. You can file your return online, by mail, or in person. If you're filing electronically, you'll receive an immediate confirmation of receipt. If you're filing by mail or in person, ensure you keep a record of your submission, as you may need to provide proof of filing in the future.

Payment Options

If you owe TPT, you can pay online, by phone, or by mail. Arizona accepts various payment methods, including credit cards, e-checks, and checks. It's essential to pay any owed taxes on time to avoid penalties and interest.

Step 5: Maintaining Compliance

After filing your Form 120, it's crucial to maintain compliance with Arizona's tax laws. This includes:

- Keeping accurate records of your business's income, deductions, and TPT liability

- Filing any required amendments or corrections

- Responding promptly to any notices or correspondence from the Arizona Department of Revenue

By following these steps and maintaining compliance, you can ensure your business remains in good standing with the state of Arizona.

Now that you've completed the 5 easy steps for understanding Arizona Form 120s, you're better equipped to navigate the complexities of Arizona's tax system. Remember to maintain accurate records, file your returns on time, and stay informed about any changes to Arizona's tax laws.

What is the purpose of the Form 120?

+The Form 120 is used to report and pay the Arizona Transaction Privilege Tax (TPT). It's a tax on the privilege of doing business in Arizona and is levied on businesses.

Who needs to file a Form 120?

+Most businesses operating in Arizona, including retailers, wholesalers, and service providers, are required to file a Form 120.

What is the due date for filing a Form 120?

+The due date for filing a Form 120 depends on your business's total annual TPT liability and filing frequency. You can file annually, quarterly, or monthly.

We hope you found this article informative and helpful in understanding Arizona Form 120s. If you have any further questions or concerns, feel free to ask in the comments below!