As a beneficiary of an estate or trust, receiving a Schedule K-1 (Form 1041) can be a daunting experience. One of the most critical components of this form is Box 11, which reports the beneficiary's share of income, deductions, and credits from the estate or trust. In this article, we will provide you with 5 essential tips to help you understand Schedule K-1 Form 1041 Box 11 and navigate the complexities of estate and trust taxation.

Tip 1: Understand the Purpose of Schedule K-1

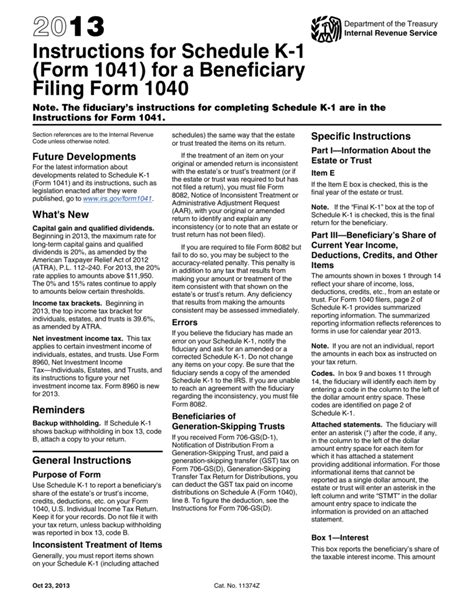

Before diving into Box 11, it's essential to understand the purpose of Schedule K-1. This form is used to report the income, deductions, and credits of an estate or trust, as well as the beneficiary's share of these amounts. The form is typically prepared by the fiduciary (executor or trustee) and distributed to the beneficiaries. As a beneficiary, you will use the information reported on Schedule K-1 to complete your individual tax return (Form 1040).

Key Components of Schedule K-1

- Identifying information: The form will include the name, address, and taxpayer identification number (TIN) of the estate or trust, as well as the beneficiary's name and TIN.

- Income: The form will report the estate's or trust's income, including interest, dividends, capital gains, and other types of income.

- Deductions: The form will report the estate's or trust's deductions, including administrative expenses, charitable contributions, and other types of deductions.

- Credits: The form will report the estate's or trust's credits, including tax credits and other types of credits.

Tip 2: Break Down Box 11

Box 11 of Schedule K-1 reports the beneficiary's share of income, deductions, and credits from the estate or trust. This box is further divided into several sub-boxes, which provide a detailed breakdown of the beneficiary's share of the estate's or trust's income, deductions, and credits.

- Sub-box 11a: Reports the beneficiary's share of ordinary income (e.g., interest, dividends).

- Sub-box 11b: Reports the beneficiary's share of capital gains (e.g., long-term capital gains).

- Sub-box 11c: Reports the beneficiary's share of qualified dividends.

- Sub-box 11d: Reports the beneficiary's share of foreign tax credits.

Tip 3: Determine the Beneficiary's Share

To determine the beneficiary's share of income, deductions, and credits, you will need to review the trust or estate's governing document (e.g., will, trust agreement). This document will outline the beneficiary's share of the estate or trust's assets and income.

Key Factors to Consider

- The beneficiary's percentage interest in the estate or trust.

- The type of income or asset being reported (e.g., ordinary income, capital gains).

- The beneficiary's tax filing status (e.g., single, married filing jointly).

Tip 4: Report the Beneficiary's Share on Form 1040

As a beneficiary, you will report your share of income, deductions, and credits from the estate or trust on your individual tax return (Form 1040). You will need to complete Schedule 1 (Form 1040) and attach a copy of Schedule K-1 to your tax return.

- Line 21: Reports the beneficiary's share of ordinary income (e.g., interest, dividends).

- Line 13: Reports the beneficiary's share of capital gains (e.g., long-term capital gains).

- Line 48: Reports the beneficiary's share of qualified dividends.

- Line 49: Reports the beneficiary's share of foreign tax credits.

Tip 5: Seek Professional Guidance

If you are unsure about how to report your share of income, deductions, and credits from an estate or trust, it's essential to seek professional guidance. Consult with a qualified tax professional or estate planning attorney to ensure you are meeting your tax obligations and taking advantage of available tax credits and deductions.

Key Takeaways

- Understand the purpose of Schedule K-1 and the information reported on the form.

- Break down Box 11 to determine the beneficiary's share of income, deductions, and credits.

- Determine the beneficiary's share of income, deductions, and credits based on the trust or estate's governing document.

- Report the beneficiary's share on Form 1040 and attach a copy of Schedule K-1 to your tax return.

- Seek professional guidance if you are unsure about how to report your share of income, deductions, and credits.

We hope these 5 tips have provided you with a better understanding of Schedule K-1 Form 1041 Box 11. Remember to seek professional guidance if you are unsure about any aspect of estate or trust taxation.

What is Schedule K-1 (Form 1041)?

+Schedule K-1 (Form 1041) is a tax form used to report the income, deductions, and credits of an estate or trust, as well as the beneficiary's share of these amounts.

What is Box 11 on Schedule K-1?

+Box 11 on Schedule K-1 reports the beneficiary's share of income, deductions, and credits from the estate or trust.

How do I determine my share of income, deductions, and credits from an estate or trust?

+To determine your share, review the trust or estate's governing document (e.g., will, trust agreement) and consult with a qualified tax professional or estate planning attorney.