Receiving compensation for childcare expenses can be a significant relief for many families. However, the process of claiming these expenses can be daunting, especially when dealing with complex forms like the SF 3881. In this article, we will break down the SF 3881 form, explaining its purpose, requirements, and step-by-step instructions on how to complete it accurately.

What is the SF 3881 Form?

The SF 3881 form, also known as the "Child Care Claim Form," is a document used by federal employees to claim reimbursement for childcare expenses incurred while working or attending school. The form is used in conjunction with the Federal Employees Health Benefits (FEHB) program, which provides financial assistance to eligible employees for childcare expenses.

Eligibility Requirements

To be eligible to claim childcare expenses using the SF 3881 form, federal employees must meet the following requirements:

- Be a federal employee, including those working for executive, legislative, or judicial branches

- Have a child under the age of 13 (or a disabled child under the age of 18)

- Have incurred childcare expenses due to work or school attendance

- Have a valid FEHB insurance plan

Gathering Required Documents

Before completing the SF 3881 form, federal employees will need to gather the following documents:

- Childcare provider's information, including name, address, and Social Security number or Employer Identification Number (EIN)

- Receipts or invoices for childcare expenses

- Proof of work or school attendance, such as a letter from the employer or school

- Proof of FEHB insurance coverage

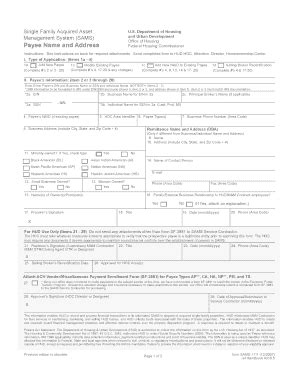

Completing the SF 3881 Form

Completing the SF 3881 form requires careful attention to detail and accuracy. The following steps will guide you through the process:

Section 1: Employee Information

- Enter your name, address, and Social Security number

- Provide your FEHB insurance plan information, including the plan name and policy number

Section 2: Child Information

- Enter the child's name, date of birth, and Social Security number

- Provide the child's relationship to the employee (e.g., son, daughter, etc.)

Section 3: Childcare Provider Information

- Enter the childcare provider's name, address, and Social Security number or EIN

- Provide the childcare provider's certification or licensure information (if applicable)

Section 4: Claim Information

- Enter the claim period, including the start and end dates

- Provide the total amount of childcare expenses incurred during the claim period

- Attach receipts or invoices for childcare expenses

Section 5: Certification

- Sign and date the form, certifying that the information provided is accurate and true

Submitting the SF 3881 Form

Once the SF 3881 form is completed, federal employees should submit it to their agency's personnel office or benefits administrator. The form can be submitted electronically or by mail, depending on the agency's instructions.

Tips and Reminders

- Keep accurate records of childcare expenses and receipts

- Submit the SF 3881 form promptly to avoid delays in reimbursement

- Review the form carefully before submitting to ensure accuracy and completeness

Common Mistakes to Avoid

When completing the SF 3881 form, federal employees should avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to attach required documents, such as receipts or invoices

- Late submission of the form

Conclusion

Completing the SF 3881 form accurately and submitting it promptly can help federal employees receive reimbursement for childcare expenses. By following the steps outlined in this guide and avoiding common mistakes, federal employees can ensure a smooth and successful claims process. If you have any questions or concerns about the SF 3881 form, don't hesitate to reach out to your agency's personnel office or benefits administrator for assistance.

We hope this comprehensive guide has been helpful in explaining the SF 3881 form and its requirements. If you have any further questions or would like to share your experiences with the form, please leave a comment below.

What is the purpose of the SF 3881 form?

+The SF 3881 form is used by federal employees to claim reimbursement for childcare expenses incurred while working or attending school.

Who is eligible to claim childcare expenses using the SF 3881 form?

+Federal employees who meet the eligibility requirements, including having a child under the age of 13 (or a disabled child under the age of 18), incurring childcare expenses due to work or school attendance, and having a valid FEHB insurance plan.

What documents are required to complete the SF 3881 form?

+Required documents include the childcare provider's information, receipts or invoices for childcare expenses, proof of work or school attendance, and proof of FEHB insurance coverage.