When individuals donate their vehicles to charitable organizations, they may be eligible for a tax deduction. The Internal Revenue Service (IRS) requires donors to complete Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes, to report the donation and claim the deduction. In this article, we will delve into the details of IRS Form 1098-C, its purpose, and the requirements for claiming a vehicle donation tax deduction.

What is IRS Form 1098-C?

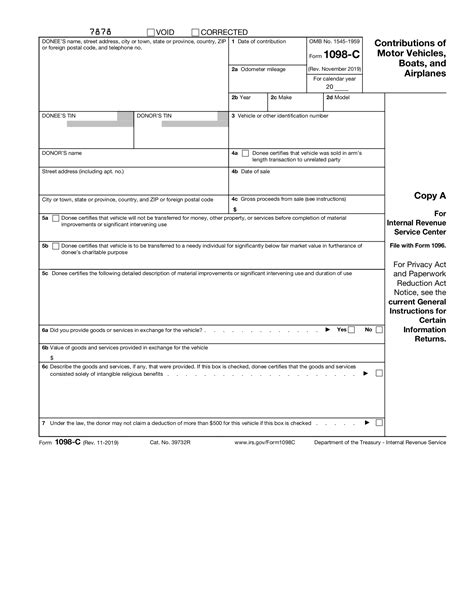

IRS Form 1098-C is a document that charitable organizations must provide to donors who contribute motor vehicles, boats, and airplanes. The form reports the donation to the IRS and serves as proof of the donation for the donor's tax records. The form includes information about the donated vehicle, such as its make, model, and year, as well as the name and address of the charitable organization.

Purpose of Form 1098-C

The primary purpose of Form 1098-C is to report the donation of a motor vehicle, boat, or airplane to the IRS. The form helps the IRS verify the donation and ensures that the donor is eligible for a tax deduction. The form also helps charitable organizations maintain accurate records of their donations and provides a way for them to acknowledge the donor's contribution.

Eligibility for a Vehicle Donation Tax Deduction

To be eligible for a vehicle donation tax deduction, the donor must meet certain requirements. The vehicle must be donated to a qualified charitable organization, and the donor must receive a Form 1098-C from the organization. The donor must also itemize their deductions on their tax return and attach the Form 1098-C to the return.

Qualified Charitable Organizations

Not all charitable organizations are qualified to receive vehicle donations. To be qualified, the organization must be a 501(c)(3) organization, which is a tax-exempt organization that is organized and operated exclusively for charitable purposes. The organization must also be registered with the IRS and have a valid Employer Identification Number (EIN).

How to Claim a Vehicle Donation Tax Deduction

To claim a vehicle donation tax deduction, the donor must follow these steps:

- Obtain a Form 1098-C: The donor must receive a Form 1098-C from the charitable organization within 30 days of the donation.

- Determine the Fair Market Value: The donor must determine the fair market value of the vehicle on the date of the donation. The fair market value is the price that a willing buyer would pay for the vehicle.

- Itemize Deductions: The donor must itemize their deductions on their tax return (Form 1040).

- Attach Form 1098-C: The donor must attach the Form 1098-C to their tax return.

Limitations on Vehicle Donation Tax Deductions

There are limitations on vehicle donation tax deductions. The donor can deduct the fair market value of the vehicle, but the deduction is limited to the amount the vehicle is sold for by the charitable organization. If the vehicle is sold for less than the fair market value, the donor can only deduct the sale price.

Common Mistakes to Avoid

When claiming a vehicle donation tax deduction, there are common mistakes to avoid. These include:

- Incorrect Fair Market Value: Donors must accurately determine the fair market value of the vehicle.

- Missing Form 1098-C: Donors must receive a Form 1098-C from the charitable organization and attach it to their tax return.

- Failure to Itemize: Donors must itemize their deductions on their tax return to claim the vehicle donation tax deduction.

Conclusion

Claiming a vehicle donation tax deduction requires careful attention to detail and adherence to IRS regulations. By understanding the requirements and limitations of Form 1098-C, donors can ensure that they receive the maximum tax deduction for their charitable donation. We encourage readers to share their experiences with vehicle donation tax deductions and ask any questions they may have in the comments below.

What is the deadline for receiving a Form 1098-C from a charitable organization?

+The charitable organization must provide the donor with a Form 1098-C within 30 days of the donation.

Can I claim a vehicle donation tax deduction if I donate a vehicle to a non-qualified charitable organization?

+No, the charitable organization must be a qualified 501(c)(3) organization to claim a vehicle donation tax deduction.

How do I determine the fair market value of my vehicle?

+You can determine the fair market value of your vehicle by researching the market value of similar vehicles or using a vehicle pricing guide.