The IRS Form 4506-C is a crucial document for lenders, tax professionals, and other authorized parties to obtain transcripts of tax returns from the Internal Revenue Service (IRS). This form is a vital tool for verifying an individual's or business's income and compliance with tax laws. In this article, we will delve into the world of IRS Form 4506-C, exploring its importance, benefits, and the step-by-step process of filing it.

What is IRS Form 4506-C?

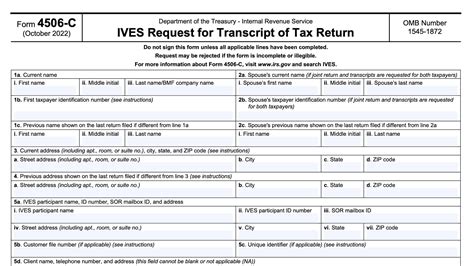

IRS Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a document used to request a transcript of a taxpayer's return information from the IRS. This form is typically used by lenders, tax professionals, and other authorized parties to verify an individual's or business's income and compliance with tax laws. The form is used to request a transcript of the taxpayer's return information, which includes the taxpayer's name, address, and tax return information.

Why is IRS Form 4506-C Important?

The IRS Form 4506-C is essential for several reasons:

- Verification of Income: The form allows lenders and other authorized parties to verify an individual's or business's income, which is crucial for loan applications, credit checks, and other financial transactions.

- Compliance with Tax Laws: The form helps to ensure compliance with tax laws by providing a transcript of the taxpayer's return information, which can be used to detect and prevent tax evasion.

- Identity Verification: The form helps to verify the identity of the taxpayer, which is essential for preventing identity theft and other forms of tax-related fraud.

Who Can Use IRS Form 4506-C?

The IRS Form 4506-C can be used by:

- Lenders: Lenders can use the form to verify an individual's or business's income and creditworthiness.

- Tax Professionals: Tax professionals can use the form to obtain transcripts of their clients' tax returns.

- Authorized Parties: Other authorized parties, such as government agencies and financial institutions, can use the form to obtain transcripts of tax returns.

Benefits of Using IRS Form 4506-C

The benefits of using IRS Form 4506-C include:

- Convenience: The form provides a convenient way to obtain transcripts of tax returns, which can be used to verify income and compliance with tax laws.

- Accuracy: The form helps to ensure accuracy by providing a transcript of the taxpayer's return information, which can be used to detect and prevent errors.

- Security: The form helps to ensure security by verifying the identity of the taxpayer and preventing identity theft and other forms of tax-related fraud.

How to File IRS Form 4506-C

Filing IRS Form 4506-C involves the following steps:

- Obtain the Form: Obtain the IRS Form 4506-C from the IRS website or by contacting the IRS directly.

- Complete the Form: Complete the form by providing the required information, including the taxpayer's name, address, and tax return information.

- Sign the Form: Sign the form to authorize the release of the taxpayer's return information.

- Submit the Form: Submit the form to the IRS, either electronically or by mail.

Common Mistakes to Avoid

When filing IRS Form 4506-C, it is essential to avoid the following common mistakes:

- Incomplete Information: Ensure that all required information is provided, including the taxpayer's name, address, and tax return information.

- Incorrect Signatures: Ensure that the form is signed by the authorized party, such as the taxpayer or their representative.

- Late Submissions: Ensure that the form is submitted on time to avoid delays in processing.

Conclusion

In conclusion, IRS Form 4506-C is a crucial document for verifying an individual's or business's income and compliance with tax laws. By understanding the importance, benefits, and step-by-step process of filing the form, authorized parties can ensure compliance with tax laws and prevent tax-related fraud. Remember to avoid common mistakes and ensure that the form is completed accurately and submitted on time.

What's Next?

We encourage you to share your thoughts and experiences with IRS Form 4506-C in the comments section below. If you have any questions or need further clarification on any of the topics discussed in this article, please do not hesitate to ask. Share this article with your colleagues and friends who may benefit from this information.