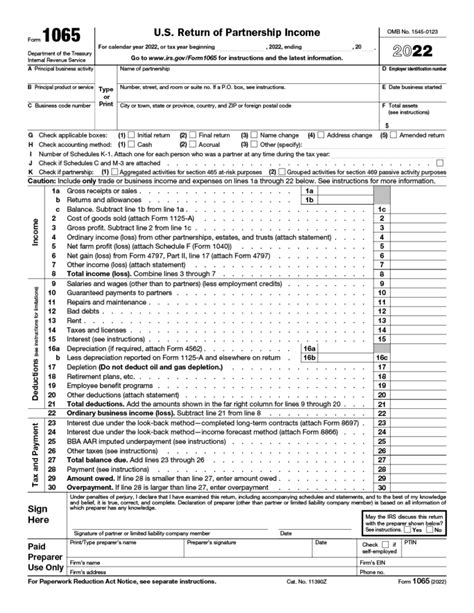

Form 1065 Schedule B-1, also known as the "Information on Partners' Shares of Income, Deductions, Credits, etc.," is a crucial component of the partnership tax return. It provides detailed information about the partners' shares of income, deductions, credits, and other items. In this article, we will provide a step-by-step guide on how to complete Form 1065 Schedule B-1, highlighting the importance of accurate reporting and compliance with tax regulations.

Understanding the Importance of Form 1065 Schedule B-1

Form 1065 Schedule B-1 is a supporting schedule to Form 1065, the partnership tax return. It is used to report the partners' shares of income, deductions, credits, and other items, which is essential for calculating each partner's tax liability. The information reported on Schedule B-1 is used to complete the partners' individual tax returns, Form 1040.

Step 1: Identify the Partners and Their Interests

To complete Schedule B-1, you need to identify the partners and their interests in the partnership. This includes the partner's name, address, and taxpayer identification number (TIN). You also need to determine each partner's percentage interest in the partnership, which is used to calculate their share of income, deductions, and credits.

Step 2: Calculate the Partners' Shares of Income

Schedule B-1 requires you to calculate the partners' shares of income from various sources, including ordinary business income, capital gains, and dividends. You need to allocate these amounts to each partner based on their percentage interest in the partnership.

Step 3: Calculate the Partners' Shares of Deductions

In addition to calculating the partners' shares of income, you also need to calculate their shares of deductions. This includes deductions for business expenses, interest, and taxes. You need to allocate these deductions to each partner based on their percentage interest in the partnership.

Step 4: Report the Partners' Shares of Credits

Schedule B-1 also requires you to report the partners' shares of credits, including the low-income housing credit, the new markets tax credit, and the renewable energy production credit. You need to allocate these credits to each partner based on their percentage interest in the partnership.

Step 5: Complete the Schedule B-1

Once you have calculated the partners' shares of income, deductions, and credits, you can complete Schedule B-1. The schedule has several columns, including columns for the partner's name, address, and TIN, as well as columns for the partner's shares of income, deductions, and credits.

Step 6: Review and Sign the Schedule

Finally, you need to review the Schedule B-1 for accuracy and completeness. The partnership's tax return, including Schedule B-1, must be signed by an authorized partner or the partnership's tax return preparer.

Common Errors to Avoid When Completing Schedule B-1

When completing Schedule B-1, there are several common errors to avoid, including:

- Failing to report all partners' interests in the partnership

- Incorrectly calculating the partners' shares of income, deductions, and credits

- Failing to allocate the partners' shares of income, deductions, and credits correctly

Tips for Accurate Reporting on Schedule B-1

To ensure accurate reporting on Schedule B-1, follow these tips:

- Maintain accurate and complete records of the partnership's financial transactions

- Use tax preparation software to calculate the partners' shares of income, deductions, and credits

- Review the Schedule B-1 carefully before submitting the partnership's tax return

Penalties for Inaccurate Reporting on Schedule B-1

Inaccurate reporting on Schedule B-1 can result in penalties, including:

- Fines and penalties for failing to report all partners' interests in the partnership

- Fines and penalties for incorrectly calculating the partners' shares of income, deductions, and credits

- Fines and penalties for failing to allocate the partners' shares of income, deductions, and credits correctly

Conclusion

Form 1065 Schedule B-1 is a critical component of the partnership tax return, providing detailed information about the partners' shares of income, deductions, credits, and other items. By following the steps outlined in this guide, you can ensure accurate reporting and compliance with tax regulations. Remember to maintain accurate and complete records, use tax preparation software, and review the Schedule B-1 carefully before submitting the partnership's tax return.

We hope this article has provided you with a comprehensive guide to completing Form 1065 Schedule B-1. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may find it useful, and don't forget to subscribe to our blog for more informative articles on tax-related topics.

What is Form 1065 Schedule B-1?

+Form 1065 Schedule B-1 is a supporting schedule to Form 1065, the partnership tax return. It provides detailed information about the partners' shares of income, deductions, credits, and other items.

Who needs to complete Form 1065 Schedule B-1?

+All partnerships that file Form 1065 need to complete Schedule B-1.

What information do I need to report on Schedule B-1?

+You need to report the partners' shares of income, deductions, credits, and other items, including ordinary business income, capital gains, and dividends.