Filing taxes can be a daunting task, especially when dealing with complex forms like the IRS Form 8958. This form is used to allocate the Section 199A deduction to shareholders in an S corporation or partners in a partnership. In this article, we will break down the process of completing IRS Form 8958 into five manageable steps.

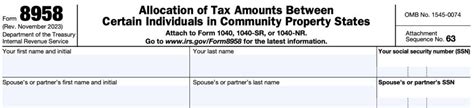

What is IRS Form 8958?

IRS Form 8958, also known as the Allocation of Taxable Amount for Noncash Charitable Contributions, is a tax form used by S corporations and partnerships to allocate the Section 199A deduction to their shareholders or partners. This form is used to report the allocation of qualified business income (QBI) deduction, which is a key component of the Tax Cuts and Jobs Act (TCJA).

Step 1: Determine Eligibility

Before completing IRS Form 8958, it's essential to determine if your S corporation or partnership is eligible for the Section 199A deduction. To qualify, the business must have qualified business income (QBI) from a qualified trade or business. QBI includes income from sole proprietorships, S corporations, and partnerships, but excludes income from C corporations.

To determine eligibility, review the following:

- Is your business a qualified trade or business?

- Does your business have QBI?

- Are you a shareholder or partner in the business?

If you answered "yes" to these questions, proceed to the next step.

Step 2: Gather Necessary Information

To complete IRS Form 8958, you'll need to gather the following information:

- Business name and address

- Employer Identification Number (EIN)

- Tax year

- Qualified business income (QBI) for the tax year

- Number of shareholders or partners

- Allocation percentage for each shareholder or partner

Ensure you have all the necessary documents and information before proceeding to the next step.

Step 3: Complete Part I - Business Information

Part I of IRS Form 8958 requires you to provide business information, including:

- Business name and address

- EIN

- Tax year

Complete this section accurately, as it will be used to identify your business and ensure correct allocation of the Section 199A deduction.

Step 4: Complete Part II - Allocation of QBI

Part II of IRS Form 8958 requires you to allocate the QBI among shareholders or partners. You'll need to:

- List each shareholder or partner

- Calculate the allocation percentage for each shareholder or partner

- Report the allocated QBI for each shareholder or partner

Use the following formula to calculate the allocation percentage:

Allocation percentage = (Shareholder's/Partner's QBI ÷ Total QBI) x 100

Ensure the total allocation percentage equals 100%.

Step 5: Complete Part III - Certification and Signatures

Part III of IRS Form 8958 requires you to certify that the information provided is accurate and complete. You'll also need to sign and date the form.

- Review the form for accuracy and completeness

- Sign and date the form

- Provide the name and title of the person signing the form

Once you've completed all five steps, you've successfully completed IRS Form 8958.

Conclusion - Next Steps

After completing IRS Form 8958, you'll need to:

- Attach the form to your business tax return (Form 1120S or Form 1065)

- Provide a copy of the form to each shareholder or partner

- Maintain records of the form and supporting documentation

By following these five steps, you'll be able to complete IRS Form 8958 accurately and efficiently. Remember to review the form carefully and seek professional help if you're unsure about any aspect of the process.

What is the purpose of IRS Form 8958?

+IRS Form 8958 is used to allocate the Section 199A deduction to shareholders in an S corporation or partners in a partnership.

Who is eligible for the Section 199A deduction?

+To qualify, the business must have qualified business income (QBI) from a qualified trade or business. QBI includes income from sole proprietorships, S corporations, and partnerships, but excludes income from C corporations.

What information do I need to complete IRS Form 8958?

+You'll need to gather business information, including business name and address, EIN, tax year, qualified business income (QBI) for the tax year, number of shareholders or partners, and allocation percentage for each shareholder or partner.