Form 571 L is a crucial document for homeowners in Orange County, California, as it pertains to the assessment of their property's value for tax purposes. As a homeowner, understanding the ins and outs of Form 571 L can help you navigate the property tax system and potentially save you money.

In Orange County, the Office of the Assessor is responsible for assessing the value of all properties within the county. This includes residential, commercial, and industrial properties. The assessor's office uses a variety of methods to determine a property's value, including sales data, income data, and physical characteristics of the property.

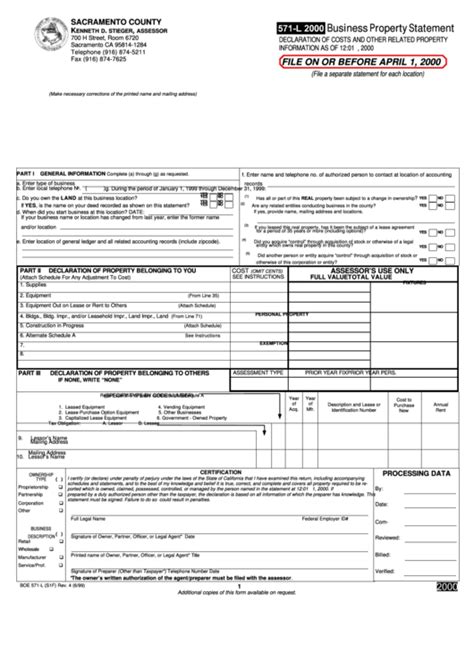

One of the most important forms used by the assessor's office is Form 571 L, also known as the Business Property Statement. This form is used to report the value of business personal property, including equipment, fixtures, and other assets used in the operation of a business.

However, for homeowners, Form 571 L is also relevant, as it can impact their property taxes. In this article, we will explore the ins and outs of Form 571 L in Orange County, including what it is, how it works, and what homeowners need to know.

What is Form 571 L?

Form 571 L is a document used by the Orange County Assessor's office to assess the value of business personal property. This includes equipment, fixtures, and other assets used in the operation of a business. The form is used to report the value of these assets as of January 1st of each year.

The form requires business owners to list their personal property, including its original cost, year of acquisition, and current value. This information is used by the assessor's office to determine the taxable value of the property.

How Does Form 571 L Affect Homeowners?

While Form 571 L is primarily used for business personal property, it can also impact homeowners. For example, if a homeowner has a home-based business, they may be required to file Form 571 L. Additionally, if a homeowner has a large amount of personal property, such as art or collectibles, they may be required to report its value on Form 571 L.

Furthermore, Form 571 L can also impact homeowners who are selling their property. The form can provide valuable information to potential buyers about the property's value and any potential tax liabilities.

What Do Homeowners Need to Know About Form 571 L?

As a homeowner in Orange County, there are several things you should know about Form 571 L:

- Filing Requirements: Homeowners who have a home-based business or a large amount of personal property may be required to file Form 571 L. The deadline for filing is typically April 1st of each year.

- Penalties for Late Filing: Failure to file Form 571 L on time can result in penalties and fines. Homeowners who miss the deadline should file as soon as possible to avoid additional penalties.

- Exemptions: Some personal property may be exempt from taxation. Homeowners should review the form carefully to ensure they are taking advantage of all eligible exemptions.

How to File Form 571 L

Filing Form 571 L is a relatively straightforward process. Homeowners can file the form online or by mail. The form can be downloaded from the Orange County Assessor's website or picked up in person at their office.

To file Form 571 L, homeowners will need to provide the following information:

- Business Name and Address: The name and address of the business or homeowner.

- Property Description: A description of the personal property being reported, including its original cost, year of acquisition, and current value.

- Exemptions: A list of any exemptions being claimed.

Once the form is complete, it should be signed and dated, and any required supporting documentation should be attached.

Common Mistakes to Avoid When Filing Form 571 L

When filing Form 571 L, there are several common mistakes to avoid:

- Late Filing: Filing the form late can result in penalties and fines.

- Inaccurate Information: Providing inaccurate information can result in an incorrect assessment and potential tax liabilities.

- Missing Exemptions: Failing to claim eligible exemptions can result in higher taxes.

Conclusion

Form 571 L is an important document for homeowners in Orange County, as it can impact their property taxes. By understanding what the form is, how it works, and what homeowners need to know, individuals can navigate the property tax system with confidence.

If you have any questions or concerns about Form 571 L, it is recommended that you consult with a tax professional or contact the Orange County Assessor's office directly.

We hope this article has provided valuable information to homeowners in Orange County. If you have any comments or questions, please don't hesitate to reach out.

What is Form 571 L?

+Form 571 L is a document used by the Orange County Assessor's office to assess the value of business personal property.

How does Form 571 L affect homeowners?

+Form 571 L can impact homeowners who have a home-based business or a large amount of personal property. It can also impact homeowners who are selling their property.

What is the deadline for filing Form 571 L?

+The deadline for filing Form 571 L is typically April 1st of each year.