Minnesota is known for its beautiful lakes, vibrant culture, and stunning natural landscapes. However, as a resident of Minnesota, it's essential to stay on top of your tax obligations, especially when it comes to filing for an extension. In this article, we'll explore five ways to file a Minnesota extension form, ensuring you have a seamless and stress-free experience.

Understanding the Importance of Filing an Extension

Filing for an extension is a common practice among taxpayers, and it's essential to understand why it's crucial. By filing for an extension, you're requesting additional time to file your tax return, which can be beneficial if you're facing unexpected delays or complexities. In Minnesota, the deadline for filing taxes is typically April 15th, but with an extension, you can push this deadline to October 15th.

Method 1: E-File Using the Minnesota Department of Revenue Website

The Minnesota Department of Revenue website is an excellent resource for filing your extension form. To e-file, follow these steps:

- Visit the Minnesota Department of Revenue website at .

- Click on the "Individuals" tab and select "File an Extension" from the drop-down menu.

- Fill out the online form, providing your name, Social Security number, and other required information.

- Submit the form electronically and receive a confirmation number.

Method 2: Mail a Paper Form

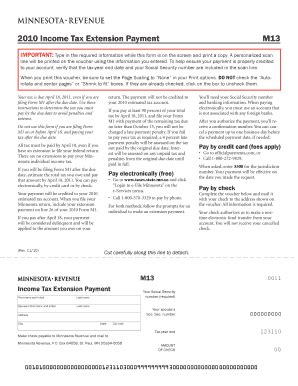

If you prefer to file a paper form, you can download the Minnesota Extension Form (Form M1) from the Minnesota Department of Revenue website. Follow these steps:

- Download and print the Form M1 from the website.

- Fill out the form carefully, ensuring you provide accurate information.

- Sign and date the form.

- Mail the form to the address listed on the form.

Method 3: Use Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can simplify the extension filing process. Follow these steps:

- Choose your preferred tax preparation software and create an account.

- Fill out the software's extension form, providing required information.

- Submit the form electronically and receive a confirmation number.

Method 4: Visit a Tax Professional

Visiting a tax professional can provide personalized assistance with filing your extension form. Follow these steps:

- Find a qualified tax professional in your area.

- Schedule an appointment and provide required documentation.

- The tax professional will guide you through the extension filing process.

Method 5: Use the IRS Free File Program

The IRS Free File program is a free service for eligible taxpayers. If you qualify, you can use this program to file your extension form. Follow these steps:

- Visit the IRS website at .

- Click on the "Free File" tab and select "File an Extension" from the drop-down menu.

- Fill out the online form, providing required information.

- Submit the form electronically and receive a confirmation number.

Final Thoughts

Filing a Minnesota extension form can be a straightforward process, especially when you're aware of the various methods available. Whether you choose to e-file, mail a paper form, or use tax preparation software, it's essential to ensure accuracy and timeliness. By following these methods, you'll be well on your way to filing a successful extension and avoiding potential penalties.

We encourage you to share your experiences with filing a Minnesota extension form in the comments below. Have you used any of the methods outlined in this article? Do you have any questions or concerns about the extension filing process?

What is the deadline for filing a Minnesota extension form?

+The deadline for filing a Minnesota extension form is typically April 15th, but with an extension, you can push this deadline to October 15th.

Can I file a Minnesota extension form electronically?

+Yes, you can file a Minnesota extension form electronically through the Minnesota Department of Revenue website or using tax preparation software.

What is the penalty for not filing a Minnesota extension form?

+The penalty for not filing a Minnesota extension form can vary, but it's typically a percentage of the unpaid tax, plus interest and additional fees.