The GCAAR Form 1221, also known as the Maryland Disclosure, is a crucial document in the real estate industry, particularly in the state of Maryland. As a seller, it's essential to understand the significance of this form and how it affects the home buying and selling process. In this article, we will delve into the world of GCAAR Form 1221, exploring its importance, benefits, and working mechanisms.

What is the GCAAR Form 1221?

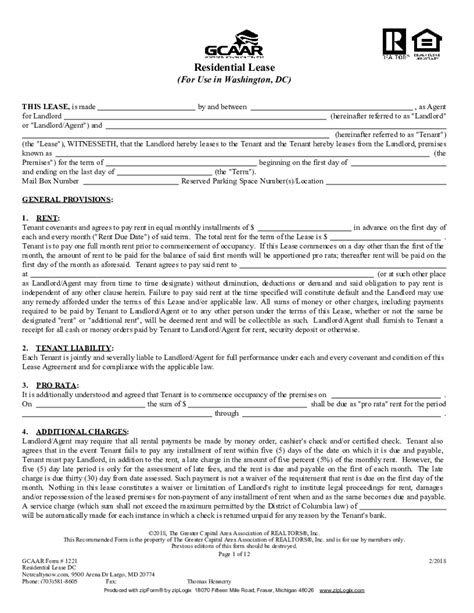

The GCAAR Form 1221, also known as the Maryland Residential Property Disclosure Statement, is a mandatory document that sellers must provide to potential buyers when selling a residential property in Maryland. The form is designed to inform buyers about the property's condition, features, and any known defects or issues. The GCAAR Form 1221 is a standardized document that helps facilitate transparency and honesty in real estate transactions.

Why is the GCAAR Form 1221 Important?

The GCAAR Form 1221 plays a vital role in the home buying and selling process. Here are some reasons why:

- Informed Decision-Making: The form provides buyers with crucial information about the property, enabling them to make informed decisions about their purchase.

- Transparency: The GCAAR Form 1221 promotes transparency in real estate transactions, helping to build trust between buyers and sellers.

- Reduced Risk: By disclosing known issues or defects, sellers can reduce the risk of potential lawsuits or disputes with buyers.

Benefits of the GCAAR Form 1221

The GCAAR Form 1221 offers several benefits to both buyers and sellers:

- Increased Confidence: Buyers can feel more confident in their purchase decision, knowing that they have been informed about the property's condition.

- Reduced Liability: Sellers can reduce their liability by disclosing known issues or defects, which can help prevent potential lawsuits.

- Smoother Transactions: The form helps facilitate smoother transactions by providing a clear understanding of the property's condition.

How Does the GCAAR Form 1221 Work?

Here's a step-by-step guide on how the GCAAR Form 1221 works:

- Seller Completes the Form: The seller completes the GCAAR Form 1221, answering questions about the property's condition, features, and any known defects or issues.

- Form is Provided to Buyer: The seller provides the completed form to the buyer, usually as part of the sales contract.

- Buyer Reviews the Form: The buyer reviews the form, taking note of any disclosed issues or defects.

- Buyer's Decision: The buyer can use the information provided in the form to make an informed decision about their purchase.

Common Issues Disclosed in the GCAAR Form 1221

The GCAAR Form 1221 requires sellers to disclose various issues or defects, including:

- Structural Issues: Problems with the property's foundation, walls, or roof.

- Environmental Concerns: Presence of lead-based paint, asbestos, or other environmental hazards.

- System Defects: Issues with the property's electrical, plumbing, or HVAC systems.

- Pest Infestations: Presence of termites, rodents, or other pests.

Consequences of Not Disclosing Issues

Failure to disclose known issues or defects can have serious consequences for sellers, including:

- Lawsuits: Buyers may sue sellers for failing to disclose known issues or defects.

- Financial Penalties: Sellers may be required to pay financial penalties for non-disclosure.

- Reputation Damage: Sellers may suffer damage to their reputation in the real estate industry.

Best Practices for Sellers

To avoid potential issues, sellers should follow these best practices:

- Honest Disclosure: Sellers should provide honest and accurate information about the property's condition.

- Timely Disclosure: Sellers should provide the GCAAR Form 1221 to buyers in a timely manner, usually as part of the sales contract.

- Professional Inspections: Sellers should consider hiring professionals to inspect the property and identify potential issues.

Conclusion

The GCAAR Form 1221 is a vital document in the real estate industry, providing buyers with crucial information about a property's condition. By understanding the importance, benefits, and working mechanisms of this form, sellers can ensure a smoother and more transparent transaction. Remember, honesty is the best policy when it comes to disclosing known issues or defects.

We invite you to share your thoughts and experiences with the GCAAR Form 1221 in the comments below. Have you ever had to deal with a disclosure issue in a real estate transaction? How did you handle it?

What is the purpose of the GCAAR Form 1221?

+The GCAAR Form 1221 is designed to inform buyers about the property's condition, features, and any known defects or issues.

What happens if a seller fails to disclose known issues or defects?

+Failure to disclose known issues or defects can result in lawsuits, financial penalties, and reputation damage for the seller.

How can sellers ensure a smooth transaction with the GCAAR Form 1221?

+Sellers should provide honest and accurate information about the property's condition, disclose known issues or defects in a timely manner, and consider hiring professionals to inspect the property.