QuickBooks Intuit Direct Deposit is a convenient and efficient way to manage employee payments, allowing businesses to deposit paychecks directly into their employees' bank accounts. To set up this service, employers need to provide their employees with a direct deposit authorization form, also known as the QuickBooks Intuit Direct Deposit Form. In this article, we will guide you through the process of obtaining, filling out, and submitting this form.

What is the QuickBooks Intuit Direct Deposit Form?

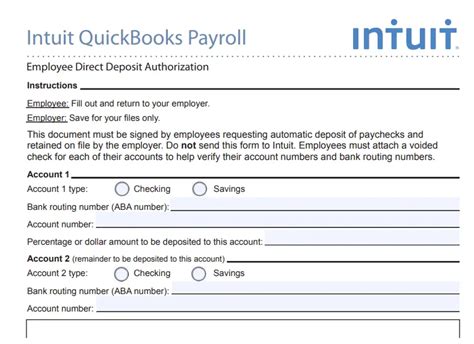

The QuickBooks Intuit Direct Deposit Form is a document that authorizes employers to deposit paychecks directly into an employee's bank account. This form is required for employers to set up direct deposit for their employees and must be completed and signed by the employee before the employer can initiate direct deposit.

Benefits of Using QuickBooks Intuit Direct Deposit

Using QuickBooks Intuit Direct Deposit offers several benefits for both employers and employees. Some of these benefits include:

- Convenience: Direct deposit eliminates the need for paper checks and allows employees to access their paychecks quickly and easily.

- Efficiency: Direct deposit saves employers time and money by reducing the need for manual check processing and distribution.

- Security: Direct deposit reduces the risk of lost or stolen checks and ensures that employees receive their paychecks securely.

- Environmentally friendly: Direct deposit reduces paper waste and minimizes the carbon footprint of traditional check processing.

How to Obtain the QuickBooks Intuit Direct Deposit Form

The QuickBooks Intuit Direct Deposit Form can be obtained in several ways:

- Download from the QuickBooks website: Employers can download the form from the QuickBooks website and print it out for their employees to complete.

- Obtain from a QuickBooks representative: Employers can contact a QuickBooks representative to request the form.

- Use the QuickBooks Online payroll service: Employers who use the QuickBooks Online payroll service can access the form through their online account.

How to Fill Out the QuickBooks Intuit Direct Deposit Form

To fill out the QuickBooks Intuit Direct Deposit Form, employees will need to provide the following information:

- Employee name and address

- Bank account information (account number and routing number)

- Type of account (checking or savings)

- Signature

Employers should ensure that employees complete the form accurately and sign it before submitting it to the employer.

Steps to Set Up QuickBooks Intuit Direct Deposit

To set up QuickBooks Intuit Direct Deposit, employers will need to follow these steps:

Step 1: Gather Employee Information

Employers will need to gather the completed direct deposit authorization forms from their employees.

Step 2: Set Up Direct Deposit in QuickBooks

Employers will need to set up direct deposit in their QuickBooks account by following these steps:

- Go to the "Payroll" menu and select "Direct Deposit"

- Click on "Set up Direct Deposit"

- Follow the prompts to enter the employee's bank account information and set up the direct deposit schedule

Step 3: Verify Employee Bank Account Information

Employers will need to verify the employee's bank account information to ensure that the direct deposit is set up correctly.

Step 4: Process Payroll with Direct Deposit

Employers will need to process payroll as usual, but with the added step of initiating direct deposit for employees who have authorized it.

Common Issues with QuickBooks Intuit Direct Deposit

Some common issues that employers may encounter when setting up QuickBooks Intuit Direct Deposit include:

- Incorrect bank account information

- Insufficient funds in the employer's account

- Technical issues with the QuickBooks software

To resolve these issues, employers can contact QuickBooks support or consult the QuickBooks user manual.

Frequently Asked Questions

What is the deadline for submitting the direct deposit authorization form?

+The deadline for submitting the direct deposit authorization form varies depending on the employer's payroll schedule. Employers should ensure that employees submit the form before the next payroll processing date.

Can employees change their direct deposit information?

+Yes, employees can change their direct deposit information by submitting a new direct deposit authorization form to their employer.

Is QuickBooks Intuit Direct Deposit secure?

+Yes, QuickBooks Intuit Direct Deposit is a secure way to manage employee payments. The system uses encryption and secure servers to protect employee bank account information.

Conclusion

QuickBooks Intuit Direct Deposit is a convenient and efficient way to manage employee payments. By following the steps outlined in this guide, employers can set up direct deposit for their employees and reduce the need for paper checks. Employees can also benefit from the convenience and security of direct deposit. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.