When it comes to buying, selling, or renting a property in New York City, the Real Estate Board of New York (REBNY) Financial Form is an essential document that facilitates a smooth transaction. This form, also known as the REBNY Financial Statement, is a standardized template used by real estate professionals to gather crucial financial information from buyers and renters. In this article, we will break down the 5 essential parts of the REBNY Financial Form, explaining their importance and what you need to know when filling it out.

Understanding the REBNY Financial Form

The REBNY Financial Form is a comprehensive document that provides a detailed picture of a buyer's or renter's financial situation. It is typically required by sellers, landlords, and their representatives to assess the financial capabilities of potential buyers or renters. The form helps to determine whether an individual can afford the purchase price or rent of a property, as well as their ability to secure financing.

Part 1: Buyer/Renter Information

The first part of the REBNY Financial Form requires basic information about the buyer or renter, including their name, address, phone number, and email. This section also asks for the type of property being purchased or rented, the proposed purchase price or rent, and the expected closing date.

Why is this section important?

This section provides essential contact information and helps to identify the type of property and transaction involved. It sets the stage for the rest of the form and ensures that all parties are on the same page.

Part 2: Income and Employment

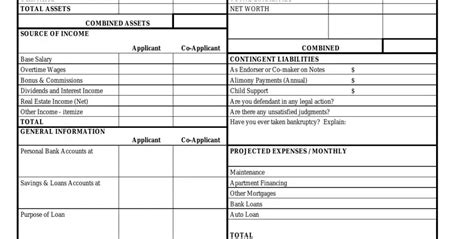

The second part of the form delves into the buyer's or renter's income and employment history. It asks for information about their current employer, job title, length of employment, and annual income. Additionally, it requires disclosure of any other sources of income, such as investments or self-employment.

Why is this section important?

This section helps to assess the buyer's or renter's ability to afford the property. By understanding their income and employment history, sellers and landlords can determine whether they have a stable financial foundation to support their purchase or rental decision.

Part 3: Assets and Liabilities

The third part of the REBNY Financial Form requires disclosure of the buyer's or renter's assets and liabilities. This includes information about their bank accounts, investments, retirement accounts, and any outstanding debts, such as credit cards, loans, or mortgages.

Why is this section important?

This section provides a comprehensive picture of the buyer's or renter's financial situation, including their net worth and debt-to-income ratio. By understanding their assets and liabilities, sellers and landlords can assess their ability to secure financing and afford the property.

Part 4: Credit History and Score

The fourth part of the form asks about the buyer's or renter's credit history and score. It requires disclosure of any past credit issues, such as bankruptcies, foreclosures, or collections.

Why is this section important?

This section helps to assess the buyer's or renter's creditworthiness and their ability to secure financing. A good credit score is essential for obtaining a mortgage or other types of financing.

Part 5: Additional Information and Verification

The final part of the REBNY Financial Form requires additional information and verification. It asks for documentation to support the information provided, such as pay stubs, tax returns, and bank statements.

Why is this section important?

This section ensures that the information provided is accurate and complete. By verifying the buyer's or renter's financial information, sellers and landlords can make informed decisions about their purchase or rental application.

Tips for Filling Out the REBNY Financial Form

When filling out the REBNY Financial Form, it's essential to be thorough and accurate. Here are some tips to keep in mind:

- Make sure to provide all required documentation to support your financial information.

- Be honest and transparent about your financial situation, including any past credit issues.

- Take the time to review and verify the information provided to ensure accuracy.

- Don't hesitate to ask questions or seek clarification if you're unsure about any part of the form.

By understanding the 5 essential parts of the REBNY Financial Form, you can navigate the process with confidence and ensure a smooth transaction. Whether you're a buyer, renter, seller, or landlord, this form is an essential tool for assessing financial capabilities and making informed decisions.

We hope this article has provided valuable insights into the REBNY Financial Form. If you have any questions or comments, please don't hesitate to reach out. Share your thoughts and experiences with the REBNY Financial Form in the comments section below.

FAQ Section:

What is the REBNY Financial Form?

+The REBNY Financial Form is a standardized template used by real estate professionals to gather financial information from buyers and renters.

Why is the REBNY Financial Form important?

+The REBNY Financial Form helps to assess the buyer's or renter's financial capabilities and determine whether they can afford the property.

What information is required on the REBNY Financial Form?

+The REBNY Financial Form requires information about the buyer's or renter's income, employment, assets, liabilities, credit history, and additional documentation to support their financial information.