As we navigate the complexities of life, it's essential to consider the "what ifs." What if you're suddenly unable to manage your finances or make medical decisions for yourself? What if you need someone to act on your behalf in a foreign country or when you're temporarily incapacitated? This is where a power of attorney (POA) comes into play. In this article, we'll delve into the world of Blumberg power of attorney forms and explore how they can help secure your interests.

What is a Power of Attorney?

A power of attorney is a legal document that grants someone you trust the authority to act on your behalf in various matters, such as financial, medical, or business decisions. This person, known as your attorney-in-fact or agent, can make decisions for you when you're unable to do so yourself. POAs can be broad or limited in scope, depending on your specific needs and preferences.

Types of Power of Attorney

There are several types of power of attorney forms, including:

- General Power of Attorney: Grants broad powers to manage your finances, property, and other affairs.

- Special Power of Attorney: Limited to specific tasks or transactions, such as selling a property or managing a business.

- Healthcare Power of Attorney: Allows your agent to make medical decisions on your behalf.

- Durable Power of Attorney: Remains in effect even if you become incapacitated.

- Springing Power of Attorney: Takes effect only when you become incapacitated.

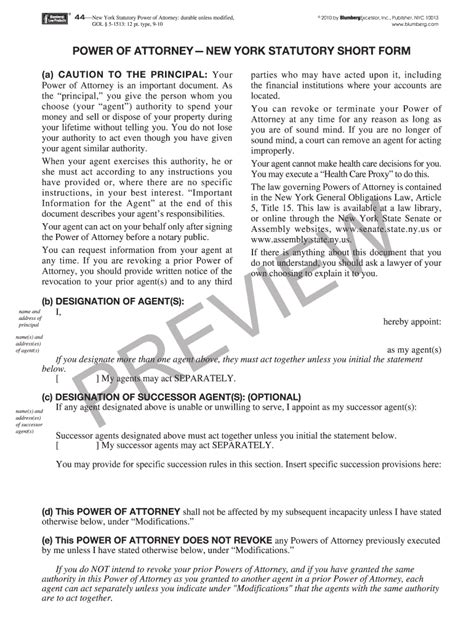

What is a Blumberg Power of Attorney Form?

Blumberg is a well-established company that provides a range of legal forms, including power of attorney documents. Their POA forms are designed to be comprehensive, easy to understand, and compliant with state laws. Blumberg power of attorney forms typically include the following elements:

- Grant of Authority: Outlines the specific powers granted to your agent.

- Agent's Responsibilities: Describes the duties and obligations of your agent.

- Duration: Specifies the length of time the POA remains in effect.

- Revocation: Explains how to revoke the POA.

Benefits of Using a Blumberg Power of Attorney Form

Using a Blumberg power of attorney form can provide several benefits, including:

- Convenience: Save time and effort by using a pre-drafted form that meets state requirements.

- Compliance: Ensure your POA complies with state laws and regulations.

- Clarity: Clearly outline the powers and responsibilities of your agent.

- Security: Protect your interests and well-being by granting authority to a trusted agent.

How to Create a Blumberg Power of Attorney Form

To create a Blumberg power of attorney form, follow these steps:

- Choose the Right Form: Select the type of POA that suits your needs.

- Fill in the Form: Complete the form with your personal details and agent information.

- Review and Sign: Review the form carefully and sign it in the presence of a notary public.

- Notarize: Have the form notarized to ensure its validity.

Conclusion

In today's uncertain world, having a power of attorney in place can provide peace of mind and protect your interests. Blumberg power of attorney forms offer a convenient and reliable way to create a comprehensive POA that meets state requirements. By understanding the types of POAs, the benefits of using a Blumberg form, and how to create one, you can take the first step towards securing your future.We encourage you to share your thoughts and experiences with power of attorney forms in the comments below. Have you used a Blumberg power of attorney form before? Do you have any questions or concerns about creating a POA? Let's discuss!

What is the difference between a general power of attorney and a special power of attorney?

+A general power of attorney grants broad powers to manage your finances, property, and other affairs, while a special power of attorney is limited to specific tasks or transactions.

Can I revoke a power of attorney?

+Yes, you can revoke a power of attorney by notifying your agent in writing and providing a copy of the revocation to any relevant parties.

Do I need a lawyer to create a power of attorney?

+No, you don't necessarily need a lawyer to create a power of attorney. However, it's recommended that you consult with an attorney to ensure your POA meets state requirements and reflects your wishes.