The world of fantasy sports and online gaming has exploded in recent years, with platforms like DraftKings leading the charge. As a user of these platforms, it's essential to understand the tax implications of your winnings. In this article, we'll delve into the world of DraftKings tax forms, exploring five critical facts you need to know.

Understanding the 1099-MISC Form

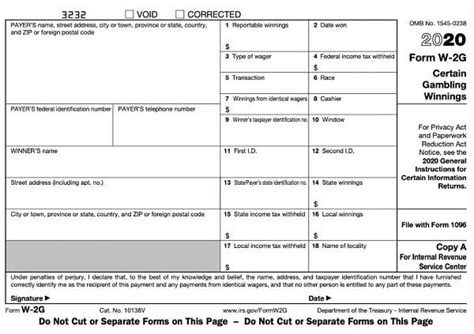

If you're a frequent user of DraftKings, you may have received a 1099-MISC form in the mail. This form is used to report miscellaneous income, including winnings from fantasy sports contests. The IRS requires DraftKings to issue a 1099-MISC form to users who have won $600 or more in a calendar year.

What to Expect on Your 1099-MISC Form

When you receive your 1099-MISC form, you can expect to see the following information:

- Your name and address

- DraftKings' name and address

- The amount of money you won in the calendar year

- A box indicating the type of income (in this case, "Other income")

Federal Tax Withholding on Winnings

As of 2020, the IRS requires fantasy sports operators like DraftKings to withhold 24% of winnings for federal taxes. This means that if you win $1,000, DraftKings will withhold $240 for federal taxes, leaving you with $760.

State Tax Withholding on Winnings

In addition to federal tax withholding, some states also require fantasy sports operators to withhold state taxes on winnings. The amount of state tax withholding varies by state, so it's essential to check with your state's tax authority to determine if you're subject to state tax withholding.

Reporting Winnings on Your Tax Return

When you file your tax return, you'll need to report your winnings from DraftKings. You'll report this income on Schedule 1 (Form 1040), which is used to report miscellaneous income. You'll also need to complete Form 1040, which is the standard form for personal income tax returns.

Deducting Losses on Your Tax Return

If you've had a losing year on DraftKings, you may be able to deduct those losses on your tax return. You can deduct losses up to the amount of your winnings, but you'll need to keep accurate records of your losses to claim this deduction.

Seeking Professional Tax Advice

Tax laws and regulations can be complex, so it's essential to seek professional tax advice if you're unsure about how to report your winnings or deduct losses. A tax professional can help you navigate the tax implications of your DraftKings winnings and ensure you're in compliance with all tax laws and regulations.

Staying Ahead of Tax Season

Tax season can be a stressful time, especially if you're not prepared. To stay ahead of tax season, make sure to:

- Keep accurate records of your winnings and losses

- Set aside money for taxes on your winnings

- Seek professional tax advice if you're unsure about how to report your winnings or deduct losses

By following these tips, you can ensure a smooth tax season and avoid any potential penalties or fines.

We hope this article has provided you with a better understanding of the tax implications of your DraftKings winnings. If you have any further questions or concerns, please don't hesitate to comment below.

What is a 1099-MISC form?

+A 1099-MISC form is used to report miscellaneous income, including winnings from fantasy sports contests.

How much tax will be withheld from my winnings?

+24% of your winnings will be withheld for federal taxes. You may also be subject to state tax withholding, depending on your state's tax laws.

Can I deduct losses on my tax return?

+Yes, you can deduct losses up to the amount of your winnings. However, you'll need to keep accurate records of your losses to claim this deduction.