Understanding the intricacies of tax forms is a daunting task for many employers. The SS-8 tax form, in particular, can be a source of confusion for those who are not familiar with it. In this article, we will delve into the world of the SS-8 tax form, exploring its purpose, who needs to file it, and the steps involved in completing it.

The Purpose of the SS-8 Tax Form

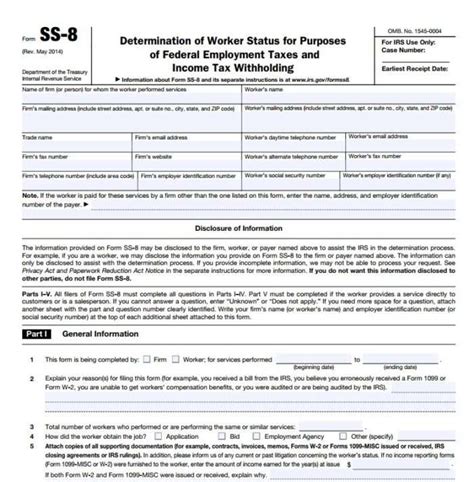

The SS-8 tax form, also known as the "Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding," is used by employers to determine the status of a worker as either an employee or an independent contractor. This distinction is crucial, as it affects the employer's tax obligations and the worker's benefits.

Who Needs to File the SS-8 Tax Form?

Employers who are unsure about the status of a worker should file the SS-8 tax form. This form is typically used in situations where a worker's status is disputed or unclear. For example, if a worker claims to be an independent contractor, but the employer believes they are an employee, the SS-8 form can be used to resolve the issue.

Benefits of Filing the SS-8 Tax Form

Filing the SS-8 tax form provides several benefits to employers, including:

- Clarifies the worker's status, reducing the risk of misclassification

- Helps employers comply with federal tax laws and regulations

- Prevents potential penalties and fines for misclassifying workers

- Ensures that workers receive the correct benefits and tax treatment

How to Complete the SS-8 Tax Form

Completing the SS-8 tax form involves providing detailed information about the worker's job duties, work arrangements, and compensation. The form consists of several sections, including:

- Section 1: Worker Information

- Section 2: Work Arrangements

- Section 3: Job Duties

- Section 4: Compensation

- Section 5: Certification

Employers must provide accurate and detailed information in each section to ensure that the worker's status is correctly determined.

Steps Involved in Filing the SS-8 Tax Form

Filing the SS-8 tax form involves the following steps:

- Gather Information: Collect all relevant information about the worker, including job duties, work arrangements, and compensation.

- Complete the Form: Fill out the SS-8 form, making sure to provide accurate and detailed information in each section.

- Submit the Form: Submit the completed form to the IRS, either online or by mail.

- Wait for Determination: Wait for the IRS to review the form and make a determination about the worker's status.

Common Mistakes to Avoid

When completing the SS-8 tax form, employers should avoid common mistakes, such as:

- Providing incomplete or inaccurate information

- Failing to sign and date the form

- Not submitting the form in a timely manner

Consequences of Misclassifying Workers

Misclassifying workers can have serious consequences, including:

- Penalties and fines from the IRS

- Back pay and benefits owed to misclassified workers

- Damage to the employer's reputation

Best Practices for Employers

To avoid misclassifying workers and ensure compliance with federal tax laws, employers should follow best practices, such as:

- Clearly defining job duties and work arrangements

- Providing accurate and detailed information about workers

- Regularly reviewing and updating worker classifications

Conclusion

In conclusion, the SS-8 tax form is an essential tool for employers to determine the status of workers and ensure compliance with federal tax laws. By understanding the purpose, benefits, and steps involved in completing the form, employers can avoid common mistakes and consequences of misclassifying workers.

Take Action

If you are an employer who is unsure about the status of a worker, take action today by filing the SS-8 tax form. Don't risk misclassifying workers and facing penalties and fines. Consult with a tax professional or attorney to ensure that you are in compliance with federal tax laws and regulations.

FAQs

What is the SS-8 tax form used for?

+The SS-8 tax form is used to determine the status of a worker as either an employee or an independent contractor.

Who needs to file the SS-8 tax form?

+Employers who are unsure about the status of a worker should file the SS-8 tax form.

What are the consequences of misclassifying workers?

+Misclassifying workers can result in penalties and fines from the IRS, back pay and benefits owed to misclassified workers, and damage to the employer's reputation.