The world of tax filing can be complex and overwhelming, especially when it comes to dealing with rejections. One such rejection that can cause frustration for taxpayers is the Form 8960 rejection. In this article, we will delve into the causes of Form 8960 rejection, its implications, and most importantly, provide resolution strategies to help you overcome this hurdle.

Understanding Form 8960

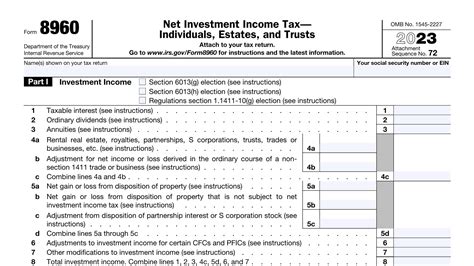

Before we dive into the causes and resolution strategies, it's essential to understand what Form 8960 is. Form 8960, also known as the Net Investment Income Tax (NIIT), is a tax form used to report certain types of investment income, such as dividends, interest, and capital gains. The NIIT is a 3.8% tax on the net investment income of individuals, estates, and trusts.

Causes of Form 8960 Rejection

A Form 8960 rejection can occur due to various reasons. Some of the most common causes include:

- Inaccurate or incomplete information: If the information provided on Form 8960 is incorrect or incomplete, it may lead to a rejection.

- Mathematical errors: Mathematical errors, such as incorrect calculations or transposed numbers, can cause a rejection.

- Missing or incorrect documentation: Failure to attach required documentation, such as Form 1099 or Schedule K-1, can lead to a rejection.

- Incorrect filing status: If the filing status is incorrect, it may cause a rejection.

Implications of Form 8960 Rejection

A Form 8960 rejection can have significant implications for taxpayers. Some of the implications include:

- Delayed processing: A rejection can delay the processing of your tax return, which may impact your refund or cause additional penalties.

- Additional penalties and interest: If the rejection is due to an error or inaccuracy, you may be liable for additional penalties and interest.

- Audit risk: A rejection can increase the risk of an audit, which can be time-consuming and costly.

Resolution Strategies

If your Form 8960 is rejected, don't panic. There are several resolution strategies you can use to resolve the issue. Here are some steps you can take:

- Review and correct the error: Carefully review your Form 8960 to identify the error or inaccuracy. Correct the mistake and resubmit the form.

- Provide additional documentation: If the rejection is due to missing or incorrect documentation, provide the required documentation to support your claim.

- Seek professional help: If you're unsure about how to resolve the issue, consider seeking help from a tax professional or the IRS.

Common Form 8960 Rejection Scenarios and Solutions

Here are some common Form 8960 rejection scenarios and solutions:

- Scenario 1: Rejection due to incorrect filing status

- Solution: Review your filing status and correct it. Ensure that you're using the correct filing status, such as single, married filing jointly, or head of household.

- Scenario 2: Rejection due to missing documentation

- Solution: Provide the required documentation, such as Form 1099 or Schedule K-1, to support your claim.

- Scenario 3: Rejection due to mathematical errors

- Solution: Review your calculations and correct any mathematical errors. Ensure that you're using the correct formulas and calculations.

Tips to Avoid Form 8960 Rejection

To avoid a Form 8960 rejection, here are some tips to keep in mind:

- Double-check your information: Ensure that the information you provide on Form 8960 is accurate and complete.

- Use the correct filing status: Ensure that you're using the correct filing status, such as single, married filing jointly, or head of household.

- Attach required documentation: Attach all required documentation, such as Form 1099 or Schedule K-1, to support your claim.

- Review and correct mathematical errors: Review your calculations and correct any mathematical errors.

Form 8960 Rejection FAQs

Here are some frequently asked questions about Form 8960 rejection:

- Q: What is Form 8960, and why is it used?

- A: Form 8960 is used to report certain types of investment income, such as dividends, interest, and capital gains. It's used to calculate the Net Investment Income Tax (NIIT).

- Q: What are the common causes of Form 8960 rejection?

- A: Common causes of Form 8960 rejection include inaccurate or incomplete information, mathematical errors, missing or incorrect documentation, and incorrect filing status.

- Q: How can I resolve a Form 8960 rejection?

- A: To resolve a Form 8960 rejection, review and correct the error, provide additional documentation, and seek professional help if necessary.

Conclusion

A Form 8960 rejection can be frustrating and overwhelming, but with the right strategies and solutions, you can resolve the issue quickly and efficiently. By understanding the causes of Form 8960 rejection, its implications, and using the resolution strategies outlined in this article, you can ensure that your tax return is processed smoothly and efficiently.

We hope this article has provided you with valuable insights and information about Form 8960 rejection. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others.

What is Form 8960, and why is it used?

+Form 8960 is used to report certain types of investment income, such as dividends, interest, and capital gains. It's used to calculate the Net Investment Income Tax (NIIT).

What are the common causes of Form 8960 rejection?

+Common causes of Form 8960 rejection include inaccurate or incomplete information, mathematical errors, missing or incorrect documentation, and incorrect filing status.

How can I resolve a Form 8960 rejection?

+To resolve a Form 8960 rejection, review and correct the error, provide additional documentation, and seek professional help if necessary.