Waivers of liability are common in various industries, including healthcare, sports, and travel. However, when it comes to health insurance, a waiver of liability can have significant implications for policyholders. In the context of UnitedHealthcare (UHC), a waiver of liability is a document that releases the insurer from liability for certain claims or damages. If you're considering a UHC waiver of liability, here are five essential things to know.

What is a UHC Waiver of Liability?

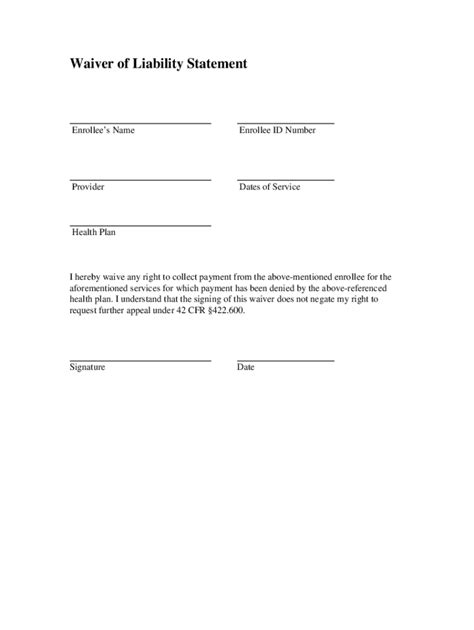

A UHC waiver of liability is a contractual agreement between the policyholder and UnitedHealthcare. By signing this document, the policyholder agrees to release UHC from liability for certain claims, damages, or losses. This waiver can be used in various situations, such as when a policyholder is seeking coverage for a pre-existing condition or when they want to opt-out of certain policy provisions.

Types of Waivers

There are different types of waivers that UHC may offer, including:

- General waiver: This type of waiver releases UHC from liability for all claims, damages, or losses arising from the policy.

- Specific waiver: This type of waiver releases UHC from liability for specific claims, damages, or losses, such as those related to a pre-existing condition.

- Voluntary waiver: This type of waiver is signed by the policyholder voluntarily, usually in exchange for a reduced premium or other benefits.

Benefits of a UHC Waiver of Liability

Signing a UHC waiver of liability can have several benefits for policyholders, including:

- Reduced premiums: By releasing UHC from liability for certain claims, policyholders may be eligible for reduced premiums.

- Increased coverage: In some cases, signing a waiver may allow policyholders to access coverage that would otherwise be unavailable.

- Flexibility: Waivers can provide policyholders with more flexibility in their coverage options.

Things to Consider

Before signing a UHC waiver of liability, policyholders should carefully consider the following:

- The type of waiver: Policyholders should understand the type of waiver they are signing and what it covers.

- The risks: Policyholders should be aware of the potential risks of signing a waiver, including the possibility of reduced coverage or increased costs.

- The benefits: Policyholders should weigh the benefits of signing a waiver against the potential risks.

How to Obtain a UHC Waiver of Liability

To obtain a UHC waiver of liability, policyholders can follow these steps:

- Contact UHC: Policyholders can contact UHC directly to inquire about available waivers.

- Review the waiver: Policyholders should carefully review the waiver document to understand its terms and conditions.

- Sign the waiver: If policyholders agree to the terms of the waiver, they can sign the document and return it to UHC.

What to Do After Signing a Waiver

After signing a UHC waiver of liability, policyholders should:

- Keep a copy of the waiver: Policyholders should keep a copy of the signed waiver for their records.

- Understand their coverage: Policyholders should understand how the waiver affects their coverage and what claims are no longer covered.

- Review their policy: Policyholders should review their policy to ensure they understand all the terms and conditions.

Risks and Limitations of a UHC Waiver of Liability

While a UHC waiver of liability can provide benefits, it also comes with risks and limitations, including:

- Reduced coverage: By signing a waiver, policyholders may be giving up certain coverage options.

- Increased costs: Policyholders may be liable for increased costs or damages if they sign a waiver.

- Limited flexibility: Waivers can limit policyholders' flexibility in their coverage options.

Alternatives to a UHC Waiver of Liability

If policyholders are not comfortable signing a waiver, they may want to consider alternative options, such as:

- Shopping for different coverage: Policyholders can shop for different coverage options that do not require a waiver.

- Negotiating with UHC: Policyholders can try negotiating with UHC to see if they can obtain more favorable terms.

Conclusion

In conclusion, a UHC waiver of liability can be a valuable tool for policyholders, but it's essential to understand the benefits, risks, and limitations before signing. By carefully reviewing the waiver document and considering alternative options, policyholders can make informed decisions about their coverage.

What is a UHC waiver of liability?

+A UHC waiver of liability is a contractual agreement between the policyholder and UnitedHealthcare that releases UHC from liability for certain claims, damages, or losses.

What are the benefits of a UHC waiver of liability?

+The benefits of a UHC waiver of liability include reduced premiums, increased coverage, and flexibility in coverage options.

What are the risks of a UHC waiver of liability?

+The risks of a UHC waiver of liability include reduced coverage, increased costs, and limited flexibility in coverage options.