As a foreign partner in a U.S. trade or business, understanding and complying with U.S. tax laws can be a daunting task. One crucial requirement is filing Form 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax. This form is used to report the foreign partner's share of income, deductions, and credits from a U.S. trade or business. In this article, we will provide a comprehensive guide to Form 8805 instructions, helping you navigate the complex world of foreign partner tax obligations.

Why is Form 8805 Important?

Form 8805 is a critical component of the U.S. tax compliance process for foreign partners. It serves several purposes:

- Reports the foreign partner's share of income, deductions, and credits from a U.S. trade or business

- Calculates the Section 1446 withholding tax liability

- Provides information necessary for the partnership to complete its tax return (Form 1065)

Failure to file Form 8805 or accurately report the required information can result in penalties, fines, and even loss of foreign tax credits.

Who Must File Form 8805?

Foreign partners who have an interest in a U.S. trade or business must file Form 8805. This includes:

- Non-resident aliens (NRAs)

- Foreign corporations

- Foreign partnerships

- Foreign estates and trusts

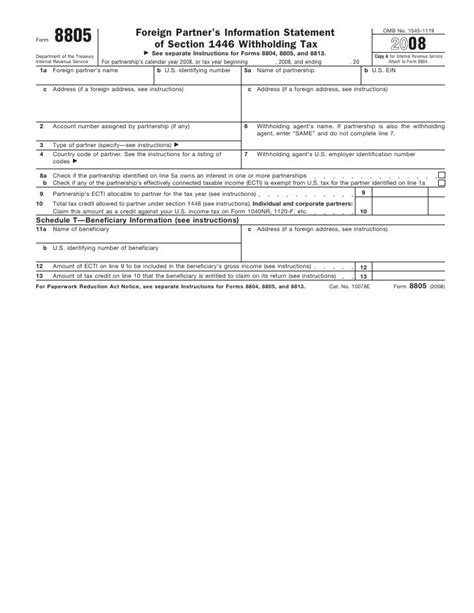

What Information is Required on Form 8805?

Form 8805 requires the following information:

- Partner's name, address, and tax identification number (TIN)

- Partnership's name, address, and employer identification number (EIN)

- Partner's percentage of ownership in the partnership

- Partner's share of income, deductions, and credits from the partnership

- Calculation of the Section 1446 withholding tax liability

Where to Find the Information Needed for Form 8805

The information required for Form 8805 can be found in the following sources:

- Partnership agreement

- Partnership tax return (Form 1065)

- Schedule K-1 (Form 1065)

- Foreign partner's tax return (if applicable)

How to Complete Form 8805

Completing Form 8805 requires careful attention to detail and accuracy. Here's a step-by-step guide:

Step 1: Identify the Partnership and Partner Information

- Enter the partnership's name, address, and EIN in Part I of Form 8805

- Enter the partner's name, address, and TIN in Part II of Form 8805

Step 2: Calculate the Partner's Share of Income, Deductions, and Credits

- Use the information from Schedule K-1 (Form 1065) to calculate the partner's share of income, deductions, and credits

- Report this information in Part III of Form 8805

Step 3: Calculate the Section 1446 Withholding Tax Liability

- Use the partner's share of income and the applicable tax rate to calculate the Section 1446 withholding tax liability

- Report this information in Part IV of Form 8805

When to File Form 8805

Form 8805 must be filed with the partnership's tax return (Form 1065). The due date for Form 1065 is typically April 15th for calendar-year partnerships.

Penalties for Failure to File or Incorrect Filing

Failure to file Form 8805 or incorrect filing can result in penalties and fines. The IRS may impose the following penalties:

- Late filing penalty: $50 to $100 per partner per month

- Accuracy-related penalty: 20% of the understated tax liability

Conclusion

Form 8805 is a critical component of the U.S. tax compliance process for foreign partners. By following the step-by-step guide and instructions outlined in this article, foreign partners can ensure accurate and timely filing of Form 8805. Remember to seek professional advice if you are unsure about any aspect of the process.

We encourage you to share your experiences or ask questions about Form 8805 in the comments section below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

FAQs

Q: What is Form 8805 used for?

A: Form 8805 is used to report a foreign partner's share of income, deductions, and credits from a U.S. trade or business.

Q: Who must file Form 8805?

A: Foreign partners who have an interest in a U.S. trade or business must file Form 8805.

Q: What information is required on Form 8805?

A: Form 8805 requires the partner's name, address, and tax identification number (TIN), partnership's name, address, and employer identification number (EIN), partner's percentage of ownership in the partnership, and partner's share of income, deductions, and credits from the partnership.

Q: Where can I find the information needed for Form 8805?

A: The information required for Form 8805 can be found in the partnership agreement, partnership tax return (Form 1065), Schedule K-1 (Form 1065), and foreign partner's tax return (if applicable).

Q: What is the due date for Form 8805?

A: Form 8805 must be filed with the partnership's tax return (Form 1065), which is typically due on April 15th for calendar-year partnerships.

What is Form 8805 used for?

+Form 8805 is used to report a foreign partner's share of income, deductions, and credits from a U.S. trade or business.

Who must file Form 8805?

+Foreign partners who have an interest in a U.S. trade or business must file Form 8805.

What information is required on Form 8805?

+Form 8805 requires the partner's name, address, and tax identification number (TIN), partnership's name, address, and employer identification number (EIN), partner's percentage of ownership in the partnership, and partner's share of income, deductions, and credits from the partnership.

Where can I find the information needed for Form 8805?

+The information required for Form 8805 can be found in the partnership agreement, partnership tax return (Form 1065), Schedule K-1 (Form 1065), and foreign partner's tax return (if applicable).

What is the due date for Form 8805?

+Form 8805 must be filed with the partnership's tax return (Form 1065), which is typically due on April 15th for calendar-year partnerships.