The Form 8582, also known as the "Passive Activity Loss Limitations," is a crucial document for taxpayers who have rental real estate or other passive activities. Completing this form can be a daunting task, especially for those who are new to the world of tax returns. However, with the right guidance, you can simplify the process and ensure accuracy. In this article, we will break down the Form 8582 into five easy worksheet steps, making it more manageable and less overwhelming.

Understanding the Importance of Form 8582

The Form 8582 is used to report passive activity losses, which are losses from activities in which the taxpayer does not actively participate, such as rental real estate or limited partnerships. The form is used to calculate the allowable loss for the tax year and to determine the amount of loss that can be carried forward to future years.

Who Needs to File Form 8582?

Form 8582 is required for taxpayers who have passive activity losses from the following activities:

- Rental real estate (e.g., rental properties, vacation homes)

- Limited partnerships

- S corporations

- Trusts

- Estates

5 Easy Worksheet Steps to Simplify Your Form 8582

To simplify the process of completing Form 8582, we have broken it down into five easy worksheet steps. Follow these steps to ensure accuracy and avoid errors.

Step 1: Gather Necessary Documents

Before starting the worksheet, gather all necessary documents, including:

- Form 1040 (Individual Income Tax Return)

- Schedule E (Supplemental Income and Loss)

- Form K-1 (Partner's Share of Income, Deductions, Credits, etc.)

- Any other relevant tax documents

Step 2: Calculate Passive Activity Losses

Calculate the passive activity losses for each activity using the following steps:

- Calculate the gross income from each activity

- Calculate the deductions and expenses for each activity

- Calculate the net loss for each activity

Step 3: Complete Worksheet 1-3

Complete Worksheet 1-3, which is used to calculate the allowable loss for the tax year. This worksheet takes into account the passive activity losses calculated in Step 2.

- Worksheet 1: Calculate the total passive activity losses

- Worksheet 2: Calculate the allowable loss for the tax year

- Worksheet 3: Calculate the amount of loss that can be carried forward to future years

Step 4: Complete Worksheet 4-5

Complete Worksheet 4-5, which is used to calculate the self-employment tax and the alternative minimum tax.

- Worksheet 4: Calculate the self-employment tax

- Worksheet 5: Calculate the alternative minimum tax

Step 5: Complete Form 8582

Complete Form 8582 using the calculations from Worksheets 1-5.

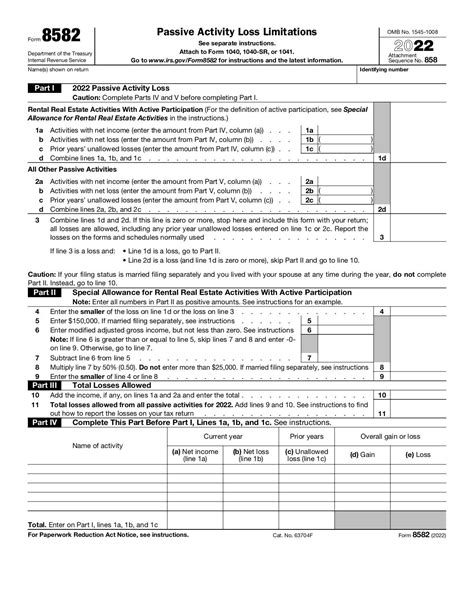

Example of Completed Form 8582

Here is an example of a completed Form 8582:

- Part I: Report the total passive activity losses

- Part II: Report the allowable loss for the tax year

- Part III: Report the amount of loss that can be carried forward to future years

Tips and Tricks for Completing Form 8582

Here are some tips and tricks to keep in mind when completing Form 8582:

- Keep accurate records of passive activity losses

- Use the correct worksheet steps to calculate the allowable loss

- Complete Form 8582 accurately to avoid errors and penalties

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing Form 8582:

- Failing to report all passive activity losses

- Incorrectly calculating the allowable loss

- Failing to complete Form 8582 accurately

Conclusion

Completing Form 8582 can be a complex and time-consuming process, but by breaking it down into five easy worksheet steps, you can simplify the process and ensure accuracy. Remember to keep accurate records, use the correct worksheet steps, and complete Form 8582 accurately to avoid errors and penalties.

We hope this article has been helpful in simplifying the Form 8582 for you. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Form 8582?

+Form 8582 is used to report passive activity losses, which are losses from activities in which the taxpayer does not actively participate.

Who needs to file Form 8582?

+Form 8582 is required for taxpayers who have passive activity losses from rental real estate, limited partnerships, S corporations, trusts, and estates.

What are the five easy worksheet steps to simplify Form 8582?

+The five easy worksheet steps are: Gather necessary documents, calculate passive activity losses, complete Worksheet 1-3, complete Worksheet 4-5, and complete Form 8582.