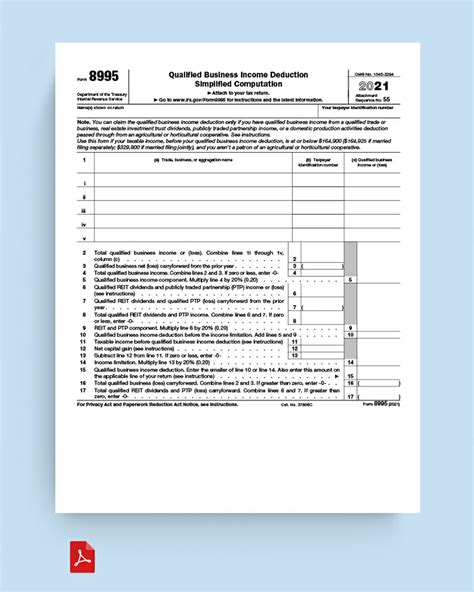

The Form 8995, also known as the Qualified Business Income Deduction, is a crucial tax form for self-employed individuals and business owners. It allows eligible taxpayers to deduct up to 20% of their qualified business income, which can result in significant tax savings. However, navigating this form can be complex, especially for those who are new to the tax deduction. Fortunately, TurboTax offers a user-friendly platform to help you complete Form 8995 with ease. Here are five tips to get you started:

Tip 1: Understand the Eligibility Criteria

Before you begin, it's essential to understand the eligibility criteria for the Qualified Business Income Deduction. According to the IRS, you must meet the following requirements:

- You must have a qualified trade or business, which includes most types of businesses, such as sole proprietorships, partnerships, S corporations, and certain trusts.

- Your business must be a domestic business, meaning it's operated within the United States.

- You must have qualified business income, which includes income from a qualified trade or business, minus any deductions and exclusions.

- Your taxable income must be below the threshold amounts, which vary depending on your filing status.

TurboTax can help you determine if you meet these eligibility criteria and guide you through the form-filling process.

What Types of Businesses Qualify?

- Most types of businesses, including sole proprietorships, partnerships, S corporations, and certain trusts.

- Self-employment income from freelancing, consulting, or contract work.

- Rental income from real estate investments.

However, some businesses do not qualify, such as:

- C corporations

- Businesses that are not operated for profit

- Businesses that involve the performance of services as an employee

Tip 2: Gather Required Documents and Information

To complete Form 8995 with TurboTax, you'll need to gather the following documents and information:

- Your business tax return (Form 1040, Schedule C, or Form 1065)

- Your business income and expense records

- Your qualified business income calculation

- Your taxable income calculation

- Your filing status and number of dependents

Having all the necessary documents and information ready will help you complete the form accurately and efficiently.

What Information Do I Need to Report?

- Your qualified business income

- Your taxable income

- Your filing status and number of dependents

- Your business entity type (sole proprietorship, partnership, S corporation, etc.)

- Your business income and expense records

Tip 3: Use TurboTax to Calculate Your Qualified Business Income

Calculating your qualified business income can be complex, but TurboTax can help you get it right. The software will guide you through the calculation process, taking into account your business income and expenses, as well as any deductions and exclusions.

TurboTax will also help you identify which types of income qualify for the deduction, such as:

- Business income from a sole proprietorship or single-member LLC

- Business income from a partnership or multi-member LLC

- Business income from an S corporation

How Do I Calculate My Qualified Business Income?

- Start with your total business income

- Subtract any deductions and exclusions, such as business expenses and depreciation

- Calculate your qualified business income using the IRS's qualified business income worksheet

Tip 4: Claim the Deduction on Your Tax Return

Once you've calculated your qualified business income, you can claim the deduction on your tax return. TurboTax will help you complete Form 8995 and attach it to your tax return.

The deduction is reported on Line 10 of Schedule 1 (Form 1040), and you'll also need to complete Form 8995-A, which is the qualified business income deduction worksheet.

Where Do I Report the Deduction?

- Line 10 of Schedule 1 (Form 1040)

- Form 8995-A, the qualified business income deduction worksheet

Tip 5: Review and Edit Your Form 8995

Before submitting your tax return, review and edit your Form 8995 to ensure accuracy. TurboTax allows you to review and edit your form at any time, and you can also use the software's audit detection tool to identify any potential errors.

By following these five tips, you can complete Form 8995 with confidence and accuracy using TurboTax.

Why Review and Edit My Form 8995?

- To ensure accuracy and avoid errors

- To avoid audit triggers and potential penalties

- To ensure you're taking advantage of the maximum deduction allowed

Now that you've completed Form 8995 with TurboTax, take a moment to review and edit your form to ensure everything is accurate and complete.

What is Form 8995?

+Form 8995 is the Qualified Business Income Deduction form, which allows eligible taxpayers to deduct up to 20% of their qualified business income.

Who is eligible for the Qualified Business Income Deduction?

+Eligible taxpayers include self-employed individuals and business owners with a qualified trade or business, domestic business, and qualified business income.

How do I calculate my qualified business income?

+Calculate your qualified business income by starting with your total business income, subtracting any deductions and exclusions, and using the IRS's qualified business income worksheet.

We hope this article has provided you with a comprehensive guide to completing Form 8995 with TurboTax. Remember to review and edit your form carefully to ensure accuracy and avoid any potential errors. If you have any further questions or concerns, feel free to ask in the comments below.