The Small Business Administration (SBA) is a vital institution that provides support to small businesses and entrepreneurs across the United States. One of the key services offered by the SBA is the provision of loan guarantees, which enable small businesses to access capital that they might not otherwise be able to obtain. The SBA Form 2202 is a critical document in this process, and in this article, we will provide a step-by-step guide for borrowers who need to complete this form.

What is SBA Form 2202?

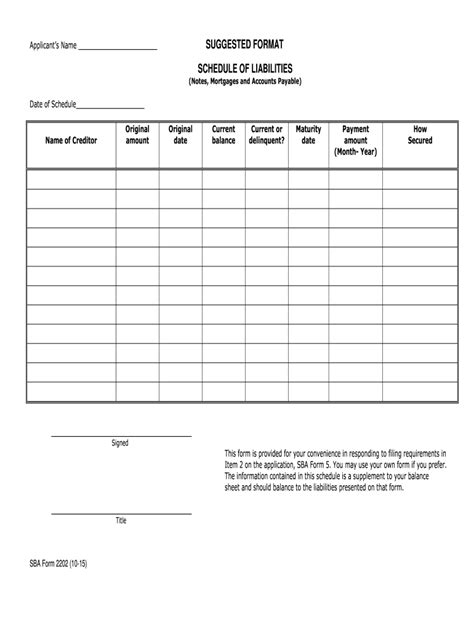

SBA Form 2202 is a loan application form used by the Small Business Administration to evaluate loan requests from small businesses. The form is designed to gather detailed information about the borrower's business, including its financial history, management structure, and loan requirements. By completing this form, borrowers provide the SBA with the necessary information to assess their creditworthiness and determine whether to approve their loan application.

Why is SBA Form 2202 Important?

The SBA Form 2202 is a critical document in the loan application process, as it provides the SBA with a comprehensive understanding of the borrower's business and financial situation. By carefully reviewing the information provided on this form, the SBA can assess the borrower's creditworthiness and make an informed decision about whether to approve their loan application.

Step-by-Step Guide to Completing SBA Form 2202

Completing the SBA Form 2202 requires careful attention to detail and a thorough understanding of the borrower's business and financial situation. Here is a step-by-step guide to help borrowers complete this form:

Step 1: Business Information

The first section of the form requires borrowers to provide basic information about their business, including:

- Business name and address

- Business type (e.g., sole proprietorship, partnership, corporation)

- Business structure (e.g., LLC, S-Corp)

- Federal tax ID number

Step 2: Loan Information

In this section, borrowers must provide detailed information about the loan they are applying for, including:

- Loan amount and term

- Interest rate and repayment schedule

- Collateral offered to secure the loan

- Loan purpose (e.g., working capital, equipment purchase, expansion)

Step 3: Business Financial Information

This section requires borrowers to provide detailed financial information about their business, including:

- Balance sheet and income statement for the past three years

- Cash flow statement for the past year

- Accounts receivable and payable aging schedules

Step 4: Management and Ownership Information

In this section, borrowers must provide information about the business's management and ownership structure, including:

- Names and titles of key management personnel

- Ownership percentage and role in the business

- Resumes of key management personnel

Step 5: Loan Repayment Information

Borrowers must provide detailed information about how they plan to repay the loan, including:

- Repayment schedule and amount

- Collateral offered to secure the loan

- Contingency plan in case of default

Tips for Completing SBA Form 2202

To increase the chances of approval, borrowers should keep the following tips in mind when completing the SBA Form 2202:

- Provide accurate and complete information

- Ensure all financial statements are up-to-date and accurate

- Clearly explain the loan purpose and repayment plan

- Highlight any unique or mitigating circumstances that may impact the loan application

SBA Form 2202 Frequently Asked Questions

Here are some frequently asked questions about the SBA Form 2202:

- Q: What is the purpose of SBA Form 2202? A: The purpose of SBA Form 2202 is to gather detailed information about the borrower's business and financial situation to evaluate their creditworthiness and determine whether to approve their loan application.

- Q: How long does it take to complete SBA Form 2202? A: The time it takes to complete SBA Form 2202 varies depending on the complexity of the borrower's business and financial situation. However, it is recommended to allocate at least 2-3 hours to complete the form.

- Q: Can I submit SBA Form 2202 electronically? A: Yes, SBA Form 2202 can be submitted electronically through the SBA's online portal.

Conclusion

Completing the SBA Form 2202 is a critical step in the loan application process for small businesses. By following the step-by-step guide outlined in this article and providing accurate and complete information, borrowers can increase their chances of approval and access the capital they need to grow and succeed.

We encourage readers to comment below with any questions or feedback about SBA Form 2202. Additionally, please share this article with any small business owners or entrepreneurs who may benefit from this information.

What is the purpose of SBA Form 2202?

+The purpose of SBA Form 2202 is to gather detailed information about the borrower's business and financial situation to evaluate their creditworthiness and determine whether to approve their loan application.

How long does it take to complete SBA Form 2202?

+The time it takes to complete SBA Form 2202 varies depending on the complexity of the borrower's business and financial situation. However, it is recommended to allocate at least 2-3 hours to complete the form.

Can I submit SBA Form 2202 electronically?

+Yes, SBA Form 2202 can be submitted electronically through the SBA's online portal.