The state of Maryland requires individuals and businesses to file their tax returns on time to avoid penalties and interest. However, there are situations where taxpayers may need more time to file their returns. This is where the Maryland tax extension form comes into play. In this article, we will guide you through the process of filing for a tax extension in Maryland, making it easy and hassle-free.

Taxpayers in Maryland can file for an automatic six-month extension, which will give them more time to prepare and submit their tax returns. The extension is available for both individual and business taxpayers. To qualify for the extension, taxpayers must file the necessary forms and pay any estimated taxes owed by the original deadline.

Benefits of Filing a Tax Extension in Maryland

Filing a tax extension in Maryland has several benefits, including:

- Avoiding penalties and interest on late tax payments

- Giving taxpayers more time to gather necessary documents and information

- Reducing stress and anxiety associated with meeting tight deadlines

- Allowing taxpayers to take advantage of deductions and credits they may be eligible for

Who Can File for a Tax Extension in Maryland?

Both individual and business taxpayers can file for a tax extension in Maryland. This includes:

- Individuals who need more time to file their personal income tax returns

- Businesses that need more time to file their corporate or partnership tax returns

- Estates and trusts that need more time to file their tax returns

How to File a Tax Extension in Maryland

Filing a tax extension in Maryland is a straightforward process. Here's a step-by-step guide to help you get started:

- Determine if you need to file a tax extension. If you're unsure, consult with a tax professional or contact the Maryland Comptroller's office.

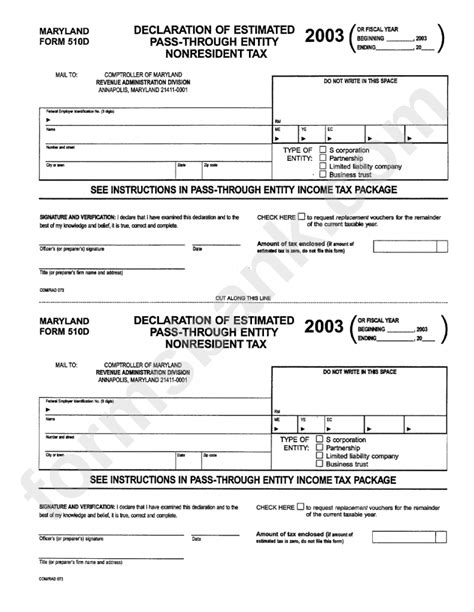

- Gather the necessary forms and documents. You'll need to file Form 502E for individuals or Form 510 for businesses.

- Complete the forms accurately and thoroughly. Make sure to include all required information and signatures.

- File the forms by the original deadline. You can file electronically or by mail.

- Pay any estimated taxes owed by the original deadline. You can pay online, by phone, or by mail.

What to Expect After Filing a Tax Extension in Maryland

After filing a tax extension in Maryland, you can expect the following:

- You'll receive an automatic six-month extension to file your tax return.

- You'll need to file your tax return by the extended deadline.

- You'll need to pay any remaining taxes owed by the extended deadline.

- You may be subject to penalties and interest if you don't file your tax return or pay any remaining taxes owed by the extended deadline.

Tips for Filing a Tax Extension in Maryland

Here are some tips to keep in mind when filing a tax extension in Maryland:

- File for the extension by the original deadline to avoid penalties and interest.

- Pay any estimated taxes owed by the original deadline to avoid penalties and interest.

- Keep accurate records of your tax extension and any correspondence with the Maryland Comptroller's office.

- Consult with a tax professional if you're unsure about the tax extension process.

Common Mistakes to Avoid When Filing a Tax Extension in Maryland

Here are some common mistakes to avoid when filing a tax extension in Maryland:

- Failing to file the necessary forms and documents.

- Failing to pay any estimated taxes owed by the original deadline.

- Failing to keep accurate records of your tax extension and any correspondence with the Maryland Comptroller's office.

- Failing to consult with a tax professional if you're unsure about the tax extension process.

Conclusion and Next Steps

Filing a tax extension in Maryland can be a straightforward process if you follow the steps outlined above. Remember to file for the extension by the original deadline, pay any estimated taxes owed, and keep accurate records of your tax extension. If you're unsure about the tax extension process, consult with a tax professional. By taking the necessary steps, you can avoid penalties and interest and ensure a smooth tax filing process.

We hope this article has been helpful in guiding you through the process of filing a tax extension in Maryland. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and family to help them navigate the tax extension process in Maryland.

What is the deadline for filing a tax extension in Maryland?

+The deadline for filing a tax extension in Maryland is the original deadline for filing your tax return.

How long is the tax extension period in Maryland?

+The tax extension period in Maryland is six months from the original deadline.

Do I need to pay any estimated taxes owed by the original deadline?

+Yes, you need to pay any estimated taxes owed by the original deadline to avoid penalties and interest.