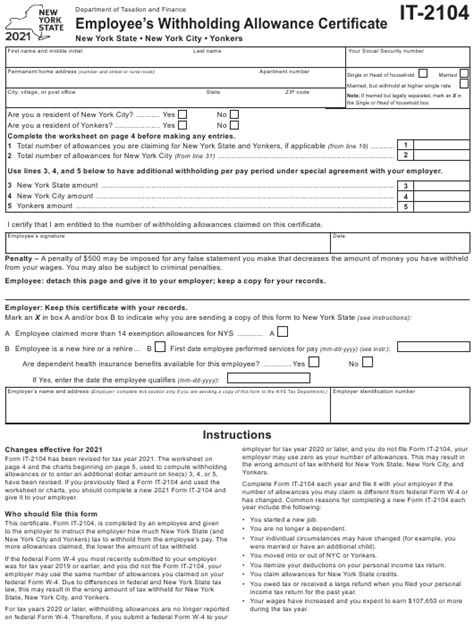

As an employee or employer in New York State, understanding the New York State withholding form is crucial for ensuring accurate tax payments and avoiding any potential penalties. The New York State withholding form, also known as the IT-2104, is a document used to report the amount of state income tax withheld from an employee's wages. In this article, we will provide a comprehensive guide to the New York State withholding form, including its purpose, who needs to file, and how to complete it.

What is the New York State Withholding Form?

The New York State withholding form, also known as the IT-2104, is a quarterly return used to report the amount of state income tax withheld from an employee's wages. Employers are required to withhold state income tax from their employees' wages and remit the withheld amounts to the New York State Department of Taxation and Finance on a quarterly basis.

Who Needs to File the New York State Withholding Form?

Employers who withhold state income tax from their employees' wages are required to file the New York State withholding form. This includes:

- Employers with employees who are subject to New York State income tax withholding

- Employers who are required to withhold New York State income tax from non-resident employees

- Employers who have employees who claim exemption from New York State income tax withholding

How to Complete the New York State Withholding Form

Completing the New York State withholding form requires accurate and detailed information. Here's a step-by-step guide to help you complete the form:

Section 1: Employer Information

- Enter your employer identification number (EIN)

- Enter your business name and address

- Enter your New York State withholding tax account number (if applicable)

Section 2: Quarterly Withholding Tax Return

- Enter the total amount of wages paid to employees during the quarter

- Enter the total amount of state income tax withheld from employees' wages during the quarter

- Enter the total amount of tax withheld for the quarter

Section 3: Calculation of Withholding Tax

- Calculate the total amount of withholding tax due for the quarter

- Calculate the total amount of tax withheld for the quarter

Section 4: Payment and Signature

- Enter the total amount of payment due for the quarter

- Sign and date the form

Due Dates and Penalties

The New York State withholding form is due on the last day of the month following the end of the quarter. The due dates are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Failure to file the New York State withholding form on time may result in penalties and interest. The penalty for late filing is 5% of the unpaid tax due, plus interest at the rate of 1% per month.

Electronic Filing Options

The New York State Department of Taxation and Finance offers electronic filing options for the New York State withholding form. Employers can file the form electronically using the Online Services system or through a third-party software provider.

Amended Returns

If you need to make changes to a previously filed New York State withholding form, you can file an amended return. To file an amended return, complete a new form and check the box indicating that it is an amended return.

Conclusion

The New York State withholding form is an important document that requires accurate and detailed information. By following the steps outlined in this guide, employers can ensure that they are in compliance with New York State tax laws and avoid any potential penalties.

We encourage you to share your thoughts and questions about the New York State withholding form in the comments section below. Additionally, if you found this guide helpful, please share it with others who may benefit from this information.

What is the due date for the New York State withholding form?

+The due date for the New York State withholding form is the last day of the month following the end of the quarter.

Who is required to file the New York State withholding form?

+Employers who withhold state income tax from their employees' wages are required to file the New York State withholding form.

What is the penalty for late filing of the New York State withholding form?

+The penalty for late filing is 5% of the unpaid tax due, plus interest at the rate of 1% per month.