The Form 8955-SSA is a crucial document for administrators of certain retirement plans, such as defined benefit and defined contribution plans. The form is used to report separated participants and beneficiaries with deferred vested benefits. In this article, we will provide a step-by-step guide on how to complete Form 8955-SSA.

What is Form 8955-SSA?

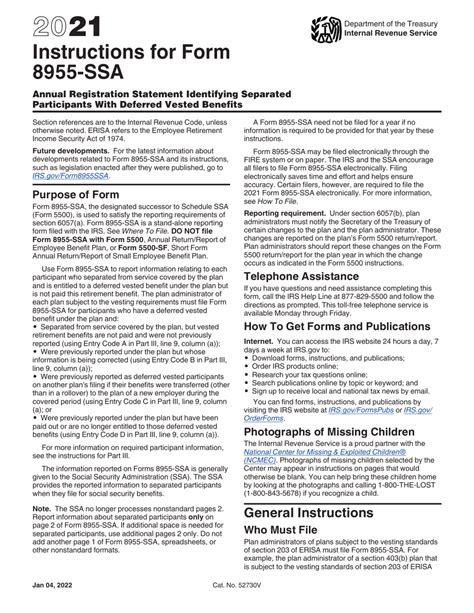

Form 8955-SSA is a report required by the Internal Revenue Service (IRS) for administrators of certain retirement plans. The form is used to report separated participants and beneficiaries with deferred vested benefits. The report includes information about the participant's name, Social Security number, date of birth, and the amount of deferred vested benefits.

Why is Form 8955-SSA Important?

Form 8955-SSA is important because it helps the IRS keep track of deferred vested benefits owed to separated participants and beneficiaries. The form also helps plan administrators to ensure compliance with the IRS regulations.

Who Needs to File Form 8955-SSA?

Form 8955-SSA needs to be filed by administrators of certain retirement plans, such as defined benefit and defined contribution plans. The plans that require filing Form 8955-SSA include:

- Defined benefit plans

- Defined contribution plans

- Money purchase pension plans

- Target benefit plans

- Employee stock ownership plans (ESOPs)

When is Form 8955-SSA Due?

Form 8955-SSA is due on January 31st of each year. However, if the plan administrator needs more time to file the form, they can request an extension by filing Form 5558.

How to Complete Form 8955-SSA

Completing Form 8955-SSA requires careful attention to detail. Here is a step-by-step guide to help plan administrators complete the form:

- Identify the Plan: Enter the plan name, plan number, and plan year.

- List Separated Participants and Beneficiaries: List the names, Social Security numbers, dates of birth, and addresses of separated participants and beneficiaries with deferred vested benefits.

- Report Deferred Vested Benefits: Report the amount of deferred vested benefits for each participant and beneficiary.

- Certify the Report: Certify that the report is accurate and complete.

Penalties for Not Filing Form 8955-SSA

Failure to file Form 8955-SSA can result in penalties and fines. The IRS can impose a penalty of $10 per participant per day, up to a maximum of $30,000 per year.

Form 8955-SSA Instructions: FAQs

Here are some frequently asked questions about Form 8955-SSA:

- Q: What is the deadline for filing Form 8955-SSA? A: The deadline for filing Form 8955-SSA is January 31st of each year.

- Q: Who needs to file Form 8955-SSA? A: Administrators of defined benefit and defined contribution plans need to file Form 8955-SSA.

- Q: What is the penalty for not filing Form 8955-SSA? A: The penalty for not filing Form 8955-SSA is $10 per participant per day, up to a maximum of $30,000 per year.

Conclusion

Form 8955-SSA is an important report required by the IRS for administrators of certain retirement plans. The form is used to report separated participants and beneficiaries with deferred vested benefits. By following the step-by-step guide provided in this article, plan administrators can ensure compliance with the IRS regulations.

We hope this article has provided valuable information about Form 8955-SSA. If you have any questions or need further assistance, please do not hesitate to comment below. Share this article with others who may benefit from this information.

What is the purpose of Form 8955-SSA?

+Form 8955-SSA is used to report separated participants and beneficiaries with deferred vested benefits.

Who needs to file Form 8955-SSA?

+Administrators of defined benefit and defined contribution plans need to file Form 8955-SSA.

What is the deadline for filing Form 8955-SSA?

+The deadline for filing Form 8955-SSA is January 31st of each year.