Ritaohio.com Form 37 has become a buzzword in recent times, especially among residents of Ohio, USA. If you're a homeowner, renter, or business owner in Ohio, chances are you've heard of this form, but might not know what it's all about. In this article, we'll delve into the world of Ritaohio.com Form 37, exploring its purpose, benefits, and how to fill it out correctly.

As a homeowner or renter, it's essential to understand the concept of property taxes and how they affect your livelihood. Property taxes are a significant source of revenue for local governments, funding essential services like education, infrastructure, and public safety. However, paying property taxes can be a daunting task, especially for those who are new to Ohio or unfamiliar with the process. This is where Ritaohio.com Form 37 comes in – a vital tool designed to help Ohio residents claim their rightful exemptions and deductions.

What is Ritaohio.com Form 37?

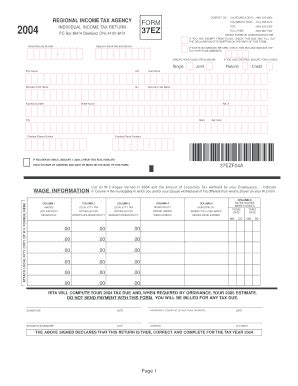

Ritaohio.com Form 37, also known as the "Homestead Exemption and Owner-Occupancy Credit Application," is a document provided by the Regional Income Tax Agency (RITA) of Ohio. The form allows eligible homeowners to apply for exemptions and credits on their property taxes, reducing their overall tax burden. By filling out Form 37, homeowners can claim the Homestead Exemption, which provides a significant reduction in property taxes for eligible residents.

Who is eligible for Ritaohio.com Form 37?

To be eligible for Ritaohio.com Form 37, you must meet specific requirements:

- You must be a resident of Ohio and own a primary residence within the state.

- You must occupy the property as your primary residence.

- Your annual income must be below a certain threshold, which varies depending on your age and disability status.

Benefits of Ritaohio.com Form 37

Filling out Ritaohio.com Form 37 can have several benefits for eligible homeowners:

- Reduced property taxes: By claiming the Homestead Exemption, you can significantly lower your property tax bill.

- Increased affordability: With reduced property taxes, you may find it easier to afford your mortgage payments, maintenance costs, and other expenses associated with homeownership.

- Simplified tax process: Form 37 streamlines the tax process, making it easier to claim your exemptions and credits.

How to fill out Ritaohio.com Form 37

Filling out Ritaohio.com Form 37 is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Gather required documents: Before starting the application, ensure you have the necessary documents, including your Social Security number, proof of income, and proof of residency.

- Fill out the application: Visit the RITA website and download Form 37. Fill out the application carefully, ensuring you provide accurate and complete information.

- Submit the application: Once you've completed the application, submit it to RITA along with the required documentation.

Common mistakes to avoid when filling out Ritaohio.com Form 37

To avoid delays or rejections, be aware of the following common mistakes when filling out Ritaohio.com Form 37:

- Incomplete or inaccurate information

- Missing required documentation

- Failure to sign and date the application

Additional resources for Ritaohio.com Form 37

If you need help with Ritaohio.com Form 37 or have questions about the application process, consider the following resources:

- RITA website: Visit the official RITA website for detailed information on Form 37, including eligibility requirements, application instructions, and FAQs.

- Local government offices: Contact your local government office for guidance on filling out Form 37 and submitting your application.

- Tax professionals: Consult with a tax professional or accountant for personalized advice on claiming exemptions and credits.

Conclusion and Next Steps

Ritaohio.com Form 37 is a valuable tool for Ohio residents, helping them claim exemptions and credits on their property taxes. By understanding the purpose and benefits of Form 37, you can take the first step towards reducing your property tax burden. Remember to carefully review the eligibility requirements, gather required documentation, and submit your application accurately to avoid delays or rejections.

If you have any questions or concerns about Ritaohio.com Form 37, feel free to comment below or reach out to RITA directly. Don't forget to share this article with friends and family who may benefit from this valuable information.

What is the deadline for submitting Ritaohio.com Form 37?

+The deadline for submitting Ritaohio.com Form 37 varies depending on your location and the tax year. Check the RITA website or consult with your local government office for specific deadlines.

Can I file Ritaohio.com Form 37 electronically?

+Yes, you can file Ritaohio.com Form 37 electronically through the RITA website. This option is available for eligible applicants who meet specific requirements.

How long does it take to process Ritaohio.com Form 37?

+The processing time for Ritaohio.com Form 37 varies depending on the volume of applications and the complexity of the review process. Typically, it takes several weeks to several months to receive a decision.