Receiving a tax form from your health insurance provider may seem like a daunting task, but understanding the information it contains is essential for accurate tax filing. If you have health coverage through Cigna, you'll receive a Form 1099-HC, which reports the amount of money spent on your health coverage. In this article, we'll delve into the details of the Cigna Form 1099-HC, explaining its purpose, the information it contains, and how to use it when filing your taxes.

What is the Cigna Form 1099-HC?

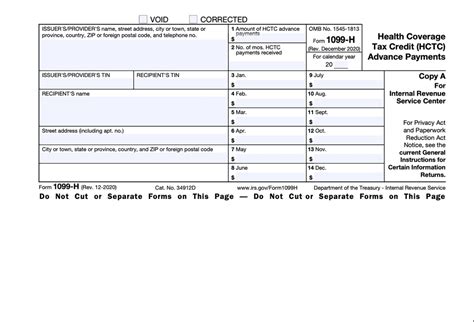

The Cigna Form 1099-HC is a tax form used to report the amount of money spent on your health coverage to the Internal Revenue Service (IRS). It is also known as the Health Coverage Tax Credit (HCTC) form. The form is typically sent to you by January 31st of each year, and it covers the previous tax year.

Why do I need the Cigna Form 1099-HC?

You need the Cigna Form 1099-HC to report the amount of money spent on your health coverage to the IRS. This form provides proof of your health coverage, which may be required to claim certain tax credits or deductions. Additionally, the form helps the IRS verify the accuracy of your tax return.

What information is included on the Cigna Form 1099-HC?

The Cigna Form 1099-HC includes the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- The policy number and plan name

- The amount of money spent on your health coverage for the tax year

- The dates of coverage

How do I use the Cigna Form 1099-HC when filing my taxes?

To use the Cigna Form 1099-HC when filing your taxes, follow these steps:

- Review the form for accuracy: Verify that the information on the form is correct, including your name, address, and Social Security number or ITIN.

- Attach the form to your tax return: Include a copy of the Cigna Form 1099-HC with your tax return, typically Form 1040.

- Report the health coverage amount: Enter the amount of money spent on your health coverage, as reported on the Cigna Form 1099-HC, on the applicable line of your tax return.

- Claim tax credits or deductions: If you're eligible, claim tax credits or deductions related to your health coverage, such as the Premium Tax Credit or the Medical Expense Deduction.

Tips for accurately completing your tax return with the Cigna Form 1099-HC

To ensure accuracy when completing your tax return with the Cigna Form 1099-HC, keep the following tips in mind:

- Use the correct tax year: Verify that the tax year on the Cigna Form 1099-HC matches the tax year you're filing for.

- Report all health coverage: Include all health coverage amounts, even if you have multiple policies or coverage through multiple providers.

- Consult a tax professional: If you're unsure about how to report your health coverage or claim tax credits or deductions, consider consulting a tax professional.

Common questions and answers about the Cigna Form 1099-HC

Q: What if I don't receive my Cigna Form 1099-HC by January 31st? A: Contact Cigna directly to request a replacement form.

Q: Can I file my taxes without the Cigna Form 1099-HC? A: While it's possible to file your taxes without the form, it's recommended that you wait until you receive it to ensure accuracy and avoid potential delays or issues with your tax return.

Q: How do I report multiple health coverage policies on my tax return? A: Combine the amounts from each policy and report the total on the applicable line of your tax return.

Q: Can I claim the Premium Tax Credit if I have employer-sponsored health coverage? A: Generally, no, but there may be exceptions. Consult a tax professional to determine your eligibility.

What is the deadline for filing my tax return with the Cigna Form 1099-HC?

+The deadline for filing your tax return is typically April 15th, but it may vary depending on your location and individual circumstances. Be sure to check with the IRS or a tax professional for specific guidance.

Can I file an amended tax return if I realize I made a mistake on my original return?

+Yes, you can file an amended tax return (Form 1040X) to correct errors or report changes. However, it's recommended that you consult a tax professional to ensure accuracy and avoid potential penalties.

How do I contact Cigna if I have questions about my Form 1099-HC?

+Contact Cigna directly via phone, email, or mail, using the information provided on their website or on the Form 1099-HC itself.

In conclusion, the Cigna Form 1099-HC is an essential tax form that reports the amount of money spent on your health coverage. By understanding the information it contains and how to use it when filing your taxes, you can ensure accuracy and potentially claim tax credits or deductions. If you have questions or concerns about your Form 1099-HC, don't hesitate to reach out to Cigna or a tax professional for guidance.