The Form 5471 Schedule O is a crucial component of the Form 5471, which is used by the Internal Revenue Service (IRS) to report information about certain foreign corporations. As a taxpayer, it's essential to understand the instructions and filing requirements for Schedule O to ensure compliance with IRS regulations.

Understanding the Purpose of Schedule O

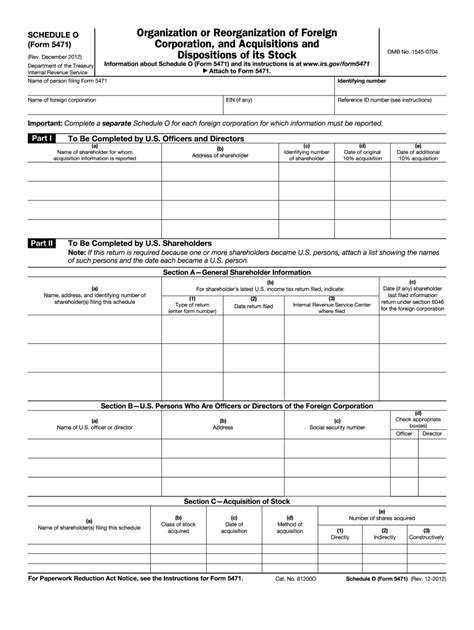

The primary purpose of Schedule O is to provide information about the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. This schedule is used in conjunction with Form 5471, which is filed by certain U.S. persons who have an interest in a foreign corporation.

Who Needs to File Schedule O?

Schedule O is required to be filed by U.S. persons who have an interest in a foreign corporation and meet certain conditions. These conditions include:

- Being a Category 4 or 5 filer (see Form 5471 instructions for more information on categories)

- Having an interest in a foreign corporation that undergoes a reorganization or acquisition/disposition of its stock

- Receiving a distribution from a foreign corporation that is treated as a dividend

Instructions for Completing Schedule O

To complete Schedule O, you will need to provide information about the foreign corporation, including its name, address, and employer identification number (EIN). You will also need to provide details about the reorganization or acquisition/disposition of stock, including the date and type of transaction.

Here are the step-by-step instructions for completing Schedule O:

- Section 1: Identifying Information

- Enter the name, address, and EIN of the foreign corporation.

- Check the box to indicate whether the corporation is a controlled foreign corporation (CFC).

- Section 2: Reorganization or Acquisition/Disposition of Stock

- Describe the type of transaction (reorganization, acquisition, or disposition).

- Enter the date of the transaction.

- Provide details about the stock involved, including the number of shares and the percentage of ownership.

- Section 3: Distributions

- Check the box to indicate whether the distribution is treated as a dividend.

- Enter the amount of the distribution.

Filing Requirements for Schedule O

Schedule O must be filed with Form 5471, which is typically due on the 15th day of the 4th month following the end of the foreign corporation's tax year. For example, if the foreign corporation's tax year ends on December 31, the Form 5471 and Schedule O would be due on April 15.

Consequences of Not Filing Schedule O

Failure to file Schedule O can result in penalties and fines. The IRS may impose a penalty of up to $10,000 for each failure to file, and the penalty can be increased if the failure is deemed willful.

Best Practices for Filing Schedule O

To avoid errors and ensure compliance, follow these best practices:

- Carefully review the instructions for Schedule O and Form 5471.

- Ensure that all required information is provided and accurate.

- File Schedule O and Form 5471 on time to avoid penalties.

- Keep accurate records of the foreign corporation's transactions and activities.

Additional Resources

For more information on Schedule O and Form 5471, refer to the following resources:

- IRS Form 5471 instructions

- IRS Publication 514 (Foreign Tax Credit for Individuals, Estates, and Trusts)

- IRS Publication 535 (Business Expenses)

By following the instructions and guidelines outlined in this article, you can ensure compliance with IRS regulations and avoid potential penalties.

What You Need to Know About Form 5471

Form 5471 is a crucial tax form used by the IRS to report information about certain foreign corporations. As a taxpayer, it's essential to understand the purpose and requirements of Form 5471 to ensure compliance with IRS regulations.

Who Needs to File Form 5471?

Form 5471 is required to be filed by certain U.S. persons who have an interest in a foreign corporation. These individuals include:

- U.S. citizens and residents who are officers, directors, or shareholders of a foreign corporation

- U.S. persons who have a 10% or greater interest in a foreign corporation

- U.S. persons who have control of a foreign corporation

What Information is Reported on Form 5471?

Form 5471 requires reporting of various information about the foreign corporation, including:

- Identifying information (name, address, and EIN)

- Financial information (income, deductions, and credits)

- Information about the corporation's officers, directors, and shareholders

- Information about the corporation's transactions with related parties

Schedules and Attachments

Form 5471 includes several schedules and attachments that require additional information. These include:

- Schedule A: Stock of Foreign Corporation

- Schedule C: Income Statement

- Schedule E: Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Schedule F: Balance Sheet

- Schedule G: Other Information

- Schedule H: Summary of Shareholder's Basis in Foreign Corporation Stock

- Schedule J: Controlled Foreign Corporation (CFC) Summary

- Schedule O: Organization or Reorganization of Foreign Corporation, and Acquisition or Disposition of Its Stock

Filing Requirements for Form 5471

Form 5471 is typically due on the 15th day of the 4th month following the end of the foreign corporation's tax year. For example, if the foreign corporation's tax year ends on December 31, the Form 5471 would be due on April 15.

Consequences of Not Filing Form 5471

Failure to file Form 5471 can result in penalties and fines. The IRS may impose a penalty of up to $10,000 for each failure to file, and the penalty can be increased if the failure is deemed willful.

Penalties and Fines for Non-Compliance

Failure to comply with IRS regulations and filing requirements can result in significant penalties and fines. It's essential to understand the consequences of non-compliance to avoid potential issues.

Penalties for Failure to File

The IRS may impose a penalty of up to $10,000 for each failure to file Form 5471 or Schedule O. The penalty can be increased if the failure is deemed willful.

Fines for Willful Failure to File

If the IRS determines that the failure to file was willful, the penalty can be increased to up to $100,000 or more.

Interest on Unpaid Taxes

In addition to penalties and fines, the IRS may also charge interest on unpaid taxes.

Conclusion

In conclusion, Schedule O and Form 5471 are critical components of the IRS's efforts to regulate and monitor foreign corporations. By understanding the instructions and filing requirements for these forms, taxpayers can ensure compliance with IRS regulations and avoid potential penalties.

Additional Resources

For more information on Schedule O and Form 5471, refer to the following resources:

- IRS Form 5471 instructions

- IRS Publication 514 (Foreign Tax Credit for Individuals, Estates, and Trusts)

- IRS Publication 535 (Business Expenses)

By following the instructions and guidelines outlined in this article, you can ensure compliance with IRS regulations and avoid potential penalties.

FAQs

Q: What is the purpose of Schedule O?

A: Schedule O is used to report information about the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

Q: Who needs to file Schedule O?

A: U.S. persons who have an interest in a foreign corporation and meet certain conditions, including being a Category 4 or 5 filer or having an interest in a foreign corporation that undergoes a reorganization or acquisition/disposition of its stock.

Q: What is the deadline for filing Schedule O?

A: Schedule O must be filed with Form 5471, which is typically due on the 15th day of the 4th month following the end of the foreign corporation's tax year.

Q: What are the consequences of not filing Schedule O?

A: Failure to file Schedule O can result in penalties and fines, including a penalty of up to $10,000 for each failure to file, and the penalty can be increased if the failure is deemed willful.

Q: What is the purpose of Form 5471?

A: Form 5471 is used to report information about certain foreign corporations, including financial information, information about the corporation's officers, directors, and shareholders, and information about the corporation's transactions with related parties.

Q: Who needs to file Form 5471?

A: Certain U.S. persons who have an interest in a foreign corporation, including U.S. citizens and residents who are officers, directors, or shareholders of a foreign corporation, and U.S. persons who have a 10% or greater interest in a foreign corporation.

Q: What are the consequences of not filing Form 5471?

A: Failure to file Form 5471 can result in penalties and fines, including a penalty of up to $10,000 for each failure to file, and the penalty can be increased if the failure is deemed willful.

What is the purpose of Schedule O?

+Schedule O is used to report information about the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

Who needs to file Schedule O?

+U.S. persons who have an interest in a foreign corporation and meet certain conditions, including being a Category 4 or 5 filer or having an interest in a foreign corporation that undergoes a reorganization or acquisition/disposition of its stock.

What is the deadline for filing Schedule O?

+Schedule O must be filed with Form 5471, which is typically due on the 15th day of the 4th month following the end of the foreign corporation's tax year.