Understanding Homestead Exemption in Nebraska: A Comprehensive Guide

As a homeowner in Nebraska, you're likely familiar with the concept of property taxes. However, you may not know about the Homestead Exemption, a valuable tax relief program designed to help eligible homeowners reduce their property tax burden. In this article, we'll delve into the world of Homestead Exemption in Nebraska, exploring what it is, how it works, and how to apply using Form 458.

What is Homestead Exemption in Nebraska?

The Homestead Exemption is a state-funded program that provides eligible homeowners with a exemption from a portion of their property taxes. The program aims to help low-income and elderly homeowners, as well as those with disabilities, by reducing the amount of property taxes they owe. In Nebraska, the Homestead Exemption is administered by the Nebraska Department of Revenue and is funded by the state's general fund.

Eligibility Requirements for Homestead Exemption in Nebraska

To be eligible for the Homestead Exemption in Nebraska, you must meet certain requirements:

- You must be a Nebraska resident and own a home in the state.

- You must occupy the home as your primary residence.

- You must meet one of the following income or disability requirements:

- Be 65 years of age or older.

- Be totally disabled and unable to work.

- Have a household income that does not exceed a certain threshold (currently $44,400 for a single person and $59,400 for a married couple).

How to Apply for Homestead Exemption in Nebraska

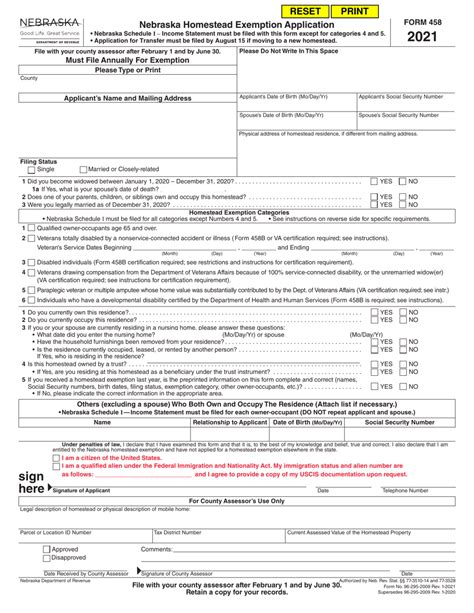

To apply for the Homestead Exemption in Nebraska, you'll need to complete Form 458, which is available on the Nebraska Department of Revenue's website. You can also contact your local county assessor's office for more information and assistance.

Here's a step-by-step guide to applying for the Homestead Exemption:

- Download and complete Form 458 from the Nebraska Department of Revenue's website.

- Gather required documentation, including proof of income, disability, and residency.

- Submit the completed form and supporting documentation to your local county assessor's office by June 30th of each year.

Benefits of Homestead Exemption in Nebraska

The Homestead Exemption in Nebraska provides several benefits to eligible homeowners, including:

- Reduced property taxes: The exemption can reduce your property taxes by up to $19,400 (2022 rate).

- Increased disposable income: By reducing your property tax burden, you'll have more money available for other expenses.

- Tax relief: The exemption provides a much-needed break for low-income and elderly homeowners who may struggle to pay their property taxes.

Common Questions and Answers about Homestead Exemption in Nebraska

Here are some common questions and answers about the Homestead Exemption in Nebraska:

Q: Do I need to reapply for the Homestead Exemption every year? A: Yes, you'll need to reapply every year by June 30th to maintain your eligibility.

Q: Can I apply for the Homestead Exemption if I'm a renter? A: No, the Homestead Exemption is only available to homeowners who occupy their home as their primary residence.

Q: How do I know if I'm eligible for the Homestead Exemption? A: Contact your local county assessor's office or the Nebraska Department of Revenue to determine your eligibility.

Conclusion

The Homestead Exemption in Nebraska is a valuable program that provides tax relief to eligible homeowners. By understanding the eligibility requirements and application process, you can take advantage of this program and reduce your property tax burden. Remember to reapply every year and stay informed about any changes to the program.

What is the deadline to apply for the Homestead Exemption in Nebraska?

+The deadline to apply for the Homestead Exemption in Nebraska is June 30th of each year.

Can I apply for the Homestead Exemption if I'm a non-resident?

+No, the Homestead Exemption is only available to Nebraska residents who own and occupy their home as their primary residence.

How much can I expect to save on my property taxes with the Homestead Exemption?

+The amount of savings varies depending on your income, disability status, and property value. However, the exemption can reduce your property taxes by up to $19,400 (2022 rate).