Understanding tax forms can be a daunting task, especially for those who are new to the world of taxation. One such form that often raises questions is the TD 420-040 form. In this article, we will delve into the details of this form, explaining its purpose, benefits, and how to navigate its complexities.

Taxpayers often find themselves entangled in a web of tax forms, each serving a unique purpose. The TD 420-040 form is no exception. This form is used by taxpayers to report specific transactions and claim tax credits or deductions. The correct completion of this form is crucial to avoid any errors or discrepancies that might lead to delays or even penalties.

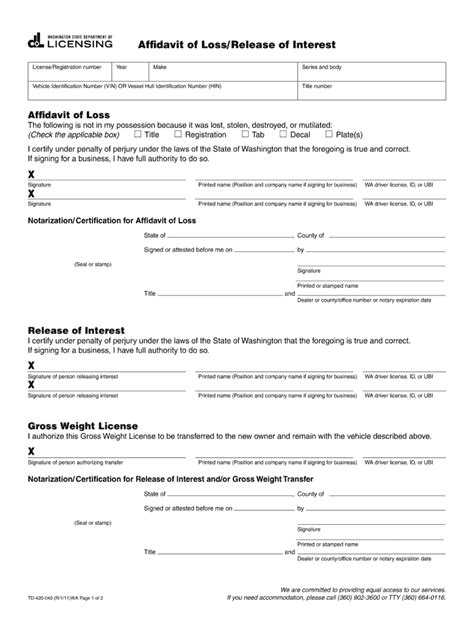

What is the TD 420-040 Form?

The TD 420-040 form is a tax document used by taxpayers to report specific transactions related to their income or business. It is designed to help taxpayers claim tax credits or deductions they are eligible for. The form requires detailed information about the transactions, including dates, amounts, and descriptions.

Why is the TD 420-040 Form Important?

The TD 420-040 form plays a vital role in the tax filing process. By accurately completing this form, taxpayers can ensure they are taking advantage of all the tax credits and deductions available to them. This can result in a lower tax liability, which can lead to significant savings.

Additionally, the TD 420-040 form helps the tax authorities to assess the taxpayer's income and tax liability accurately. It provides valuable information that enables the authorities to verify the taxpayer's claims and ensure compliance with tax laws.

How to Complete the TD 420-040 Form

Completing the TD 420-040 form requires attention to detail and a thorough understanding of the tax laws and regulations. Here are some steps to help taxpayers navigate the form:

- Gather required documents: Before starting to fill out the form, taxpayers should gather all the necessary documents, including receipts, invoices, and bank statements.

- Read the instructions carefully: The form comes with instructions that provide guidance on how to complete each section. Taxpayers should read these instructions carefully to ensure they understand what is required.

- Fill out the form accurately: Taxpayers should fill out the form accurately, using the required information and calculations.

- Attach supporting documents: Taxpayers should attach supporting documents, such as receipts and invoices, to the form to substantiate their claims.

- Review and verify: Before submitting the form, taxpayers should review and verify the information to ensure it is accurate and complete.

Common Mistakes to Avoid

When completing the TD 420-040 form, taxpayers should avoid common mistakes that can lead to delays or penalties. Some of these mistakes include:

- Inaccurate or incomplete information: Providing inaccurate or incomplete information can lead to delays or penalties.

- Failure to attach supporting documents: Failing to attach supporting documents can lead to the rejection of the form.

- Mathematical errors: Mathematical errors can lead to incorrect calculations and delays.

Consequences of Non-Compliance

Failure to comply with the requirements of the TD 420-040 form can lead to severe consequences, including:

- Penalties: Taxpayers may face penalties for non-compliance, which can result in additional taxes and interest.

- Delays: Non-compliance can lead to delays in processing the form, which can result in delayed refunds or additional taxes.

- Audits: In severe cases, non-compliance can lead to audits, which can result in additional taxes, penalties, and interest.

Benefits of Accurate Completion

Accurate completion of the TD 420-040 form can result in several benefits, including:

- Reduced tax liability: Accurate completion of the form can result in reduced tax liability, leading to significant savings.

- Faster processing: Accurate completion of the form can result in faster processing, leading to quicker refunds or reduced taxes.

- Avoidance of penalties: Accurate completion of the form can avoid penalties, interest, and audits.

Best Practices for Taxpayers

To ensure accurate completion of the TD 420-040 form, taxpayers should follow best practices, including:

- Seek professional help: Taxpayers should seek professional help if they are unsure about how to complete the form.

- Keep accurate records: Taxpayers should keep accurate records of their transactions, including receipts, invoices, and bank statements.

- Review and verify: Taxpayers should review and verify the information on the form to ensure it is accurate and complete.

As we conclude this comprehensive guide to the TD 420-040 form, we hope that taxpayers have gained a better understanding of its purpose, benefits, and complexities. By following the steps and best practices outlined in this article, taxpayers can ensure accurate completion of the form, avoid common mistakes, and reap the benefits of reduced tax liability and faster processing.

We encourage you to share your experiences or ask questions about the TD 420-040 form in the comments section below.

What is the purpose of the TD 420-040 form?

+The TD 420-040 form is used by taxpayers to report specific transactions and claim tax credits or deductions.

What are the consequences of non-compliance with the TD 420-040 form?

+Non-compliance with the TD 420-040 form can lead to penalties, delays, and audits.

How can taxpayers ensure accurate completion of the TD 420-040 form?

+Taxpayers can ensure accurate completion of the TD 420-040 form by following best practices, such as seeking professional help, keeping accurate records, and reviewing and verifying the information on the form.