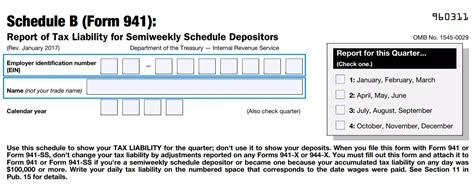

As an employer, you are required to file Form 941, Employer's Quarterly Federal Tax Return, with the Internal Revenue Service (IRS) every quarter. One of the essential components of this form is Schedule B, which reports the employer's tax liability for the quarter. In this article, we will delve into the Form 941 Schedule B instructions to help you understand how to accurately complete and submit this crucial document.

Understanding Form 941 Schedule B

Form 941 Schedule B is used to report the employer's tax liability for the quarter, including the total taxes withheld from employees' wages, tips, and other compensation. The schedule also reports the employer's share of taxes, such as Social Security and Medicare taxes. It is essential to accurately complete Schedule B to ensure that your business is in compliance with federal tax laws.

Benefits of Accurate Schedule B Reporting

Accurate reporting on Schedule B provides several benefits to employers, including:

- Reduced risk of penalties and fines: Inaccurate or incomplete reporting can result in penalties and fines from the IRS. By accurately completing Schedule B, you can minimize the risk of these consequences.

- Improved compliance: Accurate reporting demonstrates your business's commitment to complying with federal tax laws, reducing the risk of audits and other compliance issues.

- Enhanced credibility: Accurate reporting can enhance your business's credibility with the IRS, employees, and other stakeholders.

How to Complete Form 941 Schedule B

To complete Form 941 Schedule B, follow these steps:

Step 1: Gather Required Information

- Collect the following information:

- Total wages, tips, and other compensation paid to employees during the quarter

- Total taxes withheld from employees' wages, tips, and other compensation

- Employer's share of Social Security and Medicare taxes

- Any adjustments to tax liability, such as overpayments or underpayments

Step 2: Complete Schedule B

- Complete the following columns on Schedule B:

- Column 1: Total wages, tips, and other compensation

- Column 2: Total taxes withheld

- Column 3: Employer's share of Social Security taxes

- Column 4: Employer's share of Medicare taxes

- Column 5: Total tax liability

- Column 6: Adjustments to tax liability

Step 3: Calculate Total Tax Liability

- Calculate the total tax liability by adding the amounts in columns 1 through 5

- Enter the total tax liability in column 6

Common Mistakes to Avoid on Schedule B

To ensure accurate reporting on Schedule B, avoid the following common mistakes:

- Inaccurate calculations: Double-check calculations to ensure accuracy.

- Incomplete information: Ensure that all required information is included.

- Inconsistent reporting: Ensure that reporting is consistent across all quarters.

Practical Example of Schedule B Reporting

Let's consider a practical example of Schedule B reporting:

- XYZ Inc. pays its employees a total of $100,000 in wages, tips, and other compensation during the quarter.

- The company withholds $20,000 in taxes from employees' wages, tips, and other compensation.

- The employer's share of Social Security taxes is $3,000, and the employer's share of Medicare taxes is $1,000.

Using this information, XYZ Inc. would complete Schedule B as follows:

| Column 1 | Column 2 | Column 3 | Column 4 | Column 5 | Column 6 |

|---|---|---|---|---|---|

| $100,000 | $20,000 | $3,000 | $1,000 | $24,000 | $0 |

Tips for Accurate Schedule B Reporting

To ensure accurate reporting on Schedule B, follow these tips:

- Use accurate calculations: Double-check calculations to ensure accuracy.

- Keep accurate records: Maintain accurate records of employee wages, tips, and other compensation, as well as taxes withheld.

- Consult with a tax professional: If you are unsure about any aspect of Schedule B reporting, consult with a tax professional.

Conclusion

In conclusion, accurate reporting on Form 941 Schedule B is crucial for employers to ensure compliance with federal tax laws. By following the instructions outlined in this article, you can ensure that your business is accurately reporting its tax liability and avoiding penalties and fines. Remember to keep accurate records, use accurate calculations, and consult with a tax professional if needed.

FAQ Section

What is the purpose of Form 941 Schedule B?

+Form 941 Schedule B is used to report the employer's tax liability for the quarter, including the total taxes withheld from employees' wages, tips, and other compensation.

What information is required to complete Schedule B?

+To complete Schedule B, you will need to gather information on total wages, tips, and other compensation paid to employees, total taxes withheld, employer's share of Social Security and Medicare taxes, and any adjustments to tax liability.

What are the common mistakes to avoid on Schedule B?

+