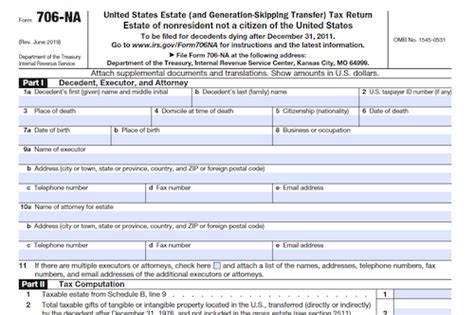

The passing of a loved one can be a difficult and emotional experience, and navigating the complexities of estate tax can add to the burden. Form 706-NA, also known as the United States Estate (and Generation-Skipping) Tax Return, is a critical document that must be filed with the Internal Revenue Service (IRS) to report the estate tax liability of a deceased individual. In this article, we will provide a step-by-step guide to completing Form 706-NA, helping you understand the process and ensure that you comply with the necessary regulations.

Understanding the Importance of Form 706-NA

Form 706-NA is required for estates with a gross value exceeding $11.58 million in 2020, or $11.7 million in 2021. This form must be filed within nine months of the decedent's date of death, unless an automatic six-month extension is granted. Failure to file Form 706-NA or pay the required estate tax can result in penalties, interest, and even litigation.

Step 1: Gather Necessary Information and Documents

Before beginning the Form 706-NA, gather all necessary information and documents, including:

- The decedent's Social Security number

- The decedent's date of birth and date of death

- The estate's gross value, including all assets and liabilities

- A list of all beneficiaries, including their names, addresses, and Social Security numbers

- Any prior estate tax returns (Forms 706) filed by the decedent or their spouse

- Any trusts, wills, or other estate planning documents

Step 2: Determine the Executor's Responsibilities

The executor, also known as the personal representative, is responsible for managing the estate and filing Form 706-NA. The executor must:

- Gather all necessary information and documents

- Complete and sign Form 706-NA

- Pay the required estate tax

- Distribute assets to beneficiaries according to the will or state law

Executor's Tax Identification Number

The executor must obtain a tax identification number (EIN) from the IRS to report the estate's income and pay taxes. Apply for an EIN online or by calling the IRS Business and Specialty Tax Line at (800) 829-4933.

Step 3: Complete Form 706-NA

Form 706-NA consists of 30 sections, including:

- Section 1: Decedent's Information

- Section 2: Executor's Information

- Section 3: Gross Estate

- Section 4: Deductions

- Section 5: Tax Computation

Carefully review and complete each section, using the instructions and examples provided in the Form 706-NA instructions.

Section 3: Gross Estate

The gross estate includes all assets, including:

- Real estate

- Stocks and bonds

- Business interests

- Life insurance policies

- Retirement accounts

Report the fair market value of each asset on the date of the decedent's death.

Step 4: File Form 706-NA and Pay Estate Tax

File Form 706-NA with the IRS at the following address:

Internal Revenue Service Estate and Gift Tax PO Box 7346 Philadelphia, PA 19101-7346

Pay the required estate tax using a check or money order payable to the United States Treasury. You can also pay online or by phone using the Electronic Federal Tax Payment System (EFTPS).

Penalties and Interest

Failure to file Form 706-NA or pay the required estate tax can result in penalties and interest. The penalty for late filing is 5% of the unpaid tax per month, up to 25%. The penalty for late payment is 0.5% of the unpaid tax per month, up to 25%.

Step 5: Distribute Assets to Beneficiaries

After filing Form 706-NA and paying the required estate tax, distribute assets to beneficiaries according to the will or state law. Ensure that all beneficiaries receive their rightful share of the estate.

Beneficiary Tax Identification Number

Each beneficiary must provide their tax identification number (Social Security number or EIN) to the executor. This information is required for tax reporting purposes.

Conclusion and Next Steps

Completing Form 706-NA is a complex process that requires careful attention to detail. Ensure that you understand the instructions and examples provided in the Form 706-NA instructions. If you are unsure about any aspect of the process, consider consulting with a tax professional or attorney.

By following these steps, you can ensure that the estate tax is reported accurately and that beneficiaries receive their rightful share of the estate.

FAQ Section

What is Form 706-NA?

+Form 706-NA is the United States Estate (and Generation-Skipping) Tax Return, required for estates with a gross value exceeding $11.58 million in 2020, or $11.7 million in 2021.

Who is responsible for filing Form 706-NA?

+The executor, also known as the personal representative, is responsible for managing the estate and filing Form 706-NA.

What is the deadline for filing Form 706-NA?

+Form 706-NA must be filed within nine months of the decedent's date of death, unless an automatic six-month extension is granted.