The New Jersey Form 1040X is a vital document for residents of the Garden State who need to amend their previously filed state income tax returns. Whether you're correcting errors, claiming additional credits, or reporting changes in income, understanding how to file Form NJ 1040X accurately is crucial to avoid delays or penalties. In this article, we'll delve into the world of amending your New Jersey state tax return, exploring five key ways to file Form NJ 1040X efficiently.

Filing Form NJ 1040X: Understanding the Basics

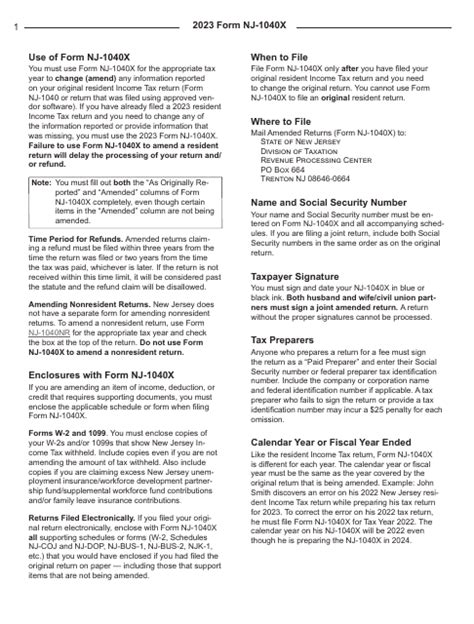

Before diving into the methods of filing, it's essential to grasp what Form NJ 1040X is and why you might need it. This form is used to make changes to a previously filed New Jersey income tax return. Reasons for filing an amended return include correcting math errors, changing filing status, or reporting additional income or deductions discovered after the original return was filed.

Who Needs to File Form NJ 1040X?

Not everyone needs to file an amended return. You should file Form NJ 1040X if you've already filed your New Jersey state tax return and need to make changes to it. This could be due to changes in your income, deductions, or credits, or if you've received additional information that affects your original return.

1. Filing by Mail

For those who prefer a more traditional approach or don't have access to online filing systems, mailing your Form NJ 1040X is a viable option. Here's how to do it:

- Ensure you have the correct form and instructions from the New Jersey Division of Taxation's website or by contacting them directly.

- Fill out the form accurately and completely, using black ink to sign it.

- Attach all required supporting documentation, such as the original return's front page, schedules, and any additional forms or statements.

- Mail the amended return to the address specified in the instructions. It's advisable to use certified mail or a trackable shipping method to prove the date of mailing.

2. Electronic Filing (E-Filing)

E-filing is a quick, secure, and convenient way to submit your amended return. Here are the steps:

- Go to the New Jersey Division of Taxation's website to access their online filing system or approved e-file providers.

- Choose the option for filing an amended return and select Form NJ 1040X.

- Follow the online prompts to fill out the form, attaching any required documentation digitally.

- Once completed, submit the form. You'll receive an electronic confirmation upon successful submission.

3. Using Tax Preparation Software

Tax preparation software like TurboTax, H&R Block, or TaxAct can guide you through the process of filing an amended return. Here's how:

- Open your account with the tax software provider or create a new one if necessary.

- Select the option to amend a previous year's return and choose New Jersey as the state.

- Follow the software's prompts to complete Form NJ 1040X, attaching any required documents.

- Review your amended return carefully, then submit it electronically through the software.

4. Filing with the Help of a Tax Professional

Sometimes, it's best to seek the advice of a tax professional, especially if your situation is complex. Here's what to do:

- Find a reputable tax professional in your area or one who specializes in New Jersey state taxes.

- Provide them with all necessary documentation, including your original return and any new information.

- Let the tax professional guide you through the process, ensuring everything is accurate and complete.

- Once they've prepared your amended return, review it carefully before signing and submitting it.

5. Visiting a Local Tax Office

For immediate assistance or to file in person, visiting a local tax office can be beneficial. Here are the steps:

- Locate a New Jersey Division of Taxation office near you.

- Bring all required documents, including your original return and supporting paperwork.

- Staff at the office can guide you through the process of filling out Form NJ 1040X and answer any questions you may have.

- Once completed, submit your amended return directly to the office staff.

Importance of Accuracy and Timeliness

Regardless of the method you choose, it's crucial to ensure your amended return is accurate and submitted timely. Late filing can result in penalties and interest on any additional tax due. Moreover, accuracy avoids further complications or potential audits.

Tips for a Smooth Filing Process

- Always keep records of your submissions, whether by mail or electronically.

- Understand the specific requirements for supporting documentation.

- Be aware of any deadlines for filing amended returns, typically three years from the original filing date or two years from the date the tax was paid, whichever is later.

What is Form NJ 1040X used for?

+Form NJ 1040X is used to make changes to a previously filed New Jersey state income tax return.

Can I e-file my amended New Jersey state tax return?

+Yes, you can e-file your amended return through the New Jersey Division of Taxation's website or approved e-file providers.

How long do I have to file an amended return in New Jersey?

+You typically have three years from the original filing date or two years from the date the tax was paid, whichever is later, to file an amended return.

In conclusion, filing Form NJ 1040X can seem daunting, but understanding your options and taking the time to accurately prepare your amended return can make the process smoother. Whether you choose to file by mail, electronically, through tax preparation software, with the help of a tax professional, or by visiting a local tax office, the key is to ensure accuracy and timeliness to avoid any potential issues.