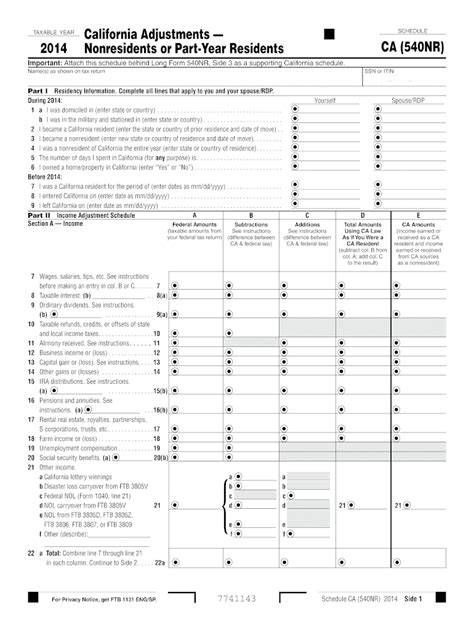

Filing taxes can be a daunting task, especially when it comes to navigating the complexities of California state taxes. One of the most important forms for California taxpayers is the California Adjustments Form, also known as Schedule CA. This form is used to report any adjustments to income that are specific to California, such as deductions for mortgage interest or charitable contributions. In this article, we will provide 5 essential tips for filing the California Adjustments Form, helping you to ensure accuracy and avoid common mistakes.

Understanding the Purpose of the California Adjustments Form

The California Adjustments Form is a critical component of the California state tax return, as it allows taxpayers to report any adjustments to their income that are unique to California. These adjustments can include items such as mortgage interest, charitable contributions, and medical expenses. By accurately completing this form, taxpayers can ensure that they are taking advantage of all the deductions and credits available to them.

Tip #1: Gather All Necessary Documents

Before starting to fill out the California Adjustments Form, it is essential to gather all the necessary documents. This includes:

- 1098 forms for mortgage interest

- 1099 forms for charitable contributions

- Medical expense receipts

- Business expense receipts (if self-employed)

Having all these documents readily available will help you to accurately complete the form and avoid any mistakes.

Tip #2: Understand the Different Types of Adjustments

The California Adjustments Form requires taxpayers to report different types of adjustments, including:

- Above-the-line adjustments: These are adjustments that are subtracted from total income, such as alimony payments and student loan interest.

- Below-the-line adjustments: These are adjustments that are subtracted from adjusted gross income, such as mortgage interest and charitable contributions.

Understanding the different types of adjustments is crucial to accurately completing the form.

Tip #3: Be Aware of California-Specific Adjustments

California has its own set of adjustments that are unique to the state. These include:

- California mortgage interest credit: This credit is available to taxpayers who have a mortgage on their primary residence.

- California renter's credit: This credit is available to taxpayers who rent their primary residence.

Being aware of these California-specific adjustments can help you to maximize your deductions and credits.

Tip #4: Use the Correct Codes and Numbers

The California Adjustments Form requires taxpayers to use specific codes and numbers to report their adjustments. It is essential to use the correct codes and numbers to avoid any errors or delays in processing your return.

- Use the correct schedule numbers: Make sure to use the correct schedule numbers when reporting your adjustments. For example, mortgage interest is reported on Schedule CA, line 7.

- Use the correct code numbers: Make sure to use the correct code numbers when reporting your adjustments. For example, the code number for mortgage interest is 204.

Tip #5: Review and Double-Check Your Form

Finally, it is essential to review and double-check your California Adjustments Form before submitting it. Make sure to:

- Check for accuracy: Review your form to ensure that all the information is accurate and complete.

- Check for completeness: Review your form to ensure that all the necessary schedules and attachments are included.

By following these 5 essential tips, you can ensure that your California Adjustments Form is accurate and complete, helping you to avoid any mistakes or delays in processing your return.

Get Help When You Need It

Filing the California Adjustments Form can be a complex and time-consuming process. If you need help or have questions, consider consulting with a tax professional or seeking guidance from the California Franchise Tax Board.

By following these 5 essential tips and seeking help when you need it, you can ensure that your California Adjustments Form is accurate and complete, helping you to maximize your deductions and credits.

What is the California Adjustments Form?

+The California Adjustments Form is a schedule that is used to report any adjustments to income that are specific to California.

What types of adjustments are reported on the California Adjustments Form?

+The California Adjustments Form requires taxpayers to report different types of adjustments, including above-the-line adjustments and below-the-line adjustments.

What is the deadline for filing the California Adjustments Form?

+The deadline for filing the California Adjustments Form is the same as the deadline for filing your California state tax return, which is typically April 15th.