In the state of New York, sales tax is a crucial aspect of business operations. As a business owner, it's essential to understand the intricacies of sales tax to avoid any potential penalties or fines. One of the most critical forms related to sales tax in New York is the St-120 form, also known as the Resale Certificate. In this article, we'll delve into the world of St-120 forms, explaining their purpose, benefits, and steps to complete them.

What is the St-120 Form?

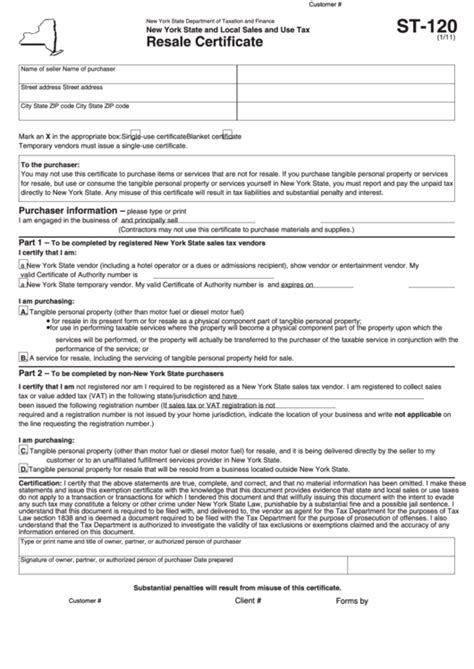

The St-120 form is a Resale Certificate used by businesses in New York to purchase goods or services without paying sales tax. This form is usually provided by the buyer to the seller, stating that the goods or services are being purchased for resale purposes. By submitting this form, the buyer certifies that they are not the end-user of the goods or services and that they will resell them.

Who Needs to Use the St-120 Form?

Businesses that engage in wholesale or resale activities in New York state need to use the St-120 form. This includes:

- Retailers who purchase goods for resale

- Wholesalers who purchase goods for resale to other businesses

- Manufacturers who purchase raw materials or components for production

- Service providers who purchase services for resale

Benefits of Using the St-120 Form

Using the St-120 form provides several benefits to businesses in New York:

- Avoid Sales Tax: By providing the St-120 form, businesses can avoid paying sales tax on goods or services purchased for resale purposes.

- Streamline Business Operations: The St-120 form simplifies the purchasing process, eliminating the need for businesses to pay sales tax upfront and claim a refund later.

- Reduce Administrative Burden: Using the St-120 form reduces the administrative burden on businesses, as they don't need to track and claim sales tax refunds.

Steps to Complete the St-120 Form

Completing the St-120 form is a straightforward process. Here are the steps to follow:

- Download the Form: Obtain the St-120 form from the New York State Department of Taxation and Finance website or create your own using the same format.

- Fill in the Required Information: Provide the following information:

- Business name and address

- Sales tax registration number (if applicable)

- Description of the goods or services being purchased

- Statement certifying that the goods or services are being purchased for resale purposes

- Sign and Date the Form: Sign and date the form, acknowledging that the information provided is accurate and true.

- Provide the Form to the Seller: Give the completed form to the seller, usually at the time of purchase.

Important Notes

- The St-120 form is only valid for purchases made in New York state.

- The form must be completed accurately and truthfully, as false statements may result in penalties.

- Businesses must keep a copy of the completed form for their records.

Common Mistakes to Avoid

When completing the St-120 form, avoid the following common mistakes:

- Inaccurate Information: Ensure that all information provided is accurate and up-to-date.

- Failure to Sign and Date the Form: Always sign and date the form, as this is a critical step in validating the form.

- Using an Invalid Form: Use the most recent version of the St-120 form, as outdated forms may not be accepted.

Conclusion

In conclusion, the St-120 form is a vital document for businesses in New York state, enabling them to purchase goods and services without paying sales tax. By understanding the purpose, benefits, and steps to complete the form, businesses can streamline their operations and avoid potential penalties.

Call to Action

If you're a business owner in New York state, ensure you're using the St-120 form correctly to avoid any sales tax issues. Share this article with your colleagues and friends to help them understand the importance of this form.

We invite you to share your thoughts and questions about the St-120 form in the comments section below.

What is the purpose of the St-120 form?

+The St-120 form is used by businesses in New York state to purchase goods or services without paying sales tax, as the goods or services are being purchased for resale purposes.

Who needs to use the St-120 form?

+Businesses that engage in wholesale or resale activities in New York state, including retailers, wholesalers, manufacturers, and service providers, need to use the St-120 form.

What are the benefits of using the St-120 form?

+The St-120 form helps businesses avoid sales tax, streamline their operations, and reduce administrative burdens.