When buying or selling a vehicle in Pennsylvania, it's essential to understand the process of paying sales tax on the transaction. The Pennsylvania Department of Transportation requires buyers and sellers to file Form MV-4ST, also known as the "Vehicle Sales Tax Return." In this article, we'll delve into the details of Form MV-4ST, including its purpose, requirements, and steps to complete it.

Understanding Pennsylvania Vehicle Sales Tax

Pennsylvania imposes a 6% sales tax on the purchase of vehicles, which includes cars, trucks, motorcycles, and other types of motor vehicles. The tax is levied on the purchase price of the vehicle, and it's the buyer's responsibility to pay it. However, there are some exceptions, such as sales to certain non-profit organizations or government entities.

Who Needs to File Form MV-4ST?

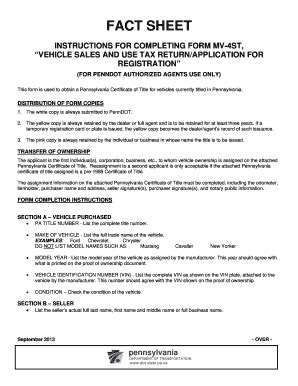

Form MV-4ST is required for all vehicle sales transactions in Pennsylvania, including private sales, trade-ins, and dealer sales. The buyer and seller must complete the form and submit it to the Pennsylvania Department of Transportation along with the required supporting documentation.

Completing Form MV-4ST: A Step-by-Step Guide

Form MV-4ST consists of several sections, which we'll outline below. It's essential to complete the form accurately and thoroughly to avoid any delays or issues with the registration process.

Section 1: Vehicle Information

In this section, you'll need to provide the following information about the vehicle:

- Vehicle Identification Number (VIN)

- Year

- Make

- Model

- Body style

Section 2: Seller Information

Here, you'll need to provide the seller's information:

- Name

- Address

- Phone number

- Email address

Section 3: Buyer Information

In this section, you'll need to provide the buyer's information:

- Name

- Address

- Phone number

- Email address

Section 4: Sales Information

This section requires the following sales information:

- Sales price

- Trade-in value (if applicable)

- Total tax due

Section 5: Exemptions and Credits

If the sale is exempt from sales tax or the buyer is eligible for a credit, you'll need to provide the necessary documentation and information in this section.

Section 6: Certifications and Signatures

Both the buyer and seller must sign and date the form, certifying that the information provided is accurate and complete.

Required Supporting Documentation

In addition to the completed Form MV-4ST, you'll need to provide the following supporting documentation:

- Proof of vehicle ownership (title or pink slip)

- Proof of insurance

- Proof of identification (driver's license or state ID)

- Proof of residency (utility bill or lease agreement)

Filing Form MV-4ST and Paying Sales Tax

Once you've completed Form MV-4ST and gathered the required supporting documentation, you can file the form with the Pennsylvania Department of Transportation. You can submit the form in person, by mail, or online.

To pay the sales tax, you can use a check or money order payable to the "Commonwealth of Pennsylvania" or pay online through the Pennsylvania Department of Transportation's website.

Penalties for Non-Compliance

Failure to file Form MV-4ST or pay the required sales tax can result in penalties and fines. The Pennsylvania Department of Transportation may impose a penalty of up to 25% of the tax due, plus interest on the unpaid tax.

In addition to the penalties, you may also be required to pay a late filing fee. It's essential to file Form MV-4ST and pay the sales tax on time to avoid these penalties.

Conclusion

Form MV-4ST is a critical document for buyers and sellers of vehicles in Pennsylvania. By understanding the requirements and steps to complete the form, you can ensure a smooth and efficient transaction. Remember to file the form and pay the required sales tax on time to avoid penalties and fines.

We hope this guide has been helpful in explaining the process of completing Form MV-4ST. If you have any further questions or concerns, please don't hesitate to ask.

What is the purpose of Form MV-4ST?

+Form MV-4ST is used to report the sale of a vehicle in Pennsylvania and to pay the required sales tax.

Who needs to file Form MV-4ST?

+Both the buyer and seller need to file Form MV-4ST, including private sales, trade-ins, and dealer sales.

What is the sales tax rate in Pennsylvania?

+The sales tax rate in Pennsylvania is 6% of the purchase price of the vehicle.